No Rate Cut Timeline While End of QT Discussed: What Do FOMC Minutes Mean for the Market?

The latest released December FOMC minutes reveal that Fed officials have conceded that "the policy rate has likely peaked" and have suggested that "a lower target range for the federal funds rate would be appropriate by the end of 2024." Additionally, discussions have commenced regarding how to manage a slowdown or cessation of balance sheet reduction (Quantitative Tightening, QT).

Despite this, Fed officials remain cautious about implementing interest rate cuts and did not provide the specifics of timing. This has diluted the dovish signal of the minutes, leading the market to lower its expectations for the likelihood and magnitude of interest rate cuts by the Fed. As a result, U.S. stocks continued to slump.

1.“All participants observed that clear progress had been made in 2023 toward the Committee's 2 percent inflation objective”.

It is worth noting that, for the first time since June 2022, the Fed did not use the phrase "unacceptable level" to describe inflation, indicating once again that officials have recognized progress in combating inflation.

2. “Participants viewed the policy rate as likely at or near its peak for this tightening cycle”.

However, officials noted that the actual policy path will hinge on how the economy develops, and more data needs to be observed. The committee also cautiously left open the possibility of further rate hikes.

3. Baseline projections of almost all participants implied that “a lower target range for the federal funds rate would be appropriate by the end of 2024”.

4. FOMC did not provide a specific timeline for the rate cut.

Although the FOMC acknowledged that a rate cut in 2024 would be appropriate, it immediately pointed out “an unusually elevated degree of uncertainty”surrounding the policy path. Some members continued to advocate for “keeping the target range at its current value for longer than they currently anticipated”. This has also poured cold water on investors who were optimistic about a rate cut as early as March.

5. The scenario of slowing and ending the balance sheet reduction is under discussion.

Some participants suggested that the Fed could slow and eventually halt the reduction of its balance sheet when reserve balances were slightly above the level deemed sufficient, and recommended that the committee should start discussing the technical factors to guide a slower pace of balance sheet reduction before making a decision. This suggests that the current round of quantitative tightening, which has been ongoing for 18 months, may end earlier than initially anticipated.

6. The FOMC dot plot implies an interest rate cut of 75 bp in 2024, while the market anticipates a 150 bp cut, twice this guidance.

According to the CME Fed Watch tool, traders currently anticipate a 91.22%probability of the Fed keeping interest rates unchanged in January, up from 87.6% the previous day. Meanwhile, the probability of a first rate cut in March has decreased from 78.98% the previous day to 70.81%. The market is gradually lowering expectations.

Following the release of the meeting minutes on Wednesday, the market's bets on interest rate cuts during the year further cooled down. U.S. stocks continued to fall, led by large technology stocks, and the U.S. dollar index hit a new high in nearly three weeks.

1. U.S. stocks

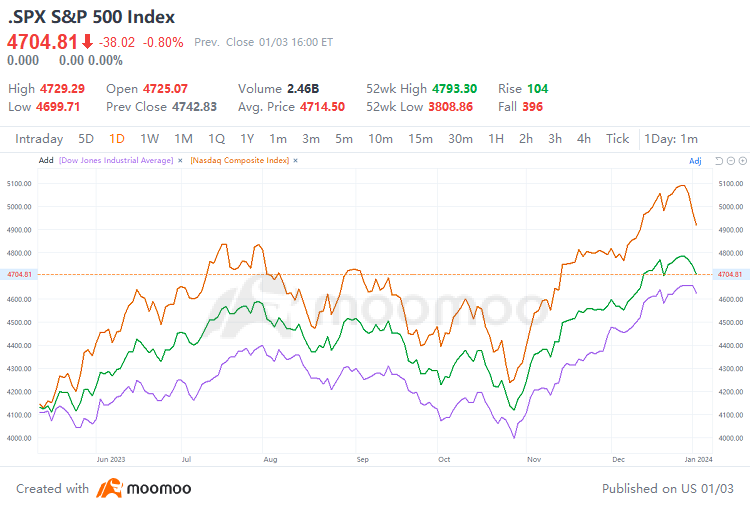

As the market continues to adjust its overly optimistic expectations for rate cuts, the three major indices collectively fell, with tech stocks leading the decline in the US stock market. The tech-heavy $Nasdaq Composite Index(.IXIC.US$ dropped 1.18%, while the $S&P 500 Index(.SPX.US$ and $Dow Jones Industrial Average(.DJI.US$ both fell by around 0.8%. Among the Magnificent 7, $Tesla(TSLA.US$ saw the biggest decline, falling 4% and hitting a new closing low since December 12 after four consecutive days of losses.

2. U.S. Treasuries

On the US Treasury side, the $U.S. 2-Year Treasury Notes Yield(US2Y.BD$, which is sensitive to interest rates, rose above 4.38% in early trading on Wednesday, hitting a one-week high, while the benchmark $U.S. 10-Year Treasury Notes Yield(US10Y.BD$ briefly surpassed the 4% mark. After the release of the minutes, the yields for both maturities declined.

Nevertheless, according to the latest report from JPMorgan as of January 2, the net decrease in long positions in US Treasuries reached the largest level since May 2020, driven primarily by the reduction of long positions and the establishment of new short positions, indicating a cautious sentiment in the US Treasury market.

3. U.S. dollar

The Fed's cautious tone, as expressed in the released meeting minutes, appears to be urging the market to exercise patience, and this slightly hawkish stance has once again bolstered the US dollar. The $USD(USDindex.FX$, which measures the currency against six major currencies, continued its upward trend from the previous day, rising 0.22% on the day to close at a new two-week high of 102.465. The US dollar has had its strongest start to a year since 1997 in the first two trading days of 2024.

4. Gold

The weakening expectation of rate cuts has further exacerbated the volatile downward movement of gold prices. On Wednesday, COMEX gold futures dropped over 1% intra-day to a nearly two-week low of $2,038.3 per ounce, marking the most significant single-day decline since December 11th of last year.

The lackluster start to U.S. stocks and bonds in 2024 reflects not only profit-taking after last year's substantial gains, but also a potential adjustment to overly optimistic rate cut expectations from the previous phase. This trend may take some time to digest.

As highlighted by repeated comments from Fed officials, the actual policy trajectory will ultimately depend on economic developments, with monetary policy decisions continuing to follow a data-dependent approach. As the next phase seeks to solidify the interest rate reduction, the importance of data will become even more pronounced.

Source: Federal Reserve, Bloomberg, CNBC

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment