Microsoft Q2 2024 Earnings Preview: Can AI-Driven Success Sustain Its Status as the World's Top-Valued Firm?

$Microsoft(MSFT.US$'s market capitalization soared past the $3 trillion for the first time Wednesday, the latest landmark that the nearly 50-year-old software company has passed with increasing speed.

In recent years, as some tech companies have struggled with slowdowns, Microsoft has found ways to boost revenue. Its recent success can be attributed to two primary factors: the expansion of its Azure cloud computing services and the burgeoning optimism surrounding its potential to capitalize on the adoption of generative artificial intelligence.

Wall Street will be desperate for an update on the company's progress in rolling out its Copilot software for Microsoft 365, an offering that has the potential to generate billions of dollars in revenue. Also expect scrutiny around the growth rate for Microsoft Azure, the company's cloud business.

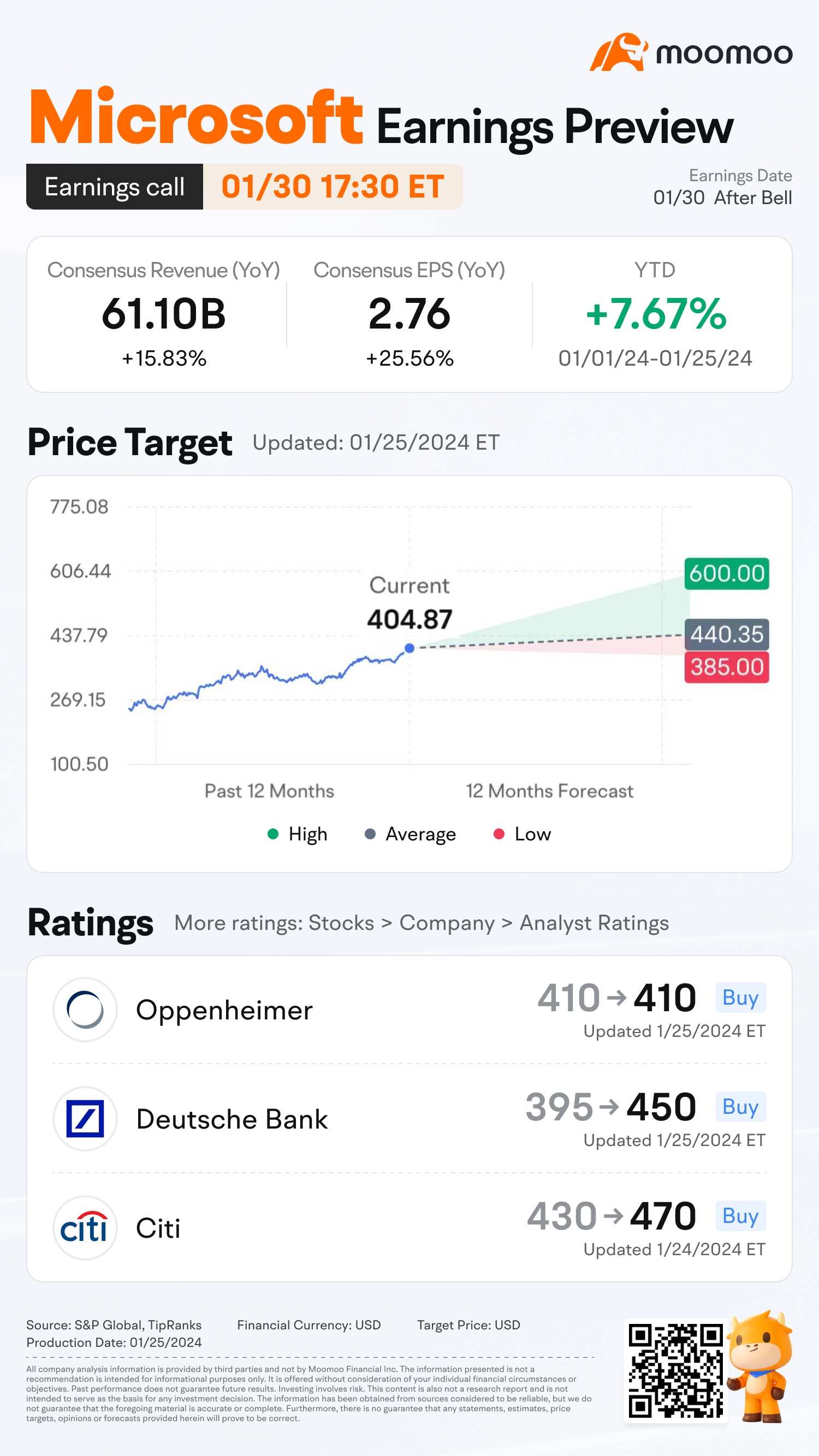

Analysts project that Microsoft's revenue and adjusted earnings per share (EPS) will maintain an upward trajectory in Q2 2024.

Consensus Estimates

● Earnings are anticipated to increase by 25.56% to $2.76 per share, relative to the previous year. Microsoft has exceeded EPS estimates four quarters in a row.

● Revenue growth is expected to be robust at 15.83%, reaching a total of $61.10 billion.

● The average price target for Microsoft is $440.35, which implies 8.76% upside from Thursday's closing price. A surge in AI investment, especially in Microsoft's generative AI product, prompted Morgan Stanley to raise its price target for Microsoft from $415 to $450. A Morgan Stanley survey indicated that 68% of chief investment officers intend to implement Microsoft's generative AI solutions within the next year.

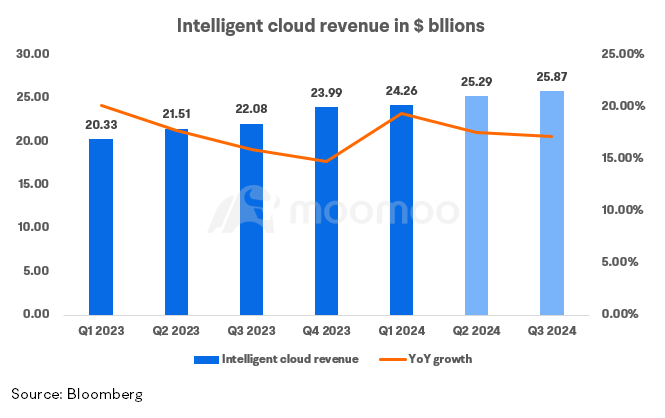

Intelligent cloud services revenue, which includes the Azure public cloud, Windows Server, SQL Server, Nuance and Enterprise Services, is a prime beneficiary of AI, given many use Azure to train and operate their AI applications. The unit is expected to grow 17.57% from a year ago at $25.29 billion, according to Bloomberg.

In the fiscal first quarter, Azure's revenue growth outpaced the previous quarter, registering a 29% year-over-year increase driven by its consumption-based business. Microsoft anticipates this growth trend to persist into the second quarter. Azure's expanded global presence strengthens Microsoft's position in the cloud market, contending with Amazon Web Services and Google Cloud.

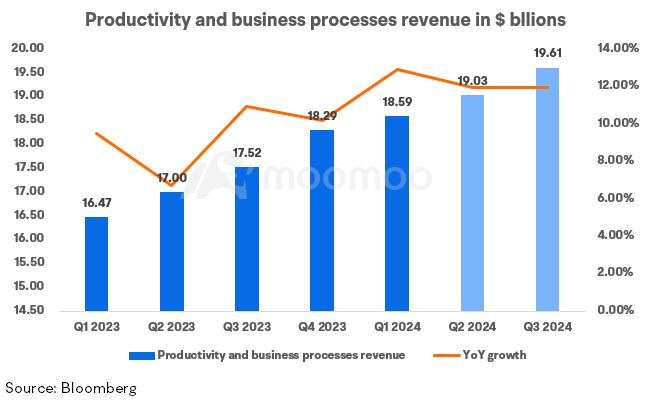

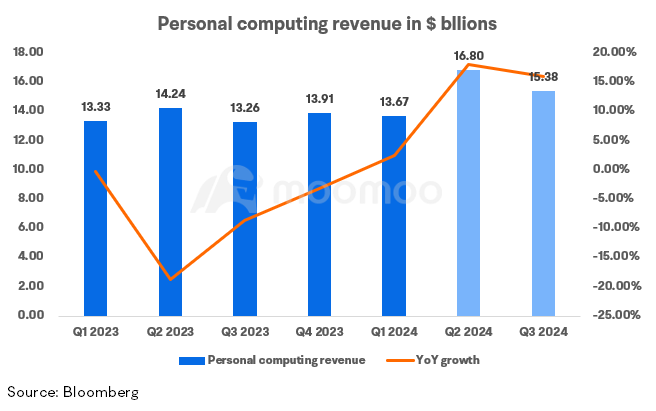

Regarding forecasts for other business areas, the productivity and business processes segment, which includes Office 365 and LinkedIn, is forecasted for a 12% growth, reaching $19.03 billion. The personal computing segment is predicted to achieve an 18% year-over-year growth rate, with revenues of $16.8 billion.

Concerns and Opportunities

Some investors express concern about a potential bubble in AI-driven stocks, questioning the actual revenue potential of the AI boom. Microsoft screens expensively on both absolute and growth adjusted multiples relative to the "Magnificent 7" names, and as a result, its stock performance will need to be primarily driven by estimate revisions, said Deutsche Bank.

Oppenheimer underscores the measurable customer gains delivered by Microsoft's Copilot, advocating for its premium pricing based on strong demand. Investors are advised to monitor customer adoption rates, average revenue per user (ARPU) growth, profitability, and the development of new Copilot applications.

Source: WSJ, Bloomberg, TheStreet, Zacks

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

safri_moomoor : corporate action

Angelita : that's great