Options Market Statistics: PLTR Surges After Winning U.S. Army Contract For Project TITAN

News Highlights

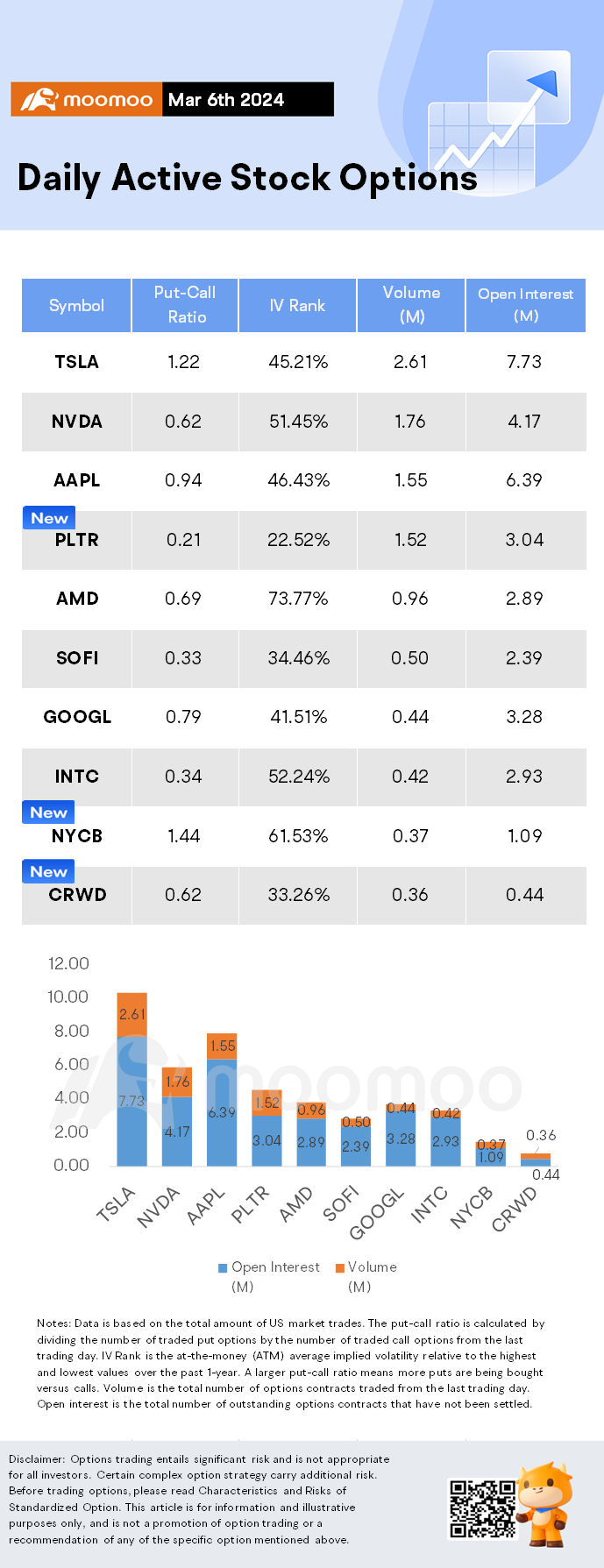

$Palantir(PLTR.US$ shares rose by 9.87%, closing at $26.16. Its options trading volume is 1.52 million. Call contracts account for 82.5% of the total trading volume. The most traded calls are contracts of $26 strike price that expire on Mar 8th. The total volume reaches 77,037 with an open interest of 17,021. The most traded puts are contracts of a $25.5 strike price that expires on Mar 8th; the volume is 29,206 contracts with an open interest of 1,971.

Data analytics software maker Palantir Technologies on Wednesday announced it has won a new, $178 million U.S. Army contract for project TITAN, a battlefield system using artificial intelligence. PLTR stock jumped on the news, clearing an aggressive buy point.

The TITAN (Tactical Intelligence Targeting Access Node) battlefield system will aggregate data from space and terrestrial sensors for long-range precision targeting and other battlefield planning.

This award demonstrates the Army's leadership in acquiring and fielding the emerging technologies needed to bolster U.S. defense in this era of software-defined warfare," said Akash Jain, president of Palantir's U.S. government business in a news release.

$New York Community Bancorp(NYCB.US$ shares rose by 7.45%, closing at $3.46. Its options trading volume is 0.37 million. Call contracts account for 40.9% of the total trading volume. The most traded calls are contracts of $4 strike price that expire on Mar 8th. The total volume reaches 15,305 with an open interest of 16,168. The most traded puts are contracts of a $2 strike price that expires on April 19th; the volume is 54,285 contracts with an open interest of 67,973.

Struggling regional lender New York Community Bancorp announced a $1 billion capital raise and a leadership shake-up on Wednesday, headlined by former Treasury Secretary Steven Mnuchin, leading to a sharp rebound for its stock.

