The Week Ahead (NVDA, TD, and PANW Earnings; Canada April CPI and Fed's Minutes)

Earnings Preview

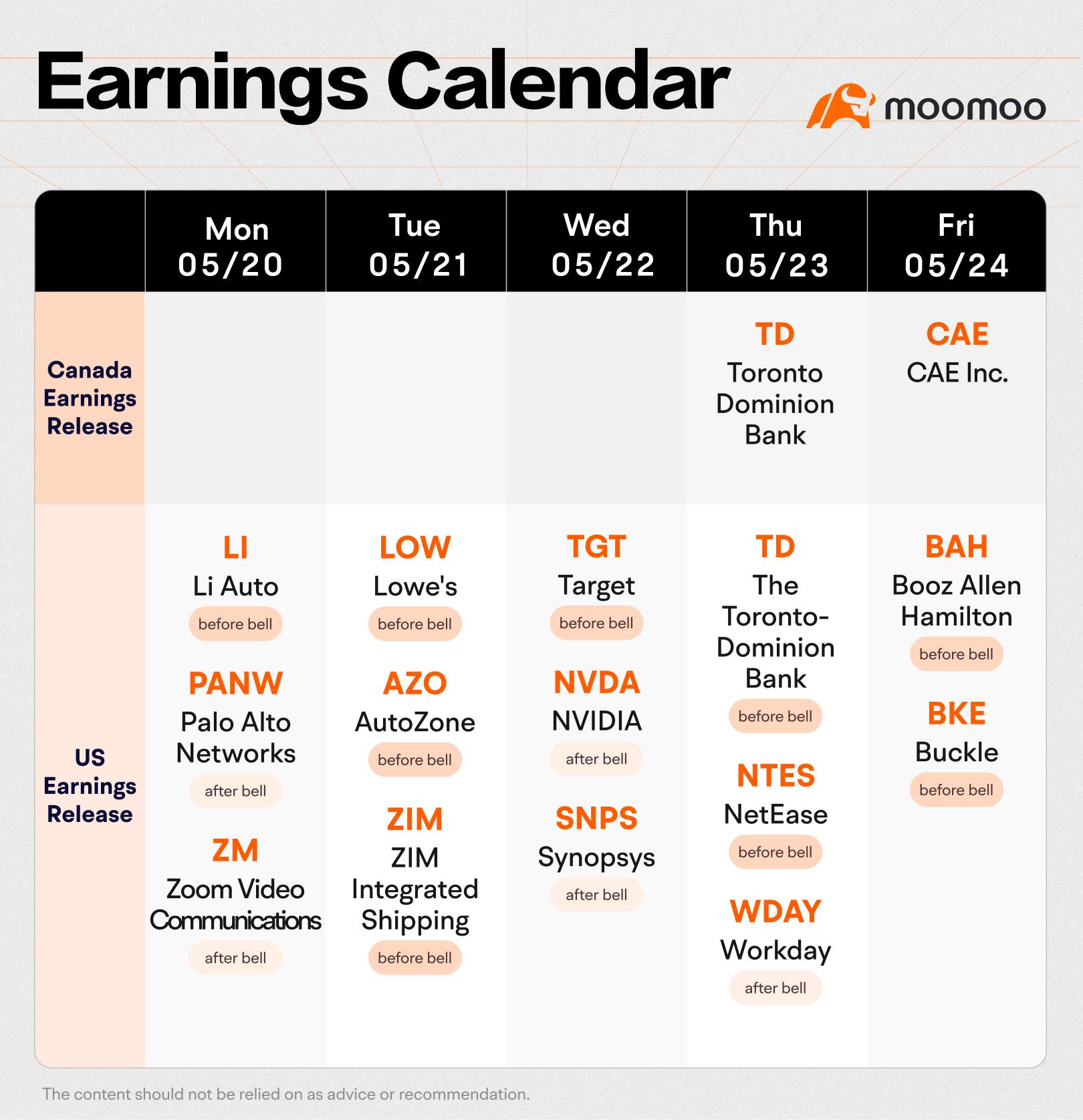

This week, investors should keep an eye on earnings reports from several key players, including $The Toronto-Dominion Bank(TD.CA$, $Palo Alto Networks(PANW.US)$, $Target(TGT.US)$, and $NVIDIA(NVDA.US)$

$NVIDIA(NVDA.US)$ may stick to a trend of edging past expectations as the company prepares to unveil first-quarter results on the back of ongoing healthy demand.

