Today's Morning Movers and Top Ratings: AAPL, TSM, PLUG, MSFT and More

Morning Movers

Gapping up

$Apple(AAPL.US$ shares jumped nearly 2% in early New York trading on Thursday after Bank of America analysts raised the stock's rating to Buy from Neutral. Analysts also hiked the price target by $17 to $225 per share, reflecting higher iPhone and Services estimates.

A more bullish stance on Apple stock is supported by several factors, including: stronger multi-year iPhone upgrade cycle, higher growth in Services, strong capital returns, etc. The upgrade move comes as investor focus shifts towards the expected launch of Vision Pro next month, as well as AI-powered iPhone, which is expected to arrive in late 2024 or 2025.

$Taiwan Semiconductor(TSM.US$ stock rose 7.7% after the world's largest contract chipmaker logged a smaller-than-expected decline in its fourth-quarter profit as revenue was buoyed by increased sales of its most advanced chips. The company projected on Thursday more than 20% growth in 2024 revenue on booming demand for high-end chips used in artificial intelligence (AI) applications even as the broader industry deals with weak smartphone and electric vehicle sales.

$Hertz Global(HTZ.US$ stock rose 8.7% after the car rental firm announced plans to sell off its fleet of electric vehicles, opting instead for gas-powered vehicles.

Gapping down

$Humana(HUM.US$ stock fell 14% after the health insurer lowered its profit guidance after it was forced to adjust its forecast for individual Medicare Advantage growth for this year.

$Discover Financial Services(DFS.US$ Shares in Discover Financial Services fell more than 10% in premarket U.S. trading on Thursday, after the credit card lender reported a steep decline in fourth-quarter net income due in part to higher compliance-related expenses.

The Illinois-based group posted net income of $388 million in the three months ended on Dec. 31, a 62% decrease compared to corresponding period in the prior year. The result translated to diluted earnings per share of $1.54, well below Bloomberg consensus estimates of $2.52.

Weighing on the returns were operating costs, which jumped by 18% year-on-year to $1.78 billion, above Wall Street projections. Discover noted that employee compensation and professional fees were elevated due to "investments in compliance and risk management."

$Plug Power(PLUG.US$ stock slumped over 14% after the fuel-cell company disclosed in an SEC filing late Wednesday that it will sell up to $1 billion in shares.

Source: CNBC; Investing.com

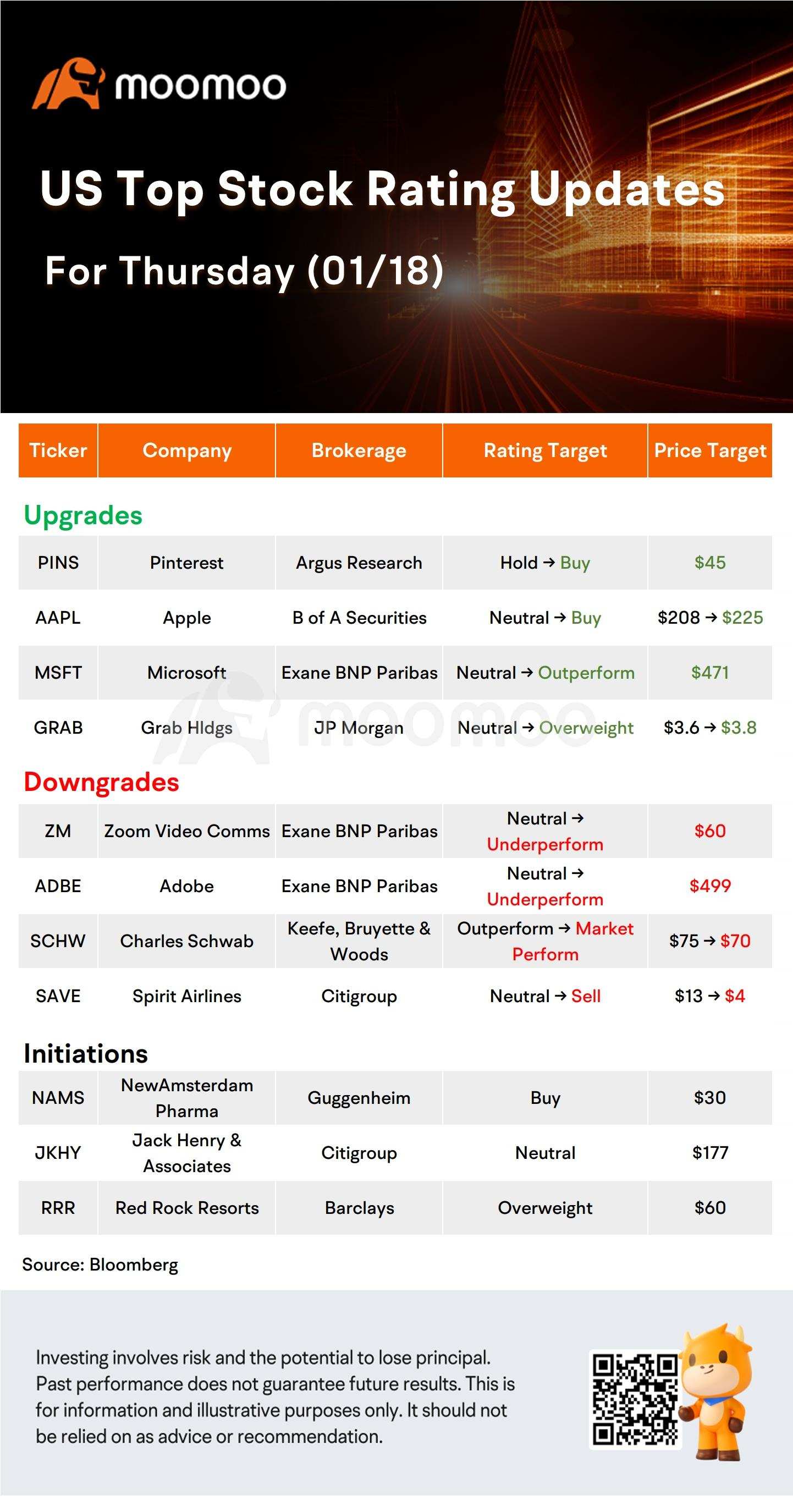

US Top Rating Updates on 01/18

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

投资大亨11 : After you've said everything, talk about Apple's negative news and the prospects will be taken by you, and you'll be taken by dizziness

103425109 投资大亨11: hi