Middle East Tensions Rise: Where Are Funds Finding Shelter?

The already complex situation in the Middle East escalated once again last weekend, following Iran's retaliatory attack on Israel, prompting concerns of a wider regional conflict. On the day of the conflict escalation, 24/7 trading cryptocurrency and Middle Eastern stock markets open on weekends were the first to release panic, with Bitcoin, known as the "digital gold," plummeting 8% intraday and dragging down other cryptocurrencies significantly. The Saudi TASI index initially fell nearly 2%, but narrowed its decline later.

With market disruptions intensifying, investors' risk aversion is on the rise, and the direction of capital seeking refuge has become a matter of universal concern. In addition to traditional safe-haven assets, such as the US dollar, US Treasury bonds, and gold, base metals and oil, which have demonstrated strong performance in the recent past, are once again drawing attention.

● Safe-Haven Mood Supports Trading:

The escalation of the Middle East conflict over the weekend reignited risk aversion, and the US dollar, as one of the most traditional safe-haven assets, gained short-term momentum once again. Last Friday, the $USD(USDindex.FX$, which measures the dollar against a basket of six major currencies, rose above 106, marking a three-day consecutive increase and a five-month high.

● Expectations of Interest Rate Cuts Diminish:

The sustained strength of the US economy and stubborn inflation have continued to dampen expectations of a rate cut by the Federal Reserve this year. The timing of the rate cut has been repeatedly postponed from as early as March to July or even September, and the number of rate cuts expected for this year has decreased from the initial estimate of six to fewer than three. The expectation of the Fed to keep interest rates higher for longer has continued to support the strength of the US dollar this year.

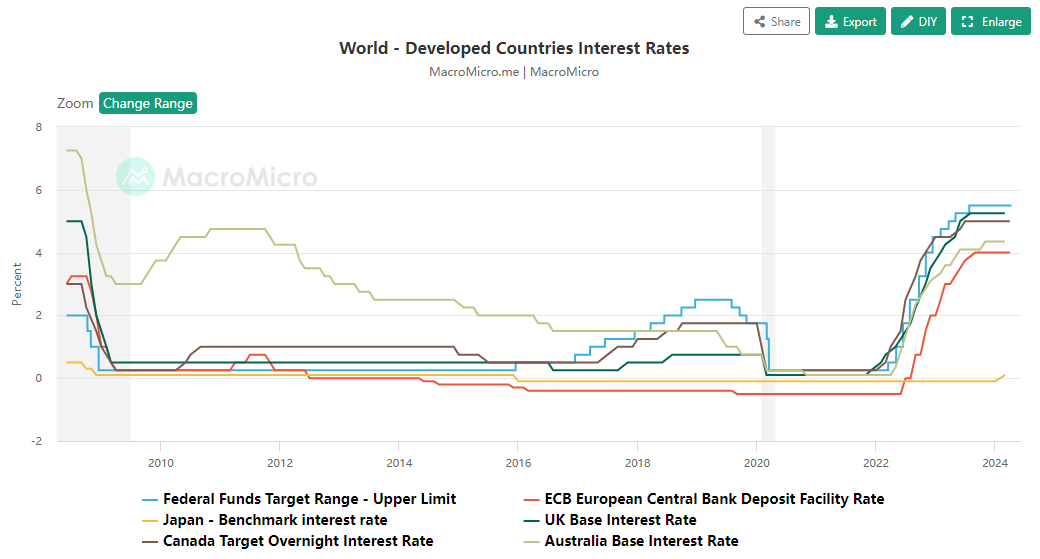

● Global Interest Rate Outlook Diverges:

Currently, the US remains the only market in the world that can offer higher nominal and real yields than any other major economy, which lays the foundation for capital inflows into the US dollar. Moreover, considering the widening gap between the US and European economies, the Fed and the European Central Bank have differences in the extent of monetary policy easing. Data shows that the spread between US and European bonds has begun to rise significantly in recent weeks, indicating that the market has begun to price in later rate cuts in the US and earlier rate cuts in the Eurozone. The widening yield spread between US bonds and those of other developed economies is driving the appreciation of the US dollar.

Analysts point out that with the strong growth of the US economy, reduced expectations of a rate cut by the Federal Reserve, and multiple support from risk aversion, the US dollar is expected to start a new round of upward momentum.

Despite doubts about the safe-haven properties of Bitcoin, known as "digital gold," gold's safe-haven capability and allocation value are still recognized. Following the weekend conflict, $Gold Futures(AUG4)(GCmain.US$ continued to rise on April 15, rising nearly $30 in early trading to stand at $2,389.6 per ounce. Goldman Sachs expects risk aversion to drive gold prices up and has raised its gold price forecast for the end of 2024 from $2,300 to $2,700 per ounce. James Hyerczyk, a financial analyst at FX Empire, pointed out that the gold price is likely to continue its volatile trend, and there is still great potential for it to maintain its high level or even increase. He expects gold to remain the preferred asset for those seeking to hedge geopolitical risks.

In addition to the escalation of geopolitical conflicts, multiple factors are supporting the current rise in gold prices, including concerns about sustained inflation in the US, uncertainty brought by macroeconomic fluctuations, a decline in credibility of the dollar-dominated credit monetary system driving central bank purchases of gold, and FOMO (fear of missing out) sentiment among investors.

Apart from gold and the US dollar, traditional safe-haven assets such as US Treasuries and the Japanese yen are also expected to gain renewed attention.

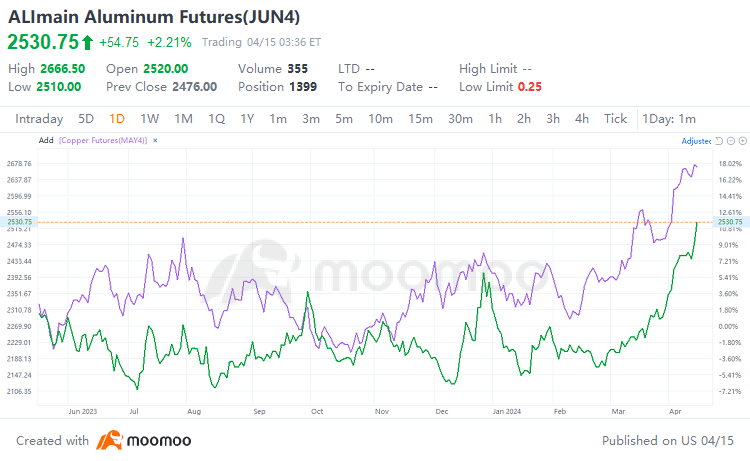

Supported by multiple factors such as supply tightness, demand improvement, and renewed US inflation expectations, non-ferrous metals such as $Copper Futures(SEP4)(HGmain.US$ and $Aluminum Futures(SEP4)(ALImain.US$ have shown significant increases this year, with gains of over 10% year-to-date.

As the conflict in the Middle East escalated, the UK and the US announced new sanctions on Russia's aluminum, copper, and nickel, prohibiting the delivery of new supplies from Russia to the London Metal Exchange and the Chicago Mercantile Exchange. The restrictions apply to copper, nickel, and aluminum produced on or after April 13. Following that, LME aluminum saw its largest increase since at least 1987, with a maximum surge of over 9% on April 15th. LME nickel also rose by approximately 8.75% at one point, while LME copper opened with an increase of about 2%.

Russia plays an important role in the global non-ferrous metal market, accounting for 4%, 5%, and 6% of global copper, aluminum, and nickel supply, respectively. Its role in the London Metal Exchange is even more significant, with Russian copper, aluminum, and nickel accounting for 62%, 91%, and 36% in LME warehouses as of the end of March. Therefore, in the short term, the sanctions on Russian metals are likely to disrupt global non-ferrous metal supply, thus supporting metal prices. In the medium to long term, analysts point out that copper and aluminum, which are subject to long-term supply-demand imbalances, may have greater upward price support, while nickel, which is relatively oversupplied and has lower warehouse pressure, may require further observation for upward potential.

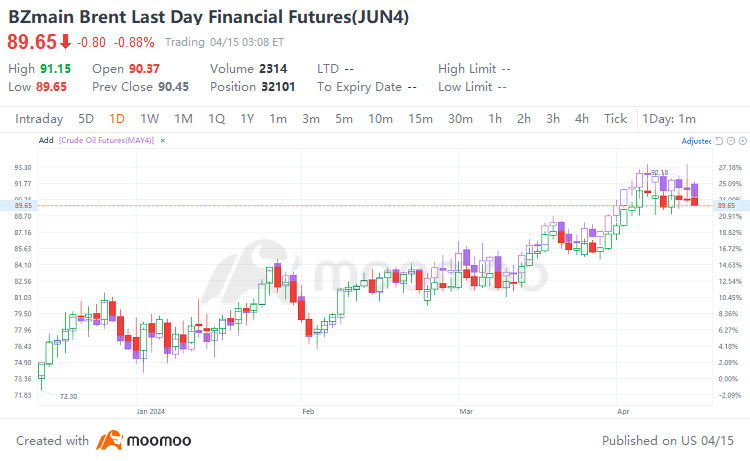

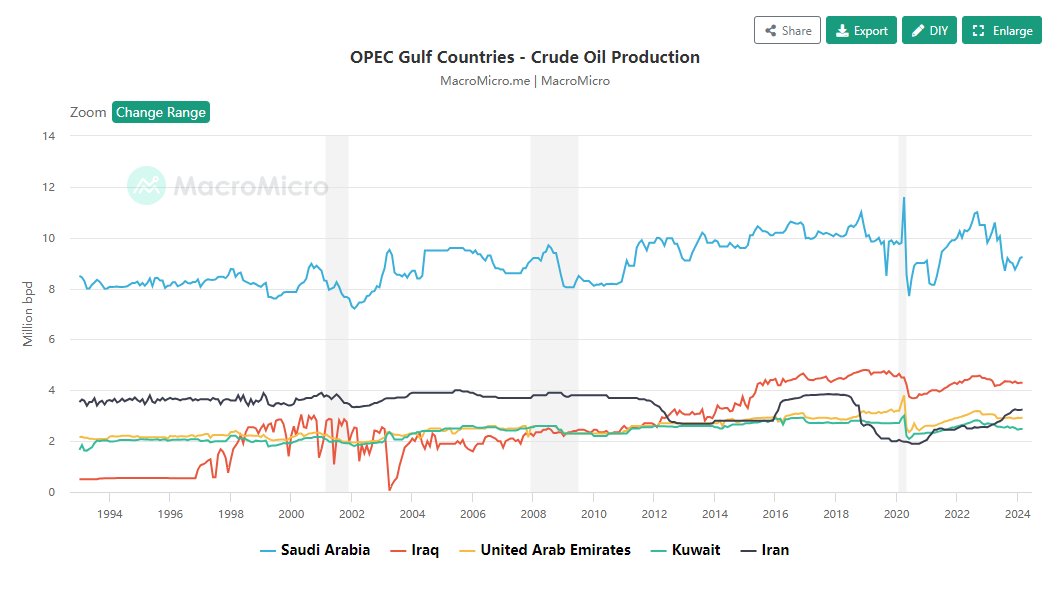

Being the third largest oil producer in OPEC and one of the top ten oil producers in the world, Iran has a significant impact on international oil prices. The escalation of tension between Israel and Iran has ignited concerns among investors about future supply disruptions. Last Friday, the global benchmark Brent crude oil briefly broke through $92 per barrel, reaching its highest level in six months.

Although Iran has signaled a response to avoid a serious escalation of the situation, the market remains cautious about the situation in the Middle East. Several analysts predict that if the geopolitical conflict persists, oil prices could soon return to over $100 per barrel.

Ed Yardeni, market veteran, and president of Yardeni Research, pointed out that the escalating tensions in the Middle East have disrupted the oil market, and oil prices could rise to $100 per barrel under this situation.

Bob McNally, President of Rapidan Energy, said earlier that if the Middle East conflict escalates, Brent crude futures could soar to $100 per barrel, and if the situation further intensifies, leading to the interruption of the important oil trade route Strait of Hormuz, oil prices could surge to $120 or $130 per barrel.

Not only geopolitical risks but also the oil supply and demand fundamentals are tight. US energy companies have cut the number of operating oil drilling platforms for the fourth consecutive week, indicating a slowdown in US oil production growth. In addition, OPEC+ is continuing to keep the oil market tight and decided in late March to extend production cuts from the first quarter to the second quarter, which has also provided some support for oil prices.

At present, the global market is closely watching the development of the direct conflict between Iran and Israel. For the capital market, the direction of this conflict directly determines risk appetite and asset selection. If the conflict remains stable without further escalation, the upside potential for oil prices may be limited, and the price of gold may also experience high-level fluctuations.

"The key risks for the global economy are whether this now escalates into a broader regional conflict, and what the response is in energy markets," stated Neil Shearing, the group's chief economist at Capital Economics.

Source: Bloomberg, Financial Times, moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

72MonkeySurvival : is a good time to fix One OZ Gold to Twenty-five Barrels of OIl.

104901579 : I’m

152252817 : I know US dollar and treasuries were a safe haven but goodness me can they be considered that today with the insanity of its financial health.