Deutsche Bank analysts have pointed out that the after-hours update will coincide with the one-year anniversary of NVIDIA's groundbreaking report from May 2023, which marked a significant shift in the market.

"We expect the company to continue its trend of delivering healthy multi-billion dollar beats [and] raises on still healthy demand for AI compute,"analysts said in a note.The bank acknowledged some may be putting off orders before the release of NVIDIA's latest Blackwell graphics processing unit, expected this year.

However, "we still expect aggregate demand trends to remain healthy," Deutsche added, likely meaning NVIDIA's near-term guidance will be unaffected. NVIDIA had guided in February for revenue to come in around US$24 billion this year, alongside gross margins of roughly 76.3%.

$The Toronto-Dominion Bank(TD.CA$ is scheduled to report 2Q result on May 23rd before the market opens. In preview of TD's second quarter earnings, BofA Securities notes that with an outlook for rate cuts to begin in Canada in June, it forecasts Canadian residential mortgage growth of +3%/+11% Q2 2024 FY24e as the bank looks to regain market share and execute on management's strategy outlined at last year's investor day.

Following the publication of TD's US bank call report on May 1 and a Wall Street Journal (WSJ) report detailing US regulators' investigation of TD, investors will look for a concrete timeline for management to resolve the ongoing BSA/AML issue. "While we appreciate that management is limited by ongoing discussion with regulators, we believe clarity on the magnitude and timing of the regulatory impact would go a long way to reversing TD's year-to-date underperformance vs peers."

$Palo Alto Networks(PANW.US)$ is expected to report a "solid quarter overall" for the quarter ended April 30, 2024, analysts at Bank of America believe. The cybersecurity solutions provider will report its fiscal third quarter 2024 financial results on Monday, May 20 after the stock market closes.

For fiscal 3Q, it has guided total billings in the range of $2.3 billion to $2.35 billion, representing year-over-year growth of 2% to 4%.Revenue is expected to grow 13% to 15% year-over-year to between $1.95 billion to $1.98 billion and adjusted earnings per share (EPS) is forecast to be in the range of $1.24 to $1.26.

The Bank of America analysts see Palo Alto Networks reporting solid overall results for the quarter on the back of reduced expectations and growth in Next Generation Security (NGS), likely offset by weak firewall trends.

"We divide up our expectations into three parts: we expect firewalls to be weak yet believe Street expectations are low," they wrote in a note to clients.

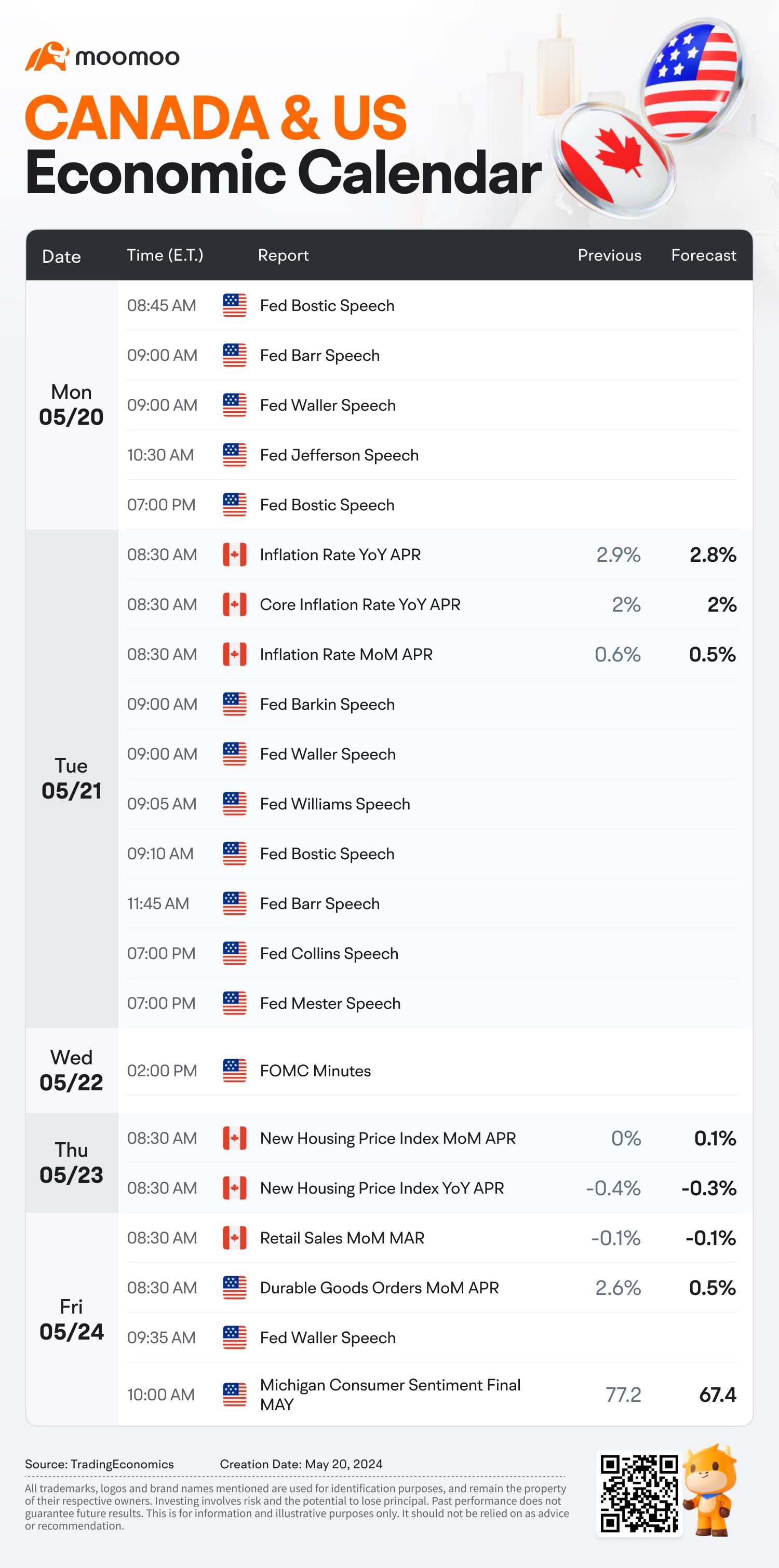

Canadian Inflation Numbers May Show Another Decline in April

Heading into the last significant economic announcement before the Bank of Canada's upcoming rate decision on June 5th, the inflation report for April is anticipated to reflect a continued downward trend. Unless there is an unexpected rise, the prevailing weak economic and job market conditions are likely to justify a reduction in interest rates by 25 basis points at the Bank of Canada's June meeting.

For April, forecasts indicate that the annual Consumer Price Index (CPI) growth will ease to 2.8%, down from 2.9% in March, inching closer to the central bank's target of 2% despite an uptick in energy costs. Gasoline prices saw a significant monthly increase of 7.6% in April, partly due to the yearly hike in the federal carbon tax. Contrarily, the growth rate of food prices has been decelerating, and the expected year-over-year increase for the "core" CPI, which excludes food and energy, is to slightly decrease to 2.6% from March's 2.9%. Although mortgage interest costs soared by 25% on a year-over-year basis in March as a delayed response to earlier rate hikes, contributing to over one-fourth of the overall price growth, this upward trend is showing signs of moderation.

The Bank of Canada's policymakers will pay closer attention to the bank's preferred core inflation indicators, which are considered more reflective of the general inflationary pressures. For instance, the 'median' and 'trim' measures of the CPI, which provide a more precise representation, averaged 3.0% year-over-year in March. This marks the first return to the upper limit of the Bank's target range of 1% to 3% since 2021. Notably, more recent patterns have softened, with the 3-month rolling average of month-over-month increases in these core measures falling below the 2% target as of March. This slowdown has been widespread, with a greater number of items in the CPI basket experiencing lower rates of inflation this year.

FOMC Minutes, Fed Speakers (Powell, Barkin, Bostic)

It is highly probable that the minutes from the FOMC won't offer much fresh insight into the Federal Reserve's forthcoming decisions. Nevertheless, it remains an event of significance that demands attention. Their last minute reminded us that "members" wanted greater confidence that "inflation is moving sustainably towards 2%". We know that inflation came in slightly softer and in line with market expectations, but it hasn't come down quickly enough to provide the confidence for the Fed it seeks to signal a cut, as much as traders want them to.

We also have plenty of Fed speakers, but looking through many of the titles suggests they might not be the biggest drivers for market volatility. But like the minutes, traders need to have these on their radar. Just in case.

Source: Trading Economics, RBC Economics

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

awilldill : nice