Unlocking the Energy Future: Inside Woodside Energy Group

Who is Woodside Energy Group?

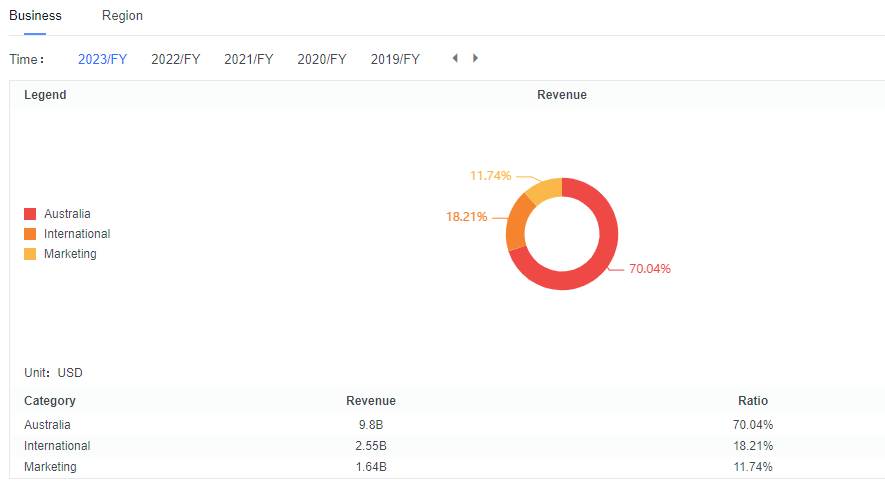

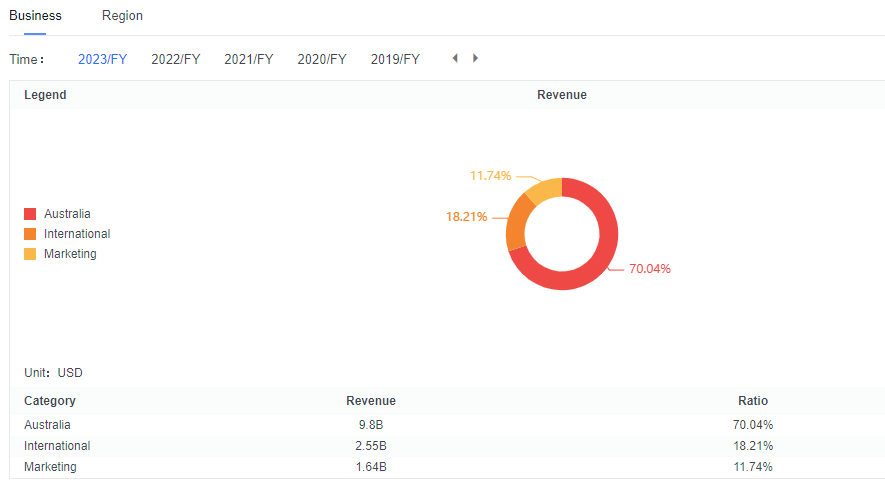

Nestled in Perth, Australia, Woodside Energy Group (WDS) is not just any oil and gas company. It's a trailblazer in the liquefied natural gas (LNG) arena, with its roots deeply embedded in Western Australia's rich natural resources. Picture a company that's like a three-legged stool, each leg representing a vital part of its structure: Australian Operations, International Ventures, and the Marketing Maestros. From unearthing energy treasures in its own backyard to delivering them to the world, Woodside is on a mission to keep the energy flowing.

Recent Operations: Navigating the Ups and Downs

Let's dive a bit deeper into Woodside's recent performance and figure out the story behind the numbers:

A Dip in Production: The recent quarter's operational performance has been characterized by a reduction in production and a decrease in commodity prices, which have affected the company's overall revenue. Specifically, production has decreased by 7% to 44.9 million barrels of oil equivalent (Mboe), averaging 494 Mboe per day. This represents a 4.1% decrease compared to the same quarter of the previous year, which saw a production of 46.8 million Mboe. The downturn is attributed to lower outputs from the Bass Strait, Pyrenees, and Pluto operations.

Why the Slowdown?: The quarter's output faced challenges from both planned and unplanned downtime, specifically at the Pluto and Pyrenees operations in Western Australia. Despite these setbacks, management remains committed to the full-year production guidance of 185-195 million Mboe, indicating that subsequent quarters will need to deliver between 47 and 50 million Mboe per quarter to meet year-end targets.

Price Pressures: In terms of pricing, the Japan-Korea Marker, a crucial LNG benchmark, fell by 59% in 2023. Consequently, the average realized price in the first quarter of 2024 dropped to $63 per boe. This is a 6% decline from the $67 per boe in the last quarter of 2023 and a significant 25.9% fall from $85 per boe in the first quarter of the previous year. The company's revenue was also impacted, declining by 12% to $2.969 billion for the quarter, a stark 31.4% decrease from the $4.330 billion generated in the same period last year.

Future Outlook and Strategic Growth

Looking ahead, the company's growth projects remain on schedule, with 2024 projections holding steady despite the possibility of consensus downgrades. Key projects such as the Scarborough LNG, with 62% completion and an anticipated first LNG in 2026, Sangomar aiming for mid-2024 to produce first oil, Trion's ongoing development, and the WDS's H2OK hydrogen project pending tax credit clarification, are poised to drive future performance.

Moreover, the Pluto LNG initiative has extended its processing agreement with the North West Shelf until the end of 2025 and is drilling Xena-3 to augment gas production. Notably, a mandate has been introduced requiring that 30% of the gas be reserved for domestic consumption, reaffirming the company's commitment to local markets and underlining its strategic operations before Scarborough commences.

Investment Considerations

As of April 26th, WDS's stock price stood at 28.26 AUD, offering an attractive trailing twelve months (TTM) dividend yield of 11.7%. The long-term investment proposition of Woodside Energy hinges on the volatile nature of international oil prices and the company's ability to meet its projected targets.

Several factors will likely influence the future direction of its stock price:

Production and Operations: WDS is facing short-term challenges with decreased production and operational disruptions. The ability to meet full-year production guidance will be pivotal. Successfully ramping up production in subsequent quarters to offset the initial decline could restore investor confidence and positively impact the stock price.

Project Development: The progress of strategic growth projects like Scarborough LNG, Sangomar, Trion, and the H2OK hydrogen project will be crucial. These projects have the potential to significantly increase production capacity and revenue streams in the medium to long term. Positive developments and milestones achieved on time could serve as catalysts for the stock price.

Commodity Prices: The volatility in oil and gas prices will continue to be a major determinant of WDS's financial performance and stock price. A rebound in LNG and oil prices would likely result in higher revenues and could lead to an uptick in the stock price, provided the company maintains cost efficiency.

In conclusion, while there are near-term headwinds, the long-term outlook for WDS's stock price may be favorable if the company can execute on its growth strategy, navigate commodity price volatility effectively, and continue to attract investors with its dividend yield. However, it's important to note that investing in the energy sector involves risk, and WDS's stock price will be subject to the dynamic interplay of these and other factors.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

103492747 : good morning