Fed's Rate Cut Delay Fuels US Dollar Surge: Analysts Expect a Bull Market Ahead

Following speeches by Fed Chairman Powell and European Central Bank President Christine Lagarde yesterday, the $USD(USDindex.FX$ recorded its strongest five-day rally since October 2022, climbing for the fifth consecutive day with an approximate 2% gain. The ongoing divergence in global monetary policies continues to leave its mark on the currency markets.

Fed Signals Longer Tightening of Monetary Policy

On Wednesday, Jerome Powell delivered a speech at the Wilson Center's Washington Forum. This speech is expected to be his final policy speech before the next central bank meeting. He warned that the continuing high inflation will probably lead to a delay in any Fed interest rate cuts until later this year, creating an opportunity for an extended period of higher rates.

The recent [inflation] data have clearly not given us greater confidence, and instead indicate that it's likely to take longer than expected to achieve that confidence.

Earlier on Tuesday, Fed Vice Chair Philip Jefferson stated in separate remarks that the U.S. central bank was prepared to maintain its restrictive monetary policy "for longer" if inflation does not decrease as anticipated. Jefferson did not mention any possible rate cuts during his remarks.

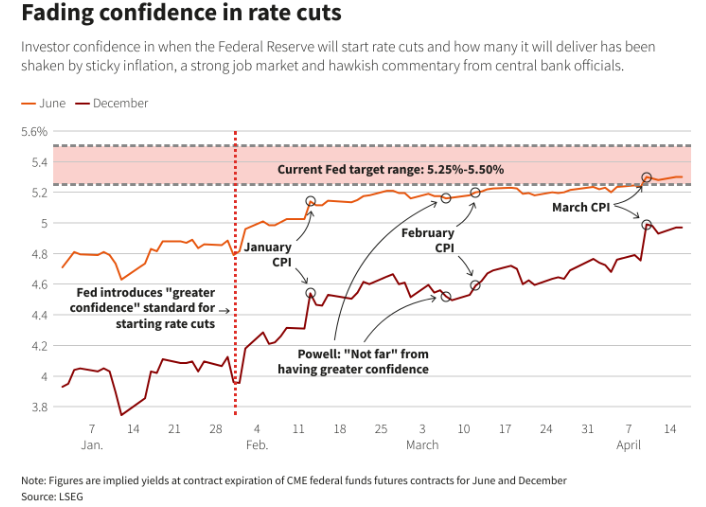

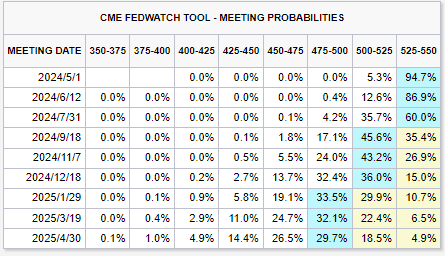

Previous data suggest that the US economy remains robust, as evidenced by the March CPI hitting a six-month high, nonfarm payrolls exceeding expectations, and strong retail sales figures. Consequently, market expectations for an interest rate cut have been steadily declining. According to the CME FedWatch Tool, it is anticipated that the probability of a rate cut in June of this year has now dropped to a mere 13%. The first interest rate cut is expected to take place in September, with a decreasing likelihood of a second cut. In fact, some economists have begun to express the opinion that if the Fed does not cut rates by June or July, it will probably be necessary to postpone any reductions until 2025.

ECB Hints at Impending Interest Rate Cut

Lagarde confirmed on Tuesday that the central bank is still planning to reduce interest rates in the near future, with the caveat that any significant unexpected events could alter this plan. "We are observing a disinflationary process that is moving according to our expectations," Lagarde said, "As I said, subject to no development of additional shock, it will be time to moderate the restrictive monetary policy in reasonably short order."

Until last Thursday, the ECB had not explicitly mentioned any intention to loosen its monetary policy in its previous communiques. However, during the ECB's fifth consecutive meeting where it held interest rates steady at a record high, they indicated that the cooling inflation could soon lead to a beginning of trimming. In contrast to previous language, the ECB stated that it would be appropriate to decrease its 4% deposit rate if there is a sustained decrease in inflation towards their 2% target.

In late March, the Swiss National Bank surprised the market by cutting interest rates by 25 basis points to 1.5%, becoming the first major western industrialized country to do so in the current cycle, which has seen a surge in global inflation due to the coronavirus pandemic.

Divergent Monetary Policies Boost US Dollar

The anticipated postponement of the first US interest rate cut is having an impact on global currencies as central banks in developed countries start to ease their monetary policies. The dollar has outperformed other major currencies in the Group-of-10 so far this year, with the yen being the hardest hit.

State Street's custodial data reveals that institutional flows into the US dollar during the five days leading up to April 11 reached their highest level since November 2022. Asset managers have been offloading the euro, especially as they are already underweight on the currency, due to growing confidence of upcoming rate cuts by the ECB.

Chris Turner, head of currency strategy at ING Groep NV, expects the dollar benchmark to extend gains and head toward October highs. He wrote in a note, "It is very hard to fight the dollar bull trend right now."

Geopolitical Uncertainty Enhance Safe-Haven Sentiment

On April 13, Iran launched a drone and missile attack against Israel in retaliation for an Israeli airstrike on its consulate in Damascus. In the aftermath, Israel's cabinet explored response options and called for the imposition of new sanctions on Iran. Meanwhile, Israeli military officials on Monday stated that Tehran must pay a price for the Saturday assault, which involved around 350 missiles and drones, many launched from Iranian territory. Lieutenant General Herzi Halevi, Chief of Staff of the Israel Defense Forces, declared that Iran's airstrike "will be responded to," heightening the prospects of a broader escalation of conflict.

Roberto Cobo Garcia,head of G-10 FX strategy at Banco Bilbao Vizcaya Argentaria SA in Madrid, stated that "The increase in geopolitical uncertainty has been the icing on the cake" in reference to the US dollar's appeal as a safe-haven currency.

Source: Bloomberg, FT, CNBC, Reuters, BBVA Research

By Moomoo News Marina

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Nathalie Cobo : And what would happen if the rumblings of war intensified for six months to a year? Or, maybe more than a year?

White_Shadow Nathalie Cobo : dollar go thru the roof![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Nathalie Cobo White_Shadow : Why do you think that war would help the DOLLAR become stronger? Our troops in Afghanistan did not show that. It was one of the longest crises and it never showed us a strong dollar. The dollar being below the EURO for a long time at that time.

eldritch : war always benefits the American economy