Is the US Economy Facing a Potential Recession?

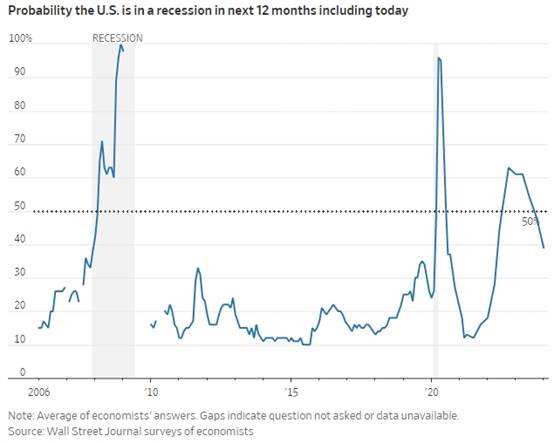

The U.S. economy managed to stave off the anticipated recession in 2023, but experts are now warning of a potential mild recession or soft landing in 2024 as the year kicks off. A recent survey of economists by The Wall Street Journal shows a decrease in the likelihood of a recession in the next year from 48% in October to 39%.

However, economists predict a meager growth rate of only 1% in 2024, which is half its typical growth rate and a significant deceleration from the 2.6% estimated in 2023. Despite the reduced likelihood of a recession, economists remain cautious about signs of an upcoming economic downturn.

What are the indicators that suggest a potential recession in the US economy?

Increasing Financial Pressure of Consumers

Since the inflation rate surged in early 2021, credit card balances have significantly increased, indicating a strain on US household finances. The rise in the cost of living after the pandemic has not always been accompanied by higher incomes, leading to this pressure. According to Philadelphia Fed, credit card revolving balances have surpassed $600 billion in 2023Q3. Additionally, all stages of delinquency rates have now exceeded pre-pandemic levels for the first time and are approaching their highest levels since 2012.

The rising financial burdens on US consumers were highlighted in a recent survey conducted by the NY Fed. When asked how they would utilize an unexpected 10% increase in income, 38.4% of households stated that they would allocate the additional funds toward debt payments, marking the highest response rate observed since August 2016. Additionally, consumers seem less inclined to make significant purchases in the coming four months.

Government Sector Job Growth

Despite recent data indicating solid job growth and low unemployment rates, the US job market is showing signs of an economic slowdown. Job growth has been primarily driven by government-sector positions, which have accelerated over the past six months and contributed between 21% and 58% of total job growth. Private sector job growth from December 2022 to December 2023 was only half that of government jobs, with private sector payrolls increasing by 1.5%. In contrast, government payrolls rose by 3% during the same period.

The correlation between government jobs and private sector jobs can serve as an indicator of an upcoming recession. The proportion of private sector jobs tends to decrease as recessions approach. In periods of robust economic expansion, government jobs typically account for less than 20% of all new jobs created.

Since last September, the government sector has consistently contributed more than 20% of all new jobs created each month, with December seeing government jobs making up 24.9% of total new jobs. Tressis chief economist Daniel Lacalle has recently stated that, the United States is currently experiencing a 'private sector recession'.

Inverted Yield Curve

In late October 2022, the yield on the 3-month Treasury bill - a very short-term investment - surpassed that of the 10-year Treasury note. This inversion has persisted since then. Priya Misra, the Head of Global Rates Strategy at TD Securities, stated "Historically, a US recession tends to follow a year after the curve inverts, though the variance is large and there are occasional false positives."

Jeffrey Gundlach, a billionaire investor and DoubleLine Capital CEO, predicts that "The economy has a better than 50% chance of hitting a recession this year. It's more like a 75% chance of running into a recession."

Source: Bloomberg, WSJ, Mises Institute

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104116110 :

Peanny : Of course; Duh