Today's Morning Movers and Top Ratings: TXN, AVGO, SMCI, ROKU and More

Morning Movers

Gapping up

$Broadcom(AVGO.US$ Goldman Sachs analysts reinstated a Buy rating on Broadcom with a 12-month price target of $1325, indicating a 16% potential upside. The bullish outlook is underpinned by expectations of “strong double-digit revenue growth” in AVGO's AI-related businesses, particularly high-speed networking and custom compute segments.

“We expect the proliferation of Gen AI across a broad set of data center workloads to drive strength in Broadcom's custom compute offload and next-generation Networking businesses both in the near- and medium-term,” analysts said. Broadcom stock is up 1.5% in pre-open Friday.

$Wayfair(W.US$ Shares in Wayfair rose by 15% in premarket U.S. trading on Friday after the online furniture and home goods seller announced it will cut about 13% of its workforce as part of an effort to revamp the business.

$Texas Instruments(TXN.US$ UBS analysts upgraded Texas Instruments to Buy with a $195 price target, up from $170. “We upgrade TXN as we believe it should be among the first to see orders inflect higher given less reliance on distribution (i.e. for TXN there is very little lag time between orders and revenue turning higher) and TXN also has cleaner comps and fundamentals as it was one of the few companies not to employ supply agreements during the peak,” analysts said. TXN stock rose 2% in early Friday trading, after ending the day 2.8% higher.

$Super Micro Computer(SMCI.US$ stock rose 11% after the hardware firm lifted its second-quarter profit forecast, delivering the latest upbeat signal for the chip industry.

Gapping down

$Boeing(BA.US$ 747-8 cargo jet encountered a technical malfunction that led to engine flames shortly after takeoff from Miami International Airport. Boeing's stock value dropped by 0.7%.

$Macy's(M.US$ stock fell 0.2% after the Wall Street Journal reported that the department store chain is set to reduce headcount and shutter locations in a bid to cut costs and streamline its business.

$Ford Motor(F.US$ stock fell 0.5% after the auto giant announced plans to reduce the production of its F-150 Lightning pickup truck.

$Chegg(CHGG.US$ stock fell 8.3% after Goldman Sachs downgraded the online learning company to sell from hold.

Source: CNBC; Investing.com

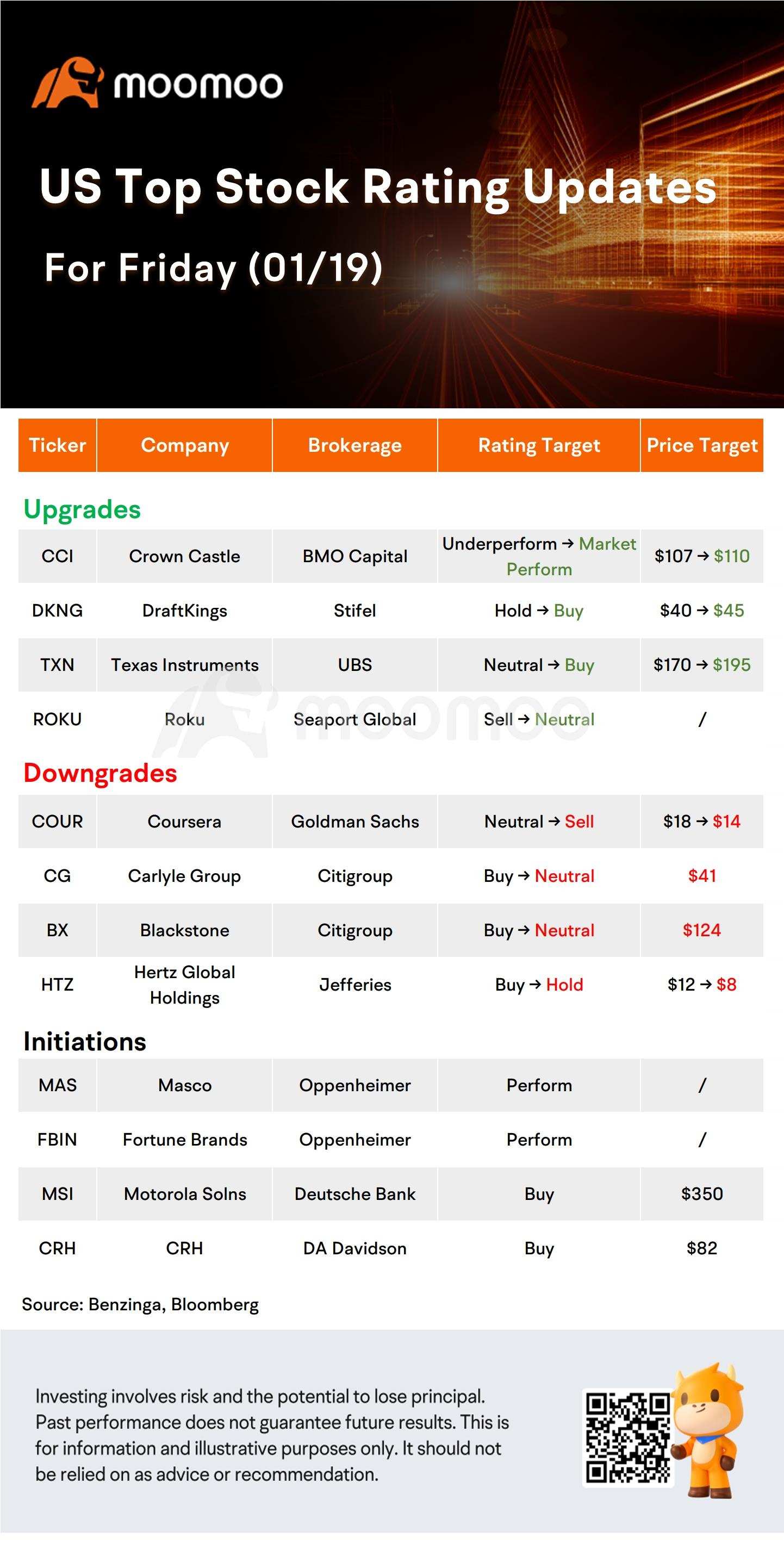

US Top Rating Updates on 01/19

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment