Why the Market Has Strong Confidence in the Recovery of the Chip Industry

The global semiconductor market is projected to rebound with a 13.1% growth in 2024, reaching a new high of $588.36 billion, driven by rising chip demand for artificial intelligence applications. This positive forecast by an industry group aligns with emerging signs of recovery in the sector, bolstered by the popularity of generative AI like OpenAI's ChatGPT, as well as an uptick in PC and smartphone sales.

Global semiconductor sales increased on a year-to-year basis in November for the first time since August 2022, an indication that the global chip market is continuing to gain strength as we enter the new year," said John Neuffer, the Semiconductor Industry Association (SIA) president and CEO. "Looking ahead, the global semiconductor market is projected to experience double-digit growth in 2024."

Recently, ASML, a renowned semiconductor equipment company, and the world's No. 2 memory chip maker SK Hynix reported exceptional results, which further reinforce market confidence in the beginning of a recovery in the chip industry.

SK Hynix Reports Surprise Profit

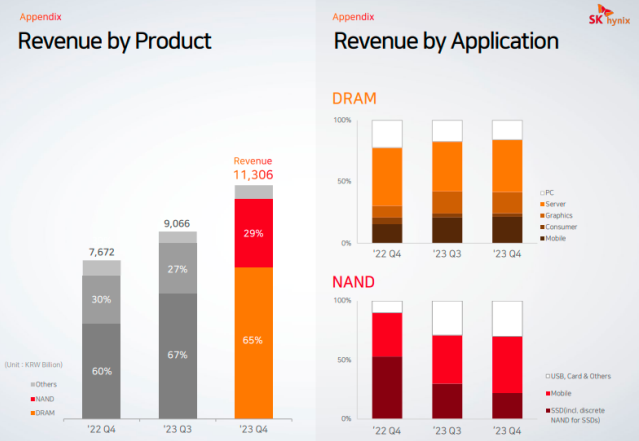

The world's second-largest memory chip manufacturer reported an operating profit of 346 billion won ($259 million) for the December quarter, surpassing expectations for another loss and marking its first operating profit in five quarters, propelled by a 47% increase in revenue. Despite this, the company's shares fell by 2.9% in Seoul, slightly reducing the impressive gains of nearly 90% it achieved over the course of 2023.

The firm, which rose to become South Korea's second-most valuable company in December, is a frontrunner in producing high-bandwidth memory chips that are paired with $NVIDIA(NVDA.US$'s AI accelerators, widely used in AI training. Investors are optimistic that the surge in generative AI will boost the need for servers equipped with advanced DDR5 DRAM.

SK Hynix recorded higher ASPs because of their higher exposure to premium products such as HBM3 and DDR5," Daiwa Securities analyst SK Kim told Bloomberg Television. "Nvidia is maintaining their dominant position in the AI GPU market, so Hynix will continue to benefit from this landscape at least in the first half of this year."

SK Hynix credited its strong performance to the enhanced state of the memory market in the final quarter of 2023. There was a notable increase in demand for AI server and mobile applications, which led to higher average selling price (ASP). The company's proactive approach to meeting customer needs, combined with its cutting-edge DRAM technology, led to significant sales growth in its key products, DDR5 and HBM3.

AI-powered smartphones and PCs are driving chip demand, SK Hynix said. The company plans to boost overall capital spending, even while continuing to cut back on legacy chip output in 2024. It will proceed with mass production of AI memory product HBM3E, focusing spending on high-bandwidth memory and other strategic products.

ASML Sees Strong Order Recovery

$ASML Holding(ASML.US$ shares surged after its orders more than tripled last quarter, in a sign that parts of the semiconductor industry are resurgent. ASML stands alone as the sole producer of machinery required for manufacturing the most advanced semiconductors, with its product demand serving as an indicator of the industry's overall well-being. The unprecedented number of orders for its premier extreme ultraviolet lithography machines reflects confidence from major technology clients such as $Intel(INTC.US$, $Samsung Electronics Co., Ltd.(SSNLF.US$, and $Taiwan Semiconductor(TSM.US$.

Artificial intelligence, which requires massive amounts of computing power, is going to be a "big driver for our business and the business of our customers," CEO Peter Wennink said.

2023 was our top year," Wennink said. "We won't see another 30% growth in 2024." ASML has previously forecast flat growth this year before a banner year in 2025.

Source: Bloomberg, ASML, SK hynix, the japantimes, MarketWatch, telecomlead

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Tsampane : How those one benifit from that