Today's Morning Movers and Top Ratings: CVS, JNJ, UBS, V and More

Morning Movers

Gapping up

$CVS Health(CVS.US$ has forecasted revenue for 2024 to be at least $366 billion, which exceeds the current Street estimate of $345.5 billion. The company anticipates adjusted earnings per share of at least $8.50, in line with the consensus, with the cash flow from operations projected to be at least $12.5 billion. Updates were shared ahead of the company's 2023 Investor Day. CVS shares rose 2.2% on the news.

$Gitlab(GTLB.US$ shares popped more than 14% after the maker of developer tool software posted stronger-than-expected fiscal first-quarter results and shared upbeat guidance. The company posted its first adjusted operating profit and said revenue grew 32% year over year. For the fourth quarter, GitLab anticipated adjusted earnings of 8 cents to 9 cents per share on $157 million to $158 million in revenue.

$Johnson & Johnson(JNJ.US$ 's stock rose nearly 1% after the pharmaceutical company offered 2024 guidance and said it expects operational sales growth to range between 5% and 6% next year. That topped a FactSet estimate of 3.6%. The drugmaker also said it has more than 10 assets with peak sales potential exceeding $5 billion.

$JM Smucker(SJM.US$ Shares of the snack food company rose 3% in pre-market trading after J.M. Smucker topped earnings expectations for its fiscal second quarter. Net sales rose year over year when excluding the pet food brands J.M. Smucker sold off in April.

Gapping down

$Take-Two Interactive Software(TTWO.US$ The video game publisher's stock fell more than 4% before the bell. Subsidiary Rockstar Games released the trailer for the new iteration of its Grand Theft Auto game, which is slated for 2025, earlier than expected following a leak on social media platform X.

$UBS Group(UBS.US$ shares slipped nearly 2% after Bank of America downgraded the Swiss bank to neutral, citing higher costs as it integrates Credit Suisse post-acquisition.

$Albemarle(ALB.US$ The lithium company about 2% after Piper Sandler downgraded shares to underweight and trimmed its price target, citing global price declines.

$AutoZone(AZO.US$ Shares dipped 1.5% after AutoZone posted fiscal first-quarter earnings. The auto parts retailer posted earnings of $32.55 per share, topping the FactSet consensus estimate of $31.57 per share. The revenue of $4.19 billion came in line with expectations.

Source: CNBC; Investing.com

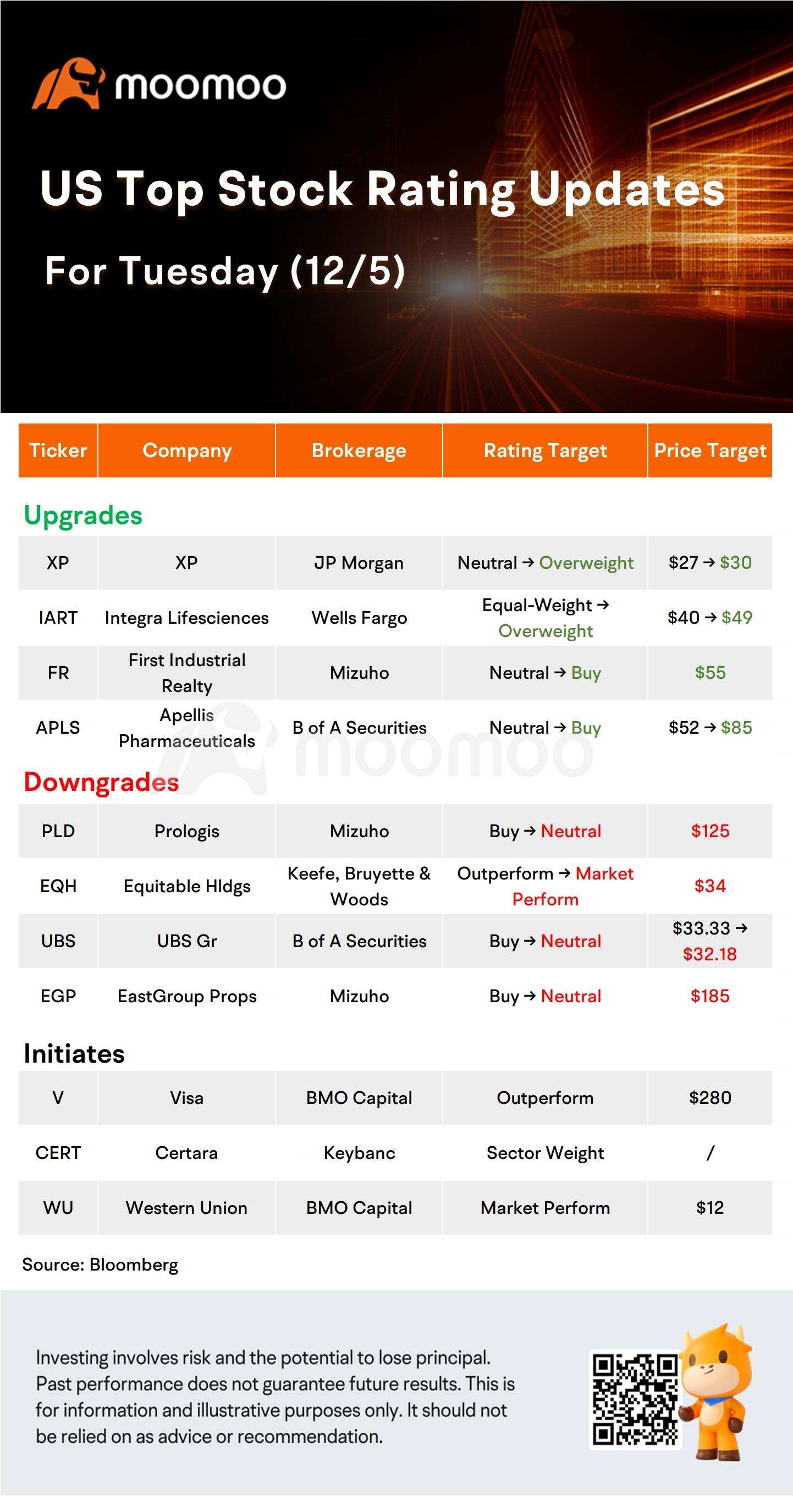

US Top Rating Updates on 12/05

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment