Options Market Statistics: NVDA Pops 16% After AI-fueled Bumper Earnings, Options Pop

News Highlights

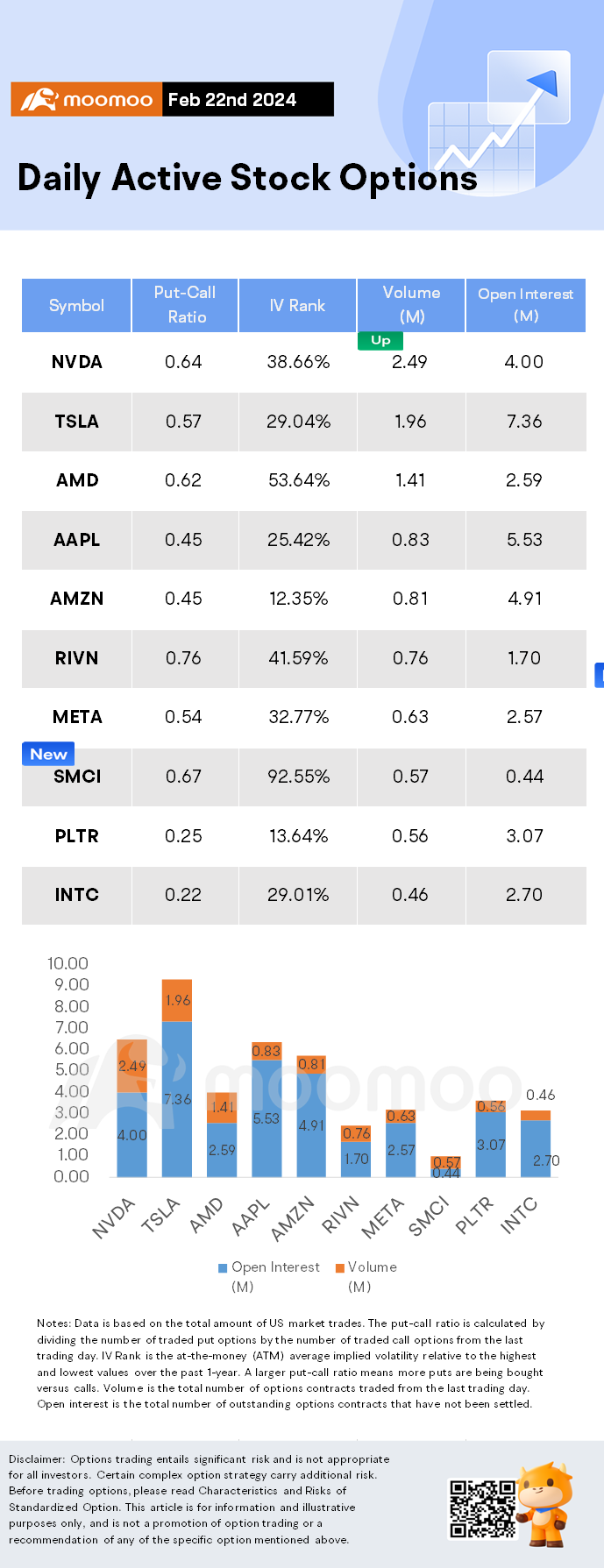

$NVIDIA(NVDA.US$ shares rose by 16.40%, closing at $785.38. Its options trading volume is 2.49 million. Call contracts account for 61.1% of the total trading volume. The most traded calls are contracts of $800 strike price that expire on Feb 23rd. The total volume reaches 115,183 with an open interest of 20,516. The most traded puts are contracts of a $750 strike price that expires on February 23rd; the volume is 38,495 contracts with an open interest of 1,498.

Nvidia shares closed up 16% on Thursday, a day after the chip giant posted bumper earnings that beat Wall Street estimates.

The U.S. tech giant reported revenue of $22.10 billion for its fiscal fourth quarter, a rise of 265% year on year, while net income surged by 769%, as the company continues to see a boost from excitement over artificial intelligence.

Nvidia chips are used to train huge AI models such as those developed by Microsoft and Meta

$Super Micro Computer(SMCI.US$ shares surged by 32.87%, closing at $975.52. Its options trading volume is 0.57 million. Call contracts account for 60.0% of the total trading volume. The most traded calls are contracts of $1000 strike price that expire on Feb 23rd. The total volume reaches 34,666 with an open interest of 4,349. The most traded puts are contracts of a $800 strike price that expires on February 23rd; the volume is 16,788 contracts with an open interest of 1,177.

Unusual Stock Options Activity

Some notable call activity is being seen in $Cameco(CCJ.US$, which is primarily being driven by activity on the March 1st Call. Volume on this contract is 18,072 versus open interest of 203.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, Barron's, The Motley Fool

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Malik ritduan : ok

Ricky Dennis : amazing work everyone's friend Ricky D

everyone's friend Ricky D

sharol104622486 : Hai,