Q1's Global Market High: US and Japan Shine, Bitcoin and Gold Rally--What's Next?

Benefiting from the optimism about the future of artificial intelligence and the anticipation of the Federal Reserve's interest rate cuts, U.S. stocks had a commendable first-quarter performance. The $Dow Jones Industrial Average(.DJI.US$ is close to the 40,000-point milestone, and the $S&P 500 Index(.SPX.US$ has reached new highs 22 times. In Japan, the $TOPIX(.TOPIX.JP$ index has risen sharply by 16.2% year-to-date, returning to its historic highs from 1989. Meanwhile, Bitcoin has soared over 60% in the quarter, captivating investor attention on whether the market's strong start can be sustained.

Q1 Performance Review: U.S. Stocks, Bitcoin, Commodities, and More

U.S. Market Highlights: Tesla Trails as S&P 500 Hits New Records

Since the onset of 2024, the U.S. stock market's uptrend has not been deterred by changing expectations for rate cuts.The major indices have consistently hit new historical highs, with the S&P 500 marking its 22nd new high of the year. However, the contribution of the Mag 7 to the first quarter's gains in the S&P 500 has diminished to 37%, compared to their two-thirds share in 2023.

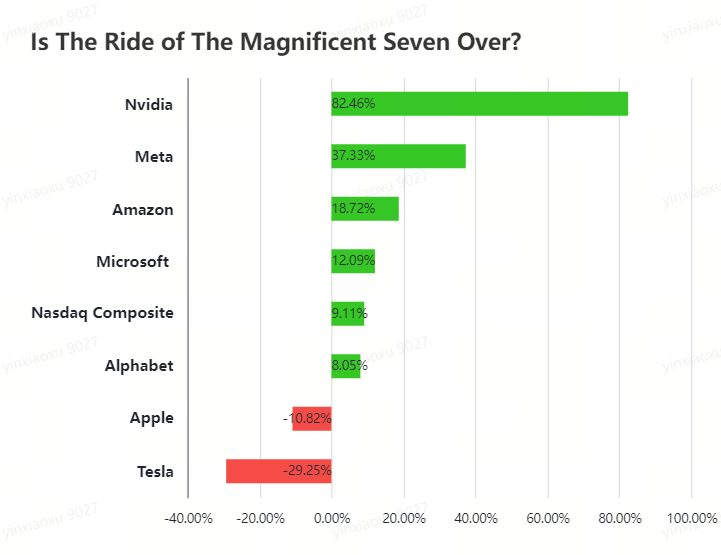

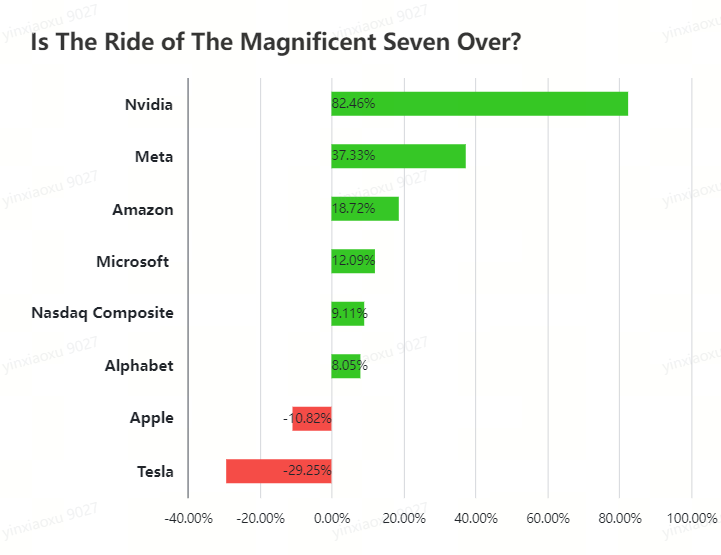

In March, the 'Mag 7' of tech experienced a gain of a mere 1.6%, while the S&P 500 index rose by 3.1%. By 2024, a clear divergence among these stocks became evident: Nvidia and Meta continued their substantial upward trend, while Apple faced a decline of 10.82% since the start of the year, and Tesla recorded a steep 29.25% drop. However, according to Howard Silverblatt's data,if Apple, Tesla, and Alphabet were to be excluded, the remaining four members of the group would account for 47% of the gains. This shift signifies that investors must conduct thorough research and be discerning in their choices, contrasting with the previous year when a collective bet on the 'Magnificent Seven' proved to be a winning strategy.

While growth in large tech stocks is decelerating, cyclical sectors such as industrials, financials, and energy are stepping in to counterbalance the downturn. These three sectors, along with information technology and telecommunications services, outperformed the S&P 500 index in the first quarter.

Semiconductor Sector Leaders: Nvidia Tops Performance Chart

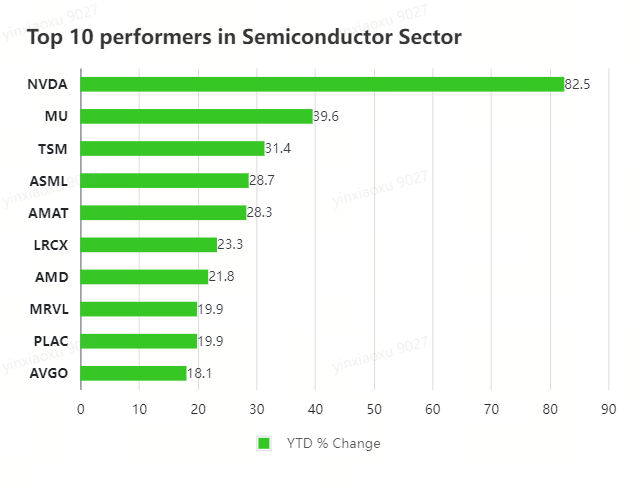

In the semiconductor sector, which is under the global investors' microscope, the following 10 stocks are the top performers, with Nvidia leading the pack boasting an impressive year-to-date (YTD) rally of 82.5%. Micron Technology and Taiwan Semiconductor are not far behind, with gains of 39.6% and 31.4%, respectively.

Japan's Market Leads the Charge

The AI boom on Wall Street has further boosted the Japanese stock market. The TOPIX index has shown a cumulative increase of 18.94% this year, while the Nikkei 225 is up by 14.99%, revisiting its historic peak from 1989. The surge in chip stocks and growing confidence in the economic outlook have been primary drivers for Tokyo's stock market rally.

Bitcoin's Wild Ride

Bitcoin surged 60% over the past three months, pushing its total market capitalization to surpass the GDP of approximately 150 countries. The next Bitcoin halving event is estimated to occur on April 20, 2024. Historically, Bitcoin halvings have been closely associated with the performance of the cryptocurrency market. The price of Bitcoin often soars to unprecedented heights in the 6 to 12 months following a halving event.

Commodities Enter "Surge" Mode

Since the start of the year, prices of various commodities have entered "surge" mode, with metals such as gold, copper, and aluminum particularly shining. "Commodities vanguard" Goldman Sachs claims that gold, copper and aluminum, and will continue to rise this year. Goldman Sachs analysts suggest that copper and gold are expected to see "the biggest direct" price increases in the commodities field due to the potential for the Federal Reserve to cut interest rates.

Can the Strong-Performing Assets of Q1 Maintain Momentum in Q2?

Where Will U.S. Stocks Head Next?

Invesco's Chief Global Market Strategist, Kristina Hooper, notes that U.S. stocks have had an upbeat first quarter, buoyed by the excitement around artificial intelligence.

Historical data indicates that April also holds promise for U.S. stocks. Market statistics from Dow Jones show that, over the past 20 years, April has been one of the best months of the year for the stock market--the S&P 500 has an 80% probability of rising, with an average return of 2%.

This aligns with Bank of America Corp.'s monthly global fund manager survey, which similarly suggests that two-thirds of respondents now view a recession as unlikely over the next year—a stark contrast to last year's consensus of an almost certain downturn.

However, cautious sentiments still exist.

Despite prevailing concerns, UBS underscores the appeal of the software industry, which is garnering attention for its central role in AI development and consistent expansion. Currently deemed to possess fair valuations, it is anticipated to surpass broader market performance in the upcoming quarter.

Meanwhile, the semiconductor industry, with its strong earnings growth and solid fundamentals, shows no signs of overinvestment at present.

Japanese Market Outlook: Post-Bubble Growth Potential

Goldman Sachs Research suggests that following the breakthrough of bubble-era peaks, the Japanese stock market is poised for further gains. Two notable structural shifts are unfolding: Japan is transitioning to an inflationary economy after a prolonged period of deflation, and there's an entrenchment of corporate governance reforms, according to strategists Kazunori Tatebe and Bruce Kirk in their report. Moreover, Goldman's research indicates room for investors to increase their holdings in Japanese stocks. Despite local individual investors selling off Japanese shares at the start of January, they have been net buyers since the end of the month, buoyed by the market's rise. Foreign investors, too, might have the capacity to augment their Japanese stock positions.

The Debate Over Bitcoin's Post-Halving Valuation

As the next Bitcoin halving approaches, many analysts are optimistic about the future price of cryptocurrencies, with some predicting a rise to between $150,000 and $200,000 by the middle of next year. Analysts at Bernstein forecast that by mid-2025, Bitcoin will reach a cyclical peak of $150,000 and will set new historical highs in 2024. Standard Chartered Bank projects that Bitcoin could be valued at $100,000 by the end of this year.

However, analysts at JP Morgan have a differing view. They suggest that due to weakening support from production costs, Bitcoin could fall back to $42,000 after April. Voices in the market are also warning of the risks associated with an overheated cryptocurrency market. Matt Hougan, Chief Investment Officer at Bitwise, cautions against the excessive optimism in the cryptocurrency market, advising investors not to assume that every token experiencing a price surge warrants a high valuation.

Commodity Price Surge and Market Forecasts

UBS notes that even though Fed rate cut expectations have been deferred, the market generally anticipates that it will maintain a loose stance. Even with stubborn inflation and strong economic data, this means real interest rates are likely to further decline, which would benefit the price of gold.

Copper: Anticipated to reach $10,000 per ton by year-end due to a looming supply gap, primarily driven by robust Chinese demand and production cuts. The second quarter is expected to see a deficit of 250,000 tons, expanding to 450,000 tons in the second half of 2024.

Aluminum: Predicted to hit $2,600 per ton as the global market faces a projected supply-demand gap of 7.24 million tons for the year, with China's strong demand being a significant factor. European demand is improving, and a significant incident in the US could affect supply chains and inventory levels.

Gold: Prices are likely to climb to $2,300 per ounce by the end of the year, fueled by expectations of Federal Reserve rate cuts, ETF demand resurgence, geopolitical risks, and Chinese physical asset demand. March saw gold achieving its best monthly performance in three years.

Source: moomoo, Bloomberg, Goldman Sachs, UBS

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Joanna Chung : @74265036

Winnerspayout Joanna Chung: Mr Chung Congratulations very nice very nice