NYCB has agreed to a deal with several investment firms including Mnuchin's Liberty Strategic Capital, Hudson Bay Capital and Reverence Capital Partners for more than $1 billion in exchange for equity in the regional bank, according to a press release Wednesday afternoon.

Mnuchin will be one of four new members of the bank's board of directors as part of the deal. Joseph Otting, former comptroller of the currency, is also joining the board and taking over as CEO.

The stock jumped sharply after the announcement, but trading was highly volatile. Shares were briefly halted, up nearly 30% for the day. They gave back some of those gains when trading resumed and finished the day up more than 7% after several more halts.

$CrowdStrike(CRWD.US$ shares rose by 10.76%, closing at $329.57. Its options trading volume is 0.36 million. Call contracts account for 61.7% of the total trading volume. The most traded calls are contracts of $400 strike price that expire on Mar 15th. The total volume reaches 13,749 with an open interest of 1,079. The most traded puts are contracts of a $330 strike price that expires on Mar 8th; the volume is 5,946 contracts with an open interest of 257.

Shares in CrowdStrike Holdings surged on Wednesday after the cybersecurity firm reported fourth-quarter earnings that topped estimates as a key growth metric beat. The company's fiscal 2025 guidance for CrowdStrike stock came in above expectations.

CrowdStrike reported earnings after the market close on Tuesday. On the stock market today, CrowdStrike stock jumped 10.8% to close at 329.57.

The rally in CRWD stock follows sell-offs in $Palo Alto Networks(PANW.US$ and $Zscaler(ZS.US$ on disappointing earning reports.

CrowdStrike management noted no signs of spending fatigue, with multiple tailwinds including rising cyberattacks, new SEC regulations and artificial intelligence driving increased demand," said Morgan Stanley analyst Hamza Fodderwala in a report.

