Market Awaits Earnings Season for Insights on Rally Potential and Economic Health

Following a recent downturn in the stock market, investors are turning their attention to the upcoming earnings season, seeking insights into companies' growth potential.

The financials sector, with upcoming results from major banks like $JPMorgan(JPM.US$ and $Bank of America(BAC.US$, stands at the center of investor focus this week. The quarterly reports and executive commentary are expected to provide indications on whether the recent market downturn is justifiable or if robust corporate earnings can reignite a market rally.

Larger than average Q4 EPS estimates cuts

Analysts are predicting a consecutive quarter of earnings growth for $S&P 500 Index(.SPX.US$ companies. Projections suggest a modest 1.3% rise in fourth-quarter profits over the previous year, a significant revision from the 8% growth anticipated at the end of September, according to FactSet research.

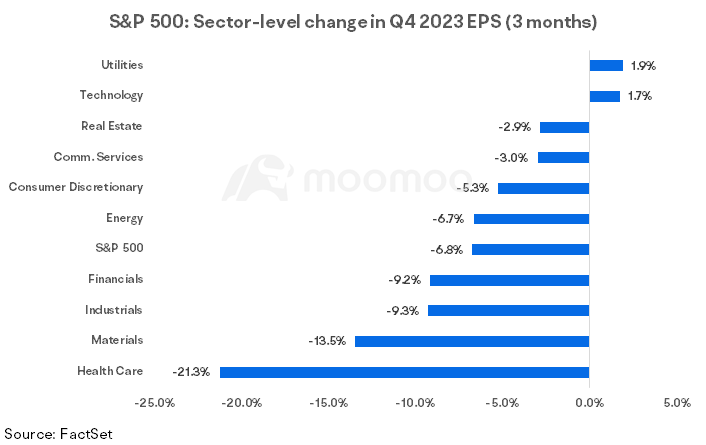

Typically, analysts revise earnings estimates downward throughout a quarter. However, heightened concerns about an economic downturn have led to more substantial cuts than usual for the fourth quarter. The reduction in Q4 EPS estimates surpasses the average of the past 5, 10, 15, and 20 years.

At the industry level, declines in EPS estimates were seen in nine out of eleven sectors, notably in health care and materials. In contrast, utilities and information technology were the only sectors to see increased earnings projections for Q4 2023.

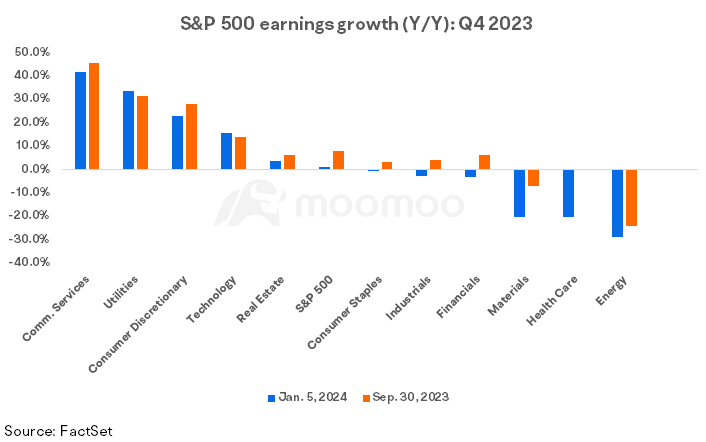

The communications-services sector is expected to lead with the highest year-over-year earnings growth at approximately 42%, propelled mainly by $Meta Platforms(META.US$, as per FactSet data. Conversely, the energy sector is predicted to have the most significant earnings drop from the previous year's surge, driven by high oil prices.

Will stocks rally if earnings climb?

Looking into 2024, analysts on Wall Street predict a sharp earnings growth of about 12% for S&P 500 companies. However, a Bloomberg survey of market participants reveals skepticism, with half of the respondents viewing the S&P 500 earnings forecasts as overly optimistic, citing economic deceleration as a primary concern for corporate profitability. This sentiment suggests earnings may not be the driving force behind stock market gains this year.

Additionally, S&P 500 companies are currently valued at around 19.2 times their projected earnings for the next 12 months, slightly above the five-year average of 18.9, FactSet reports indicate.

Rajeev De Mello of Gama Asset Management SA notes that investors seem to have factored in expectations for a benign soft-landing in 2024. However, concerns linger about potential economic softness, particularly with 40% of Bloomberg survey respondents pointing to slowing US consumer spending as a risk factor. Early retail reports have already issued cautious revenue projections and warnings on dampened demand.

Despite these worries, there is still a sense of optimism among Wall Street strategists and investors for an equity market rally in 2024, with nearly a third of survey participants intending to increase their S&P 500 exposure in the coming month.

Source: FactSet, WSJ, Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment