Netflix Shines in Q1 Earnings but Stock Stumbles: Reasons of Unexpected Market Reactions

Stay Connected.Stay Informed. Follow me on MooMoo!![]()

![]()

![]()

Netflix's financials were looking good, but their stock price took a hit after hours. The Q1 2024 earnings report they released showed that their core metrics like net subscriber additions, revenue, and operating income exceeded expectations, thanks to a strong line-up of original content. Despite this, the stock price fell by over 4% post-market, which indicates that investors weren't exactly thrilled with the results.

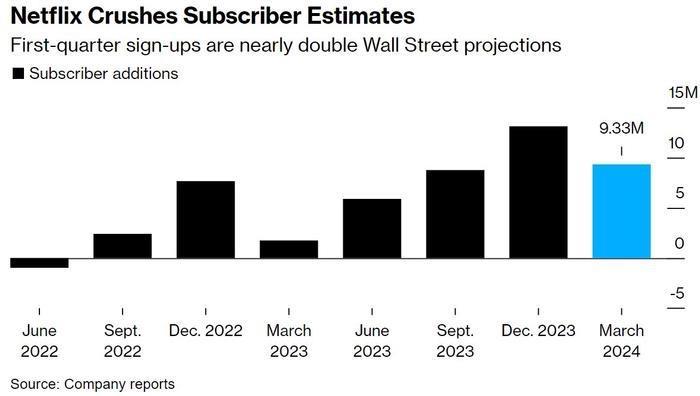

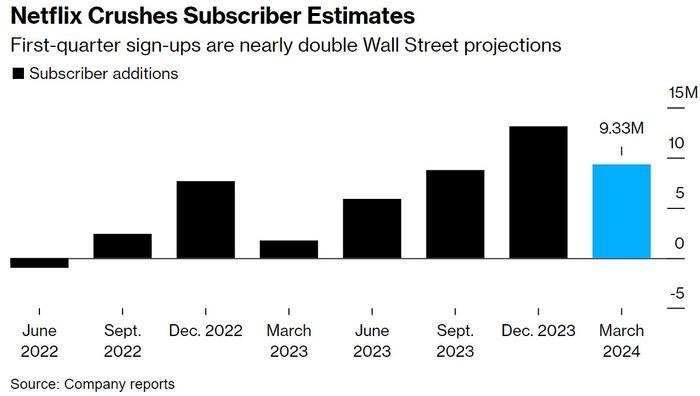

They added 9.33 million new subscribers, almost double what analysts had predicted. This growth was largely driven by the appeal of Netflix's original programming and their crackdown on password sharing. They saw a surge in new customers globally, with particularly strong performance in the U.S. and Canadian markets.

I think the disappointment from the market isn't about Q1's performance but more about two points regarding future outlook and expectations:

(1) The decision to stop disclosing key operating metrics starting in Q1 of 2025 is a big one.

Netflix plans to stop publishing data like subscriber numbers and average revenue per user. The management explained that they would shift their focus more towards overall revenue and profits and that after introducing an ad-supported tier, they would adopt different operational strategies for different regions. As the percentage of advertising revenue grows in some areas, the single metrics of subscriber volume and average revenue per user will have less predictive power for revenue expectations.

However, the market interprets this change as a signal that subscriber growth will slow down significantly, reaching a plateau or even a bottleneck. With a target of 500 million households and 1 billion users, ceasing to disclose these figures halfway through the journey undoubtedly undermines market confidence in Netflix's long-term growth. To compensate, the company has started to provide annual revenue guidance from this quarter, projecting a 15% increase in 2024 (internally predicted at 13%) and raising the operating profit margin target from 24% to 25%. The company's annual guidance is roughly in line with current market expectations and doesn't provide a positive boost for now.

(2) The company's revenue guidance for the second quarter is slightly below market expectations. Netflix mentioned that due to typical seasonal factors, they expect the number of net additional paid subscribers in Q2 to be lower than in Q1. They predict Q2 revenue to be $9.49 billion, which is slightly below Wall Street's expectation of $9.54 billion.

I think this minor difference in expectations is within an acceptable range and doesn't create a bearish investment narrative. So, comparing the two points, the main reason for the post-market drop is probably due to the decision to stop disclosing key operating metrics.

Post-market fluctuations are mainly due to the already high expectations relative to the valuation, which isn't cheap. Netflix's valuation multiple, or the PE ratio relative to its 2024 performance, has risen from 30 to 35 times. Along with liquidity in the broader market, this is primarily because the market has increased its long-term growth expectations for Netflix. The valuation's lower limit, at 30 times the 2024 PE, equates to a market cap of $240 billion. Currently, with the Fed's interest rate path becoming unclear again and geopolitical risks intensifying, market sentiment is very fragile, making the stock less attractive for short-term investment gains.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

R30R : Human responses are so unpredictable and unreasonable. Such a polar opposite reaction to the last few earnings (even when not up to expectations), that it makes me wonder who is sitting up top with a master key to manipulate so extensively. Dem be crazy!!

On Paris : Stay Connected Stay Informed

On Paris : Learn how much you want grow up

Carter WestOP R30R: I also find it a bit unbelievable. I believe that if it weren’t for the news yesterday that new user growth data would no longer be announced, the stock price would have performed well, but it is unlikely that there will be any significant stock price growth. This quarter's tech stock earnings are not promising, and I won't bet on earnings unless I'm very sure.

R30R Carter WestOP: With you 100%. I’m used to exaggerated reactions but I found this a bit over the top considering the overall bottom line wasn’t negative.

Someone’s clearly pulled the rugs from under the technology pedestal

Someone’s clearly pulled the rugs from under the technology pedestal

I think the market is just resetting itself now. Best to cut losses and take one in the chin and look forward to what’s next.

I felt uneasy with the reactions stemming from geopolitics (valid but still knee-jerk) but everything since then feels like an overdramatised script

Foodie Investor R30R: Agreed!! Some results don’t make sense!!