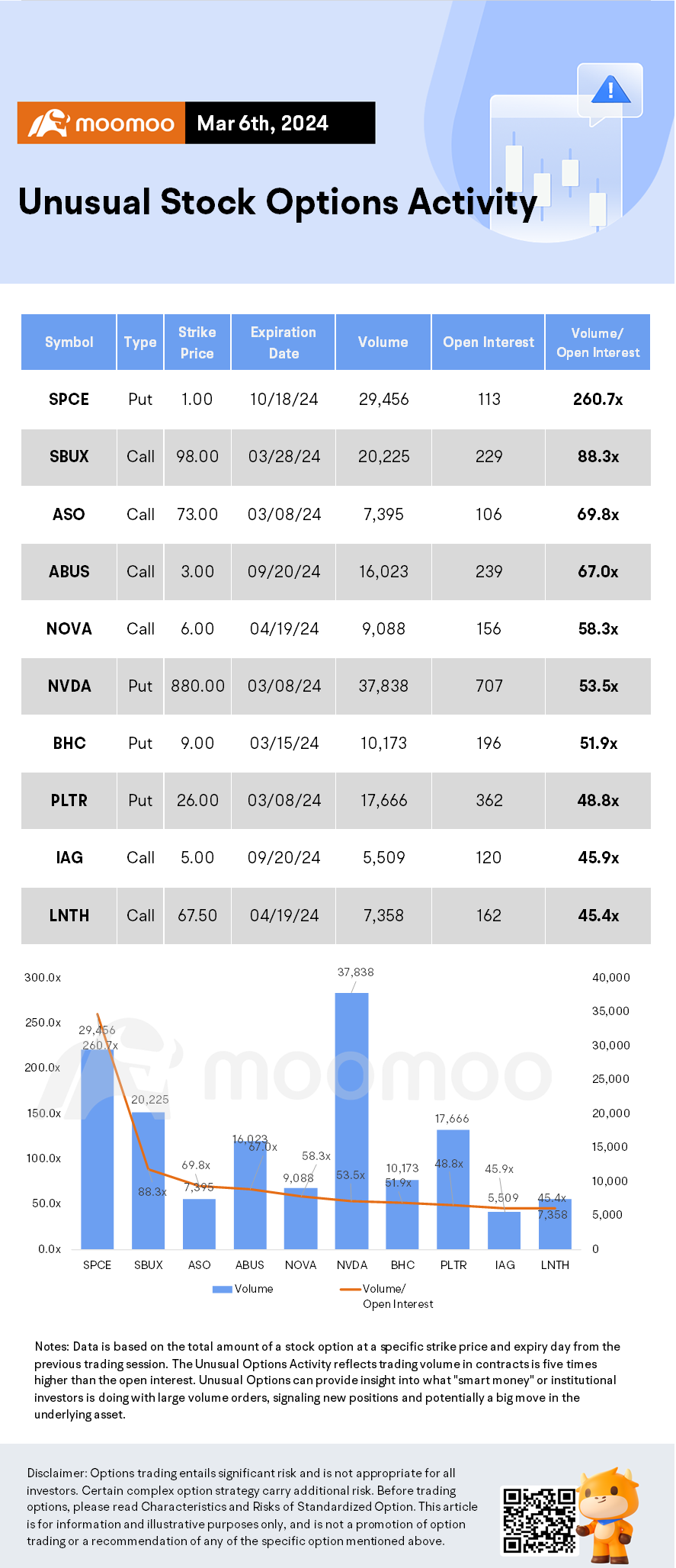

Unusual Stock Options Activity

Some notable put activity is being seen in $Virgin Galactic(SPCE.US$, which is primarily being driven by activity on the Oct. 18th put. Volume on this contract is 29,456 versus open interest of 113.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

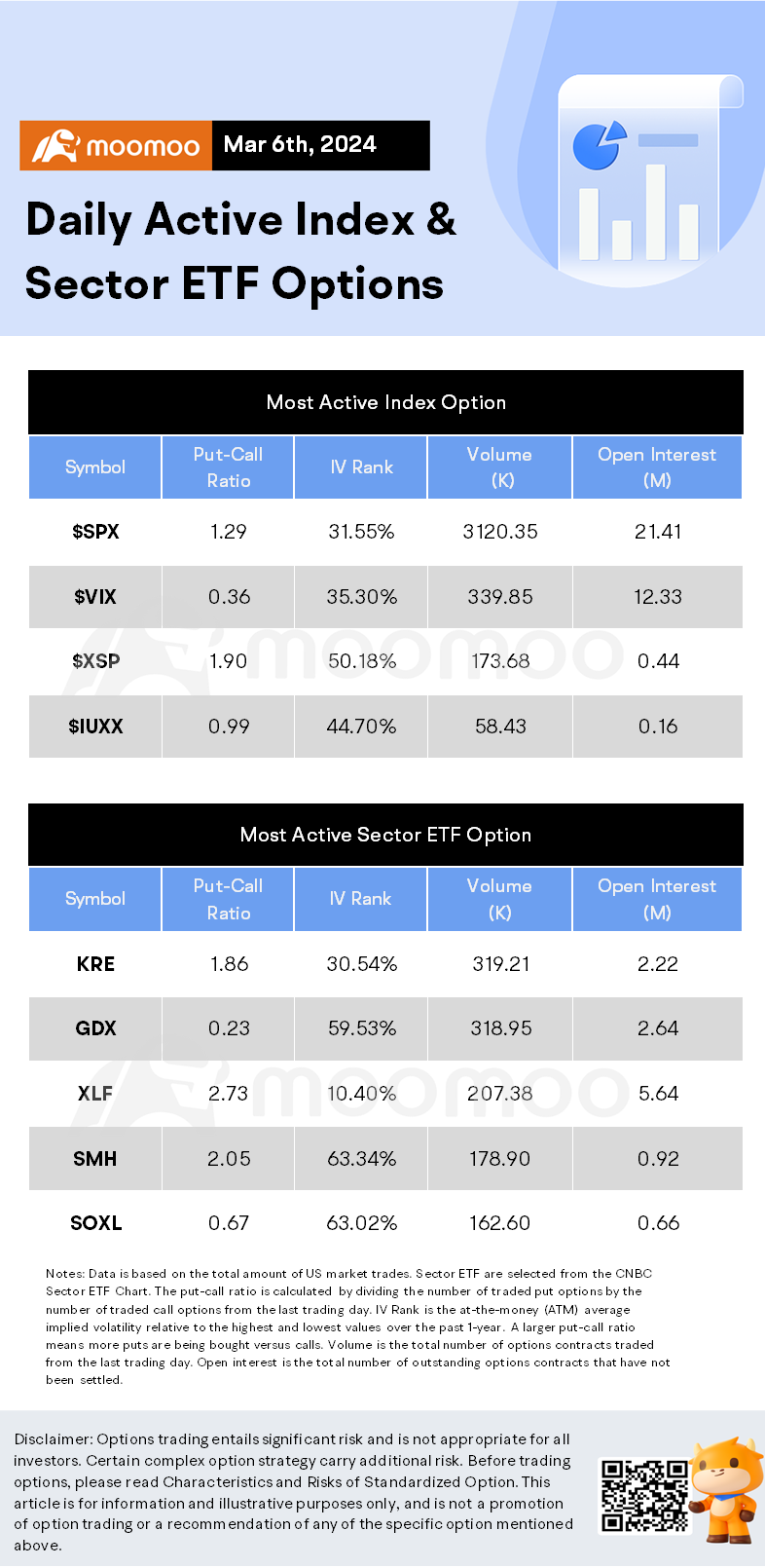

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, Barron's, The Motley Fool

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment