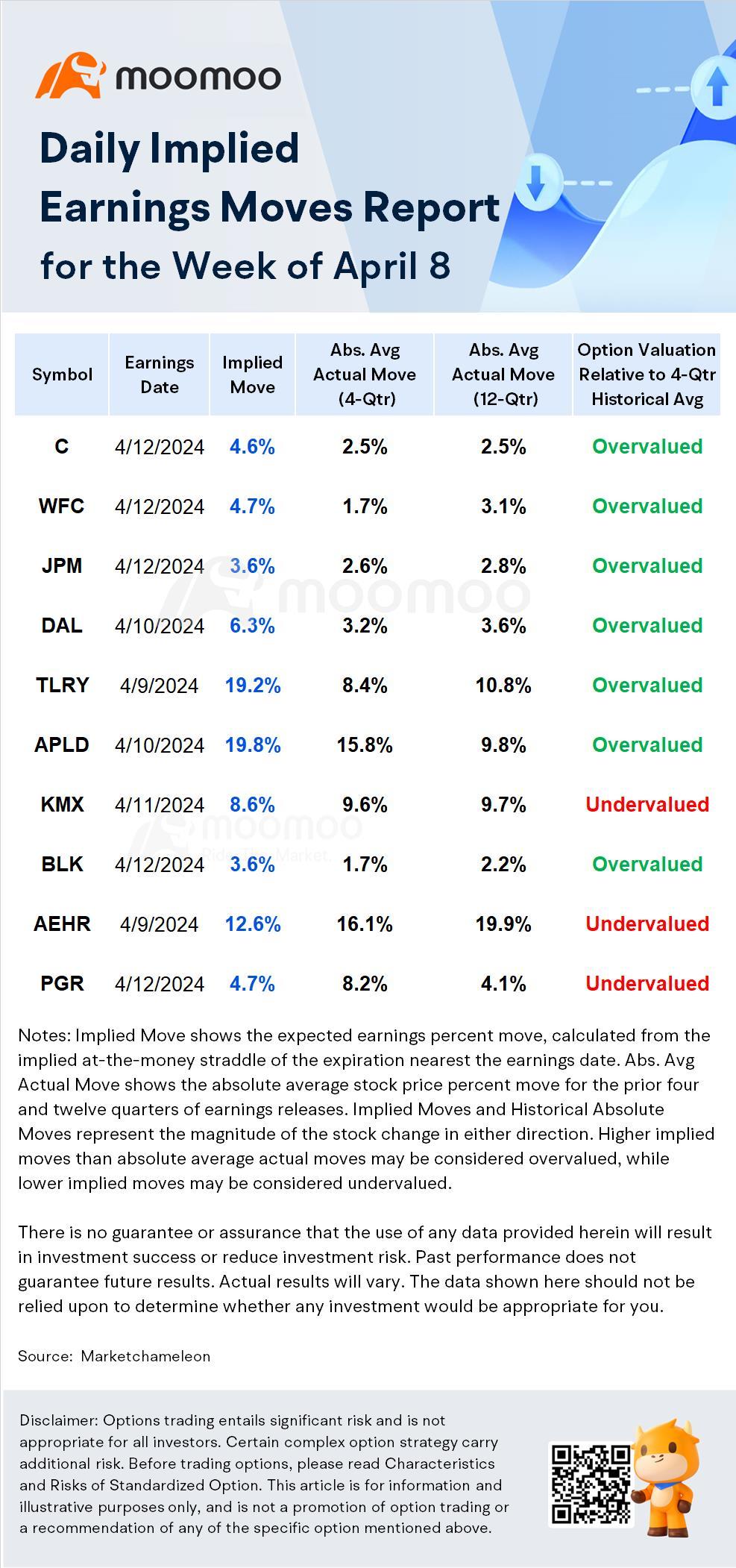

Earnings Volatility | Citi and JPMorgan Kick-Start Earnings Season Amidst Macro Headwinds

Stock prices may see larger-than-normal moves during earnings season, making it a potentially attractive time for options traders. For investors looking to trade against these moves, you should always keep track of how the options might shift after their earnings. Here are the top earnings and volatility for the week:

-Earnings Date: 4/12 After Market Close

-Implied Move: 4.6%

-Absolute Average Actual Move for the past 4 Quarters: 2.5%

-Absolute Average Actual Move for the past 12 Quarters: 2.5%

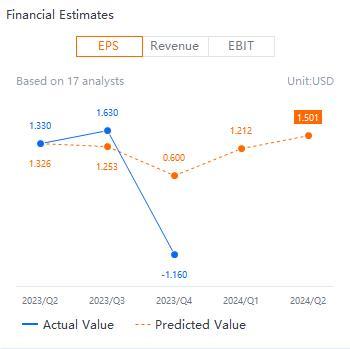

-Earnings Normalized Estimate: USD $1.212

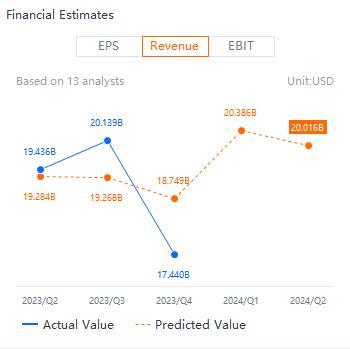

-Revenue Estimate: USD $20.386 billion

According to recent data from Market Chameleon, the options prices predicted a ±4.0% post earnings move, compared to a +1.0% actual move. The options market overestimated C stocks earnings move 69% of the time in the last 13 quarters. The predicted move after earnings announcement was ±3.5% on average vs an average of the actual earnings moves of 2.8% (in absolute terms).

Earnings Catalyst

JPMorgan (JPM), Wells Fargo (WFC), BlackRock (BLK), and Citi (C) are set to report earnings of the first quarter earnings season along with Delta Air Lines (DAL).Big banks still operate in a complex environment, and both favorable and unfavorable variables need to be taken into account. Macroeconomic data and the most recent non-farm payroll report demonstrate a strong economy and brisk activity, both of which are advantageous to banks. But the market's and the banks' surge has been spurred by decreased expectations for interest rate decreases. Investors have been considering the effects of higher rates for a longer period of time on net interest income because inflation is still sticky. First-quarter earnings show that community banks' lending profitability and declining credit quality are not as pressured.

According to data from S&P Global Market Intelligence, the median net interest margin of U.S. banks, a crucial indicator of profitability, fell to 3.35% in the fourth quarter of last year, down 2 basis points sequentially after falling 3 basis points in the third and 5 basis points in the second quarter.

It is anticipated that first-quarter figures would demonstrate that the downward pressure on NIM continued into the early months of this year. Higher interest rates have also hurt more borrowers for commercial real estate and consumers. In the wake of the pandemic, credit card fees increased along with interest rates, making monthly payments more expensive and challenging to handle. CRE office properties, in particular, have suffered due to persistent tendencies toward remote employment.

Simona Mocuta, chair of the ABA committee and chief economist at State Street Global Advisors, predicts that factors such as persistent high interest rates, weakened demand, reduced consumer savings, and a slight increase in unemployment will lead to a decline in credit quality. However, the American Bankers Association (ABA) committee notes that the likelihood of a recession has lessened, and with inflation continuing to moderate—having fallen from a peak of 9.1% in 2022 to an annual rate of 3.2% in February—there is potential for interest rate reductions starting this summer.

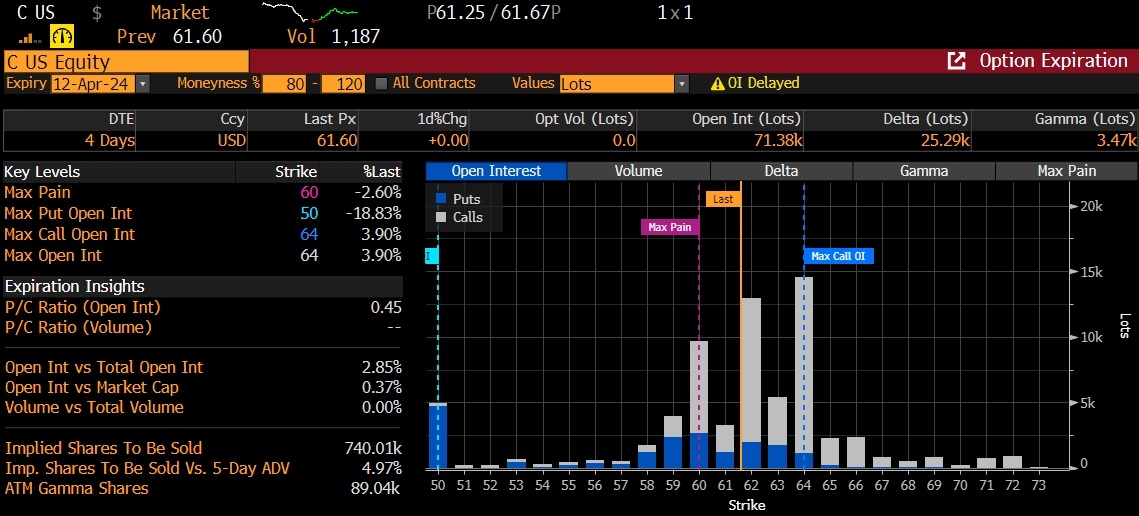

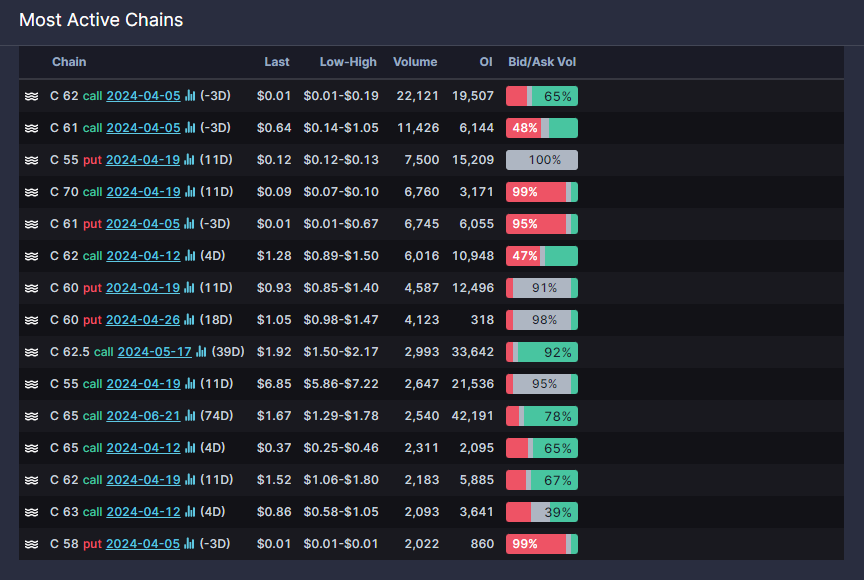

Last Friday, Citi Group experienced the highest options activity among major banks, with trading volume peaking at 140K—just below its 30-day average of 174K.

The put/call ratio for Citi Group stands at 0.45, suggesting an optimistic sentiment regarding the stock's post-earnings performance. This figure is considerably lower than the typically neutral benchmark of 0.7, hinting at a bullish outlook from options traders ahead of the earnings release.

Notably, the most open interest clustered at the 64, 62, and 60 strike prices for options expiring that same day, indicating focused investor attention. The open interest allocation signals a relatively neutral outlook ahead of earnings, as the concentration centered around the last price. Additionally, Citi Group is slated to announce its earnings before the market opens on the day of expiration, a factor that could be driving heightened options activity.

Don't Get Crushed by Earnings. Here are things you should know before considering a trade.

Knowing the IV Crush

Before significant corporate events such as earnings announcements, product launches, or clinical trial results, implied volatility tends to increase. However, after the news has been released, the implied volatility can drop significantly due to the sudden clarity in the market and the stock price reaction to the news. This phenomenon is referred to as IV crush.

IV Crush And Option Prices

IV crush can lead to a decrease in option prices because the Implied volatility is lowered dramatically. This decrease in option prices due to IV crush can be a risk for options traders who have purchased options at a higher price with the expectation of making a profit from a significant move in the underlying stock price. Conversely, IV crush may not be as prevalent if the option is undervalued and the stock price moves drastically, which can pose a risk for option sellers. It's important for traders to be aware of IV crush and factor it into their trading strategy when considering options trades around significant corporate events.

Not all options are affected equally by an IV crush. IV crush affects short-term option prices more than long-term option prices.

Nonetheless, it's important to note that trading options always involve risks, and investors should consult with a financial advisor before making any trades.

Source: Dow Jones, Market Chameleon, Bloomberg

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

The data and information provided has been obtained from sources considered to be reliable, but Moomoo Financial and its affiliates do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

麦克格 : If you don't have anywhere to go, you can still reap benefits, thank you

Options NewsmanOP 麦克格: Feel free to ask me anything about options