Enbridge Earnings Preview: Utility Acquisitions and Consistent Dividend Hikes May Pressure Post-Dividend Free Cash Flow

$Enbridge Inc(ENB.CA$ is expected to release its first quarter 2024 financial result on Friday before the bell. Although this oil and natural gas transportation company stands out in the low-growth midstream sector with its scale and leading asset position, analysts would like to see greater emphasis on free cash flow (FCF) after the dividend.

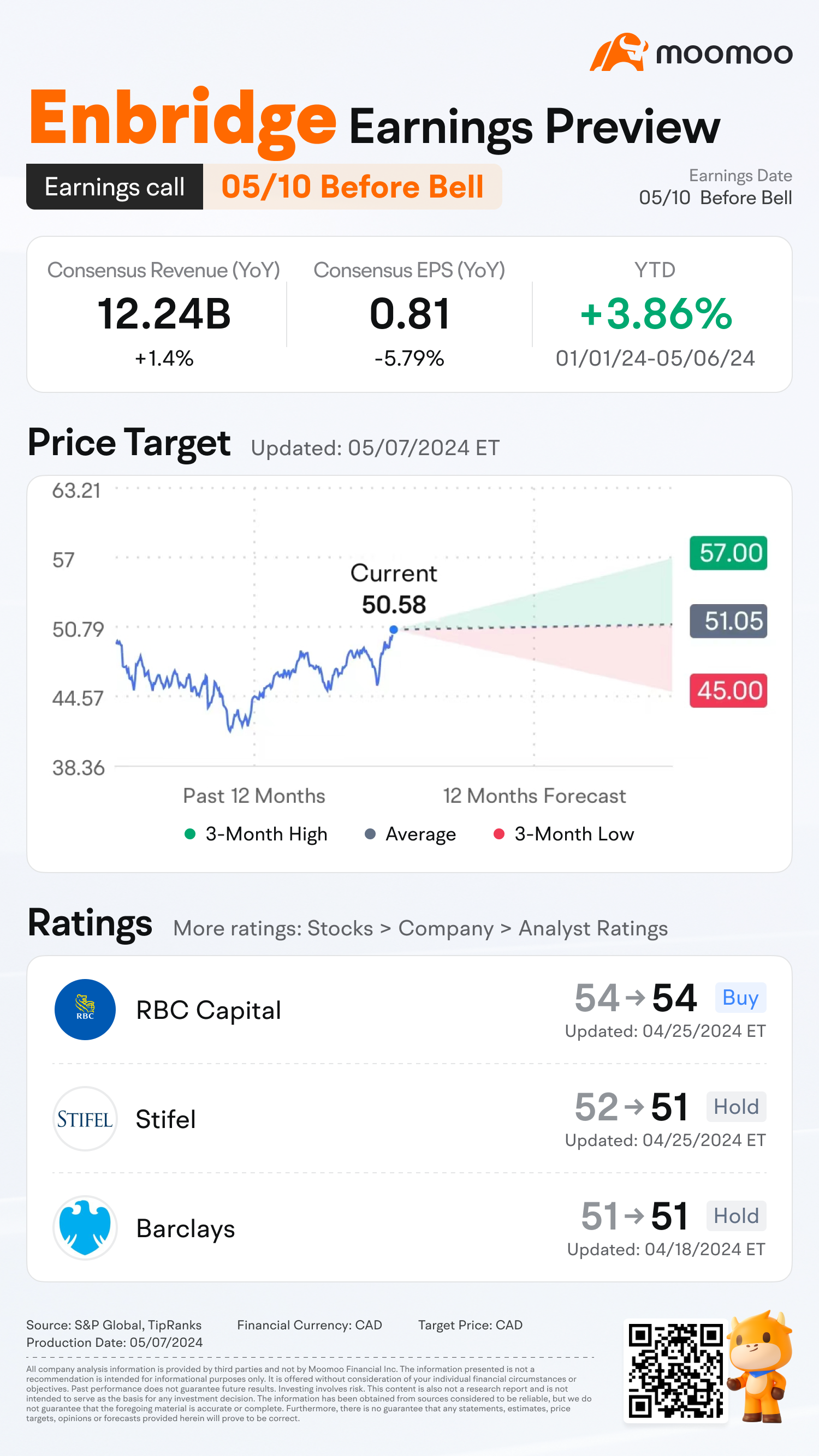

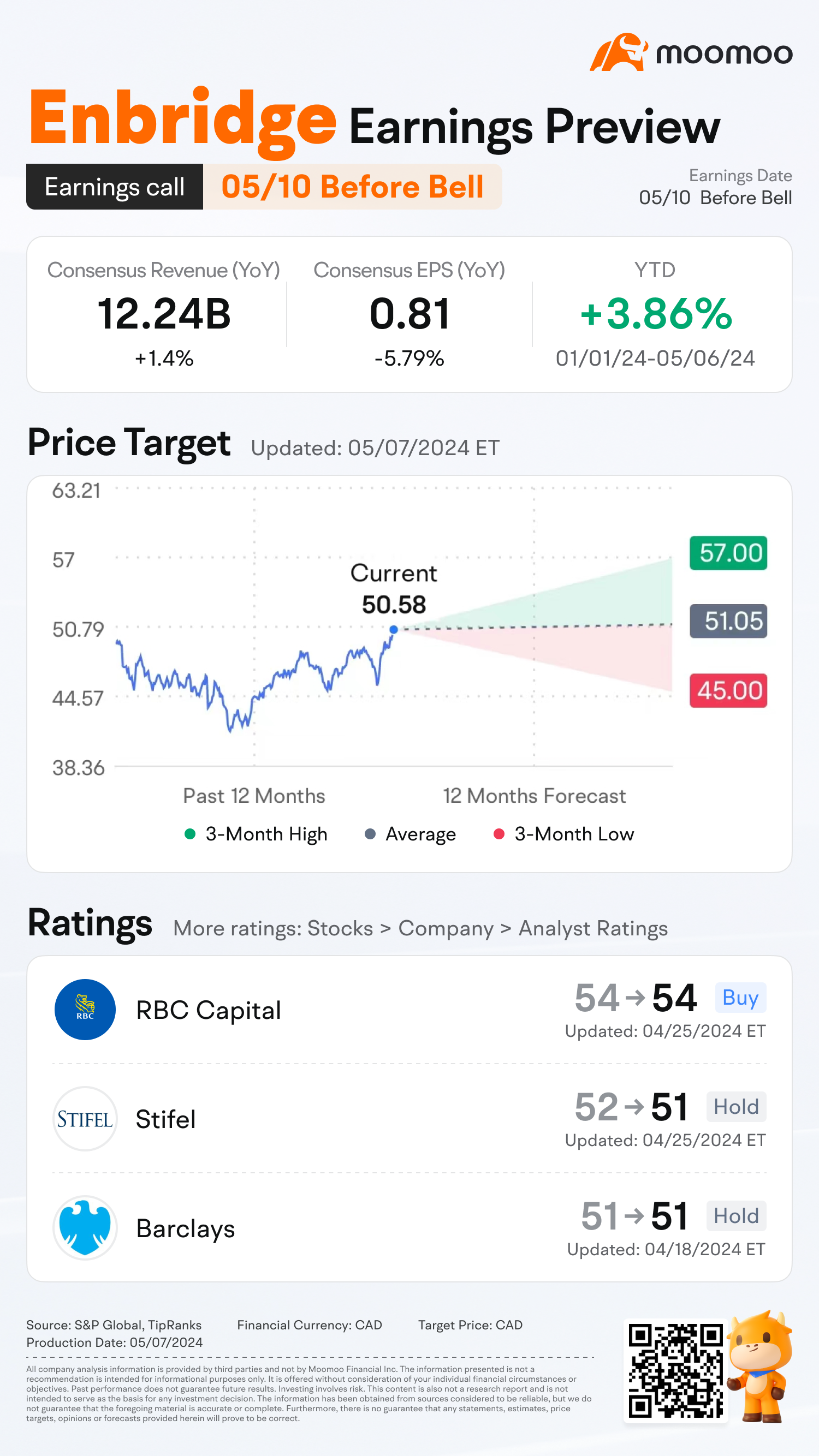

Consensus Estimates

● Enbridge is expected to post quarterly earnings of C$0.81 per share in its upcoming report, which represents a year-over-year change of -5.79%.

● Revenues are expected to be C$12.24 billion, up 1.4% from the year-ago quarter.

● Analysts expect Enbridge's EBITDA to rise 2% in the first quarter to C$4.58 billion on higher projected gas segment results.

Here are key points to focus on:

Utilities acquisitions expand scale, but may put pressure on post-dividend FCF

Enbridge stands out due to its scale, and its extensive project backlog and strategic acquisitions could drive above-average EBITDA growth vs. peers, bolstering its position as the largest North American midstream operator. Though these factors - along with stable dividend hikes - likely drive its valuation, scale and growth fuel spending and can put pressure on post-dividend free cash flow (FCF).

Enbridge's pending acquisitions of three US gas utilities from Dominion will bring reliable cash flow, steady growth and diversification, but may stretch the balance sheet and increase the dividend burden. The company issued 102.9 million shares to cover about C$4.6 billion of the total C$19 billion payment price for the acquisition of three gas utilities, raising the annual dividend payout by C$377 million. Enbridge will assume about C$6.2 billion in debt and has issued roughly C$3.7 billion in hybrid subordinated notes to help pre-fund the deal. One of the three deals closed in first quarter.

Enbridge's further push into utilities will likely double Gas Distribution segment EBITDA after the deals close in 2024. The moves suggest a strategy to diversify away from liquids toward gas and regulated earnings, as well as a potential lack of midstream opportunities.

Steadily Growing, High-Yielding Dividend Is Main Enbridge Draw

Enbridge is generating more than adequate distributable cash flow (DCF) to cover the dividend, but the pipeline operator may remain deficient in free cash flow after the common and preferred payouts, due partly to significant spending on growth projects. Despite a lack of post-dividend free cash flow, analysts believe the backlog, contracts, strong EBITDA, debt and asset-sale proceeds should let the company sustain small annual dividend increases.

Enbridge increased its dividend by 3.1% this year, and analysts think the company can sustain this pace in the midterm. With about 98% of cash flow backed by cost-of service or contractual agreements and 80% of EBITDA supported by inflation protection, this helps provide some cash-flow visibility to plan for the payout. The company's dividend-growth trajectory tracks closely with its primary peer, TC Energy. Enbridge's dividend yields 7.6%, the highest in a group of midstream peers that include companies such as TC Energy, Oneok and Targa.

What do analysts say about Enbridge?

Barclays has maintained a target price for Enbridge at C$51 and keeps an Equal Weight rating on the shares. Enbridge reiterated its medium-term growth outlook at its analyst day and continues to pave the way for growth with projects that bolster and complement its existing footprint, the analyst tells investors in a research note.

Jefferies initiated coverage of Enbridge with a Buy rating and C$53 price target. The firm likes Enbridge for its expansive and diversified asset base, including key crude oil export pipelines and North America's largest integrated natural gas utility, pending close of acquisitions.

Source: Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Meme_Short_Queen : wow, no direct link to quote?! shame on you moomoo

74583607 : a big thanks to everyone. I'm having a hard time and consideration and support means alot . if someone now's how to get the stuff off my phone that's on the bad list I had no idea it was there. Let me know