Options Market Statistics: Apple's Options Pop as Traders Bet on Its Earnings

News Highlights

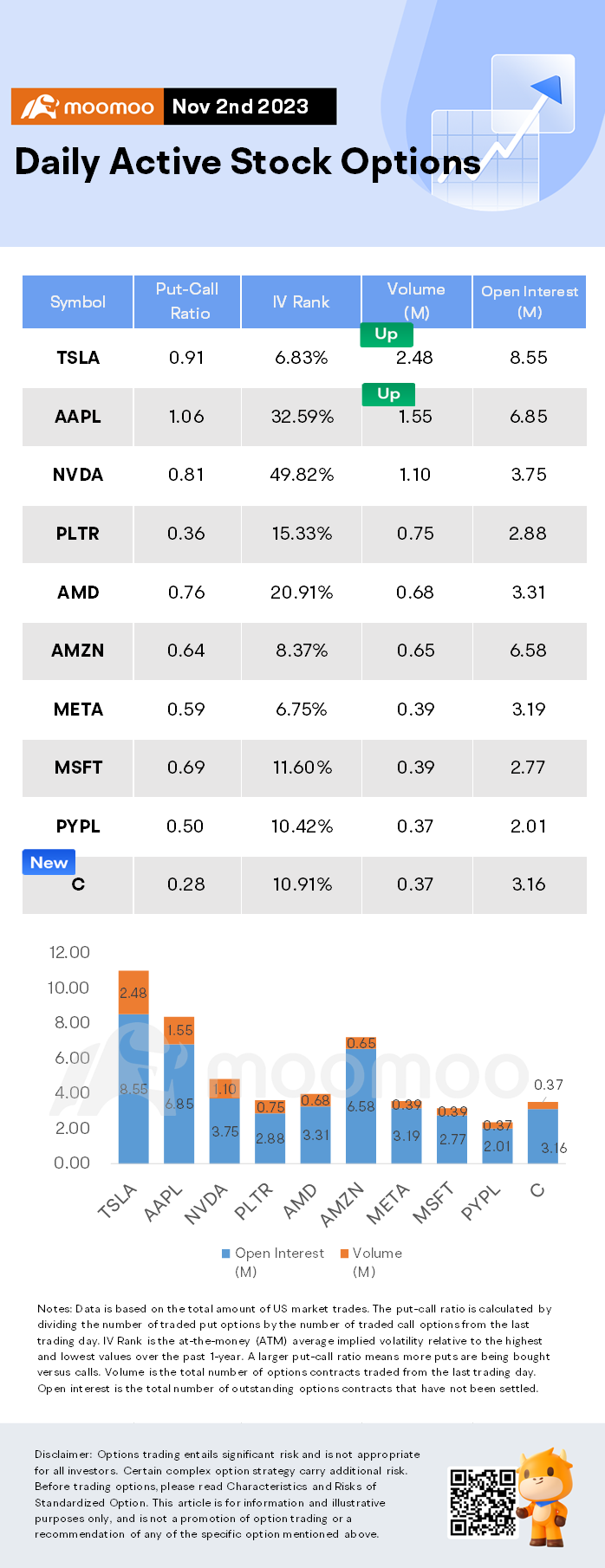

$Tesla(TSLA.US$ shares rose by 6.25%, closing at $218.51. Its options trading volume is 2.48 million. Call contracts account for 52.3% of the whole trading volume.

Billionaire investor and Baron Capital CEO Ron Baron envisions Tesla Inc achieving a $4 trillion market capitalization in a decade, a sentiment shared by company CEO Elon Musk.

Musk responded to Baron's hopeful estimates on Thursday, stating, "We do need to knock the ball out of the park several times to achieve that value, but I think we can."

Baron's insights emerged during an interview with MarketWatch on Wednesday, during which he discussed Tesla and his involvement with Musk's rocket manufacturing firm, SpaceX.

Having invested approximately $400 million, equivalent to 2% of his assets under management, in Tesla between 2014 and 2016, Baron explained the company's initial investment decision in 2014.

Despite early skepticism, Baron commended Musk's "mission-driven" approach and described him as a "brilliant" individual.

$Apple(AAPL.US$ shares rose by 2.07%, closing at $177.57. Its options trading volume is 1.55 million. Call contracts account for 48.5% of the whole trading volume.

Apple stock fell as much as 3% in extended trading on Thursday after the iPhone maker reported earnings after the bell that beat estimates while the company offered a cautious outlook for the current quarter.

In its fiscal fourth quarter, Apple reported earnings per share of $1.46 on revenue that reached $89.5 billion. Wall Street had expected earnings per share to come in at $1.39 with revenue reaching $89.3 billion, according to estimates from Bloomberg. This marked the fourth-straight quarter revenue fell from the year ago period.

The company said iPhone sales increased to $43.8 billion in its fourth quarter, slightly beating expectations and marking a new record for iPhone sales in its fiscal fourth quarter. Services revenue surpassed $22 billion for the first time.

Revenues in its Mac, iPad, and Wearables categories fell from the same quarter last year. For its just-completed fiscal year, Apple reported total revenue of $383.3 billion, down from $394.3 billion in the prior year.

On a call with analysts following the results, Apple CFO Luca Maestri said revenue in the current quarter to be "similar" to last year. Maestri also said the company is expecting revenue for Mac, iPad, and Wearables categories to "decelerate significantly" from the fourth quarter.

$Citigroup(C.US$ shares rose by 4.42%, closing at $41.35. Its options trading volume is 0.37 million. Call contracts account for 77.9% of the whole trading volume.

Unusual Stock Options Activity

Some notable call activity is being seen in $DoorDash(DASH.US$, which is primarily being driven by activity on the February 16th 2024 70.00 call. Volume on this contract is 52,016 versus open interest of 165.

Daily Active Index & Sector ETF Options

Source: Benzinga, Dow Jones, CNBC

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Source: Benzinga, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Methods : Yah well they bet wrong

Alpha Returns : Interesting

ديب الجارح : welcome

金融弟弟 : Asd