EU Probe Into Electric Vehicle Subsidies, What's the Impact on Stock Market?

The EU has announced an anti-subsidy probe into China’s electric car industry in an attempt to shield European manufacturers before they are priced out by Chinese rivals.

If the commission finds that domestic producers have been harmed, it could levy tariffs, likely to be about 10-15 percent. The probe is expected to last nine months.

The prevailing market conditions.

“We cannot afford to lose our car industry,” said a senior EU diplomat.

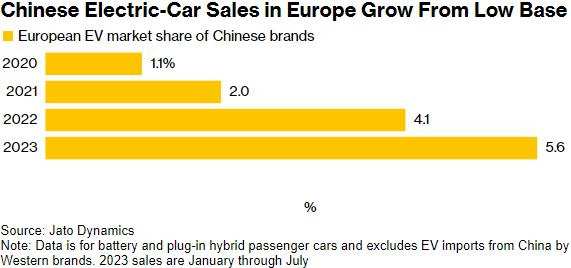

The European Union (EU) is banning the sale of new combustion engine cars from 2035 to reduce carbon emissions but fears that their electric replacements will be made in China rather than Europe. Chinese companies' share of electric vehicles (EVs) sold in Europe has risen to 8% and could reach 15% by 2025, which is putting pressure on European automakers to produce lower-cost EVs as Chinese imports undercut local models by about 20%.

The EU currently levies a 10% duty on imported cars from China compared to the United States' 27.5%, allowing Chinese manufacturers to carve out a significant and rapidly growing foothold in the European market.

According to a recent estimate by UBS, Chinese carmakers' global market share may double from 17% to 33% by 2030, with European firms suffering the most significant loss of market share.

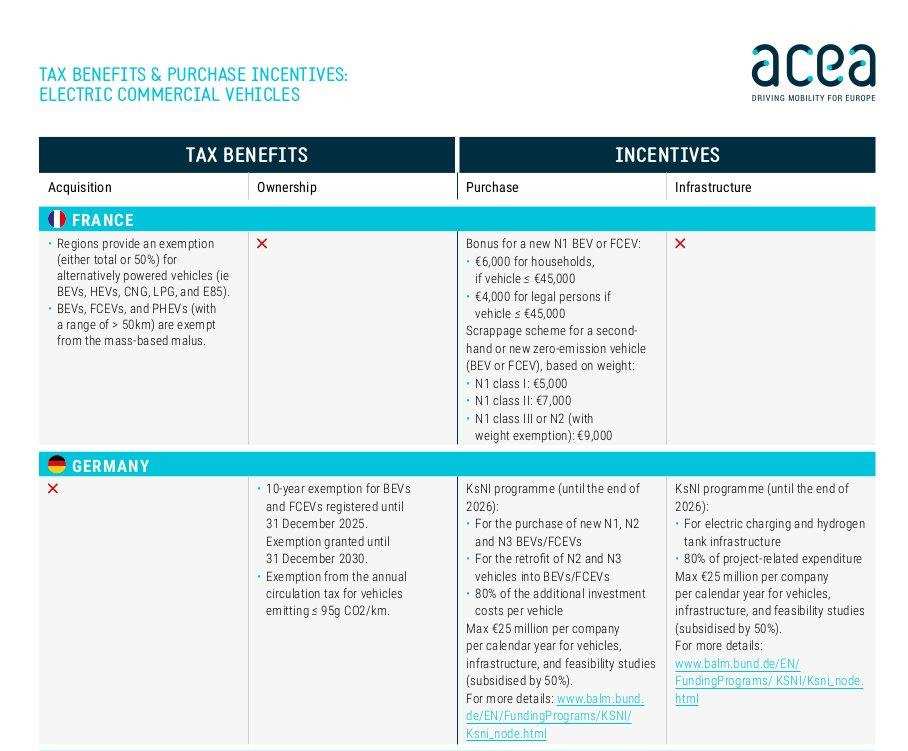

The Chinese government has criticized the European Union's decision to investigate subsidies in China's flourishing electric vehicle (EV) market, calling it "sheer protectionism." Beijing's leading official for European affairs, Wang Lutong, took to X (formerly known as Twitter) to respond, citing statistics from the European Automobile Manufacturers' Association (ACEA) and a screen grab of incentives offered by France and Germany for buyers of EVs.

Key statistics of EV exporter China.

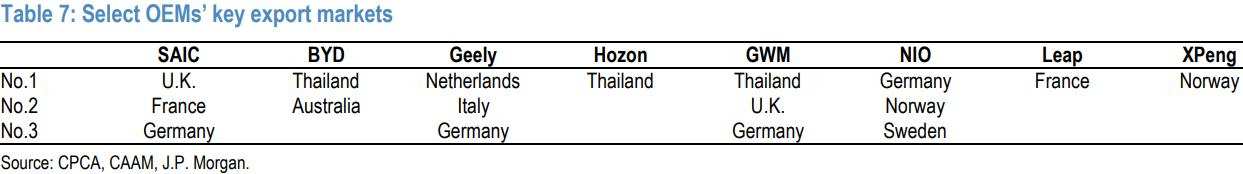

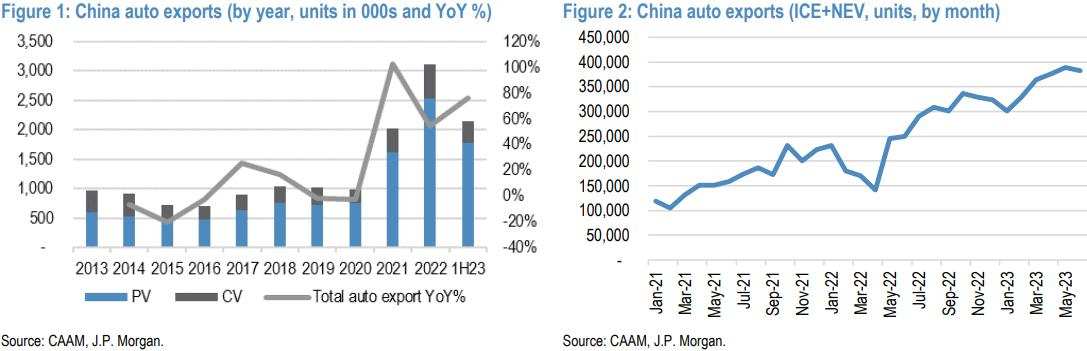

According to J.P. Morgan's report, new energy vehicle (NEV) exports witnessed an upward trend, accounting for 25% of total exports in H1 2023, up from 8% in 2020. Leading original equipment manufacturer (OEM) players include SAIC, BYD, and Geely, among others.

It is reported that Chinese-manufactured electric cars' global market share surged by 10 percentage points to 35% in 2022. Most of these vehicles, along with their batteries, were exported to Europe, which saw 16% of its batteries and vehicles being made in China in 2022.

The Chinese government’s supportive measures in the NEV market are in two areas:

1) Consumers

China has previously offered substantial subsidies for new energy vehicle (NEV) buyers, which varied based on whether the vehicle was a battery electric vehicle (BEV) or plug-in hybrid electric vehicle (PHEV). These subsidies were as high as 30-50% of the manufacturer's suggested retail price in 2018-2019. However, the subsidies have steadily decreased every year and were completely phased out in 2023.

Apart from these subsidies, NEV buyers in China had two other benefits, namely exemption from the 10% purchase tax (invalid in 2028) and free license plates in select Tier 1 and major Tier 2 cities.

2) Manufacturers

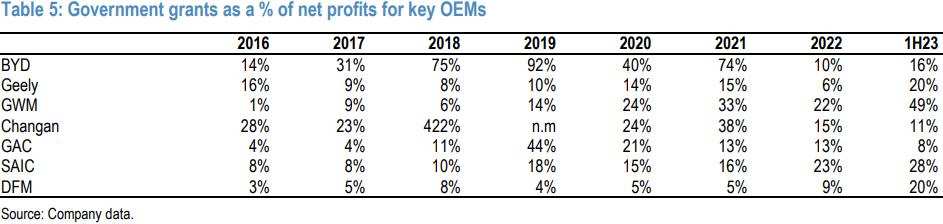

Chinese car manufacturers usually receive tax rebates or subsidies based on their research and development (R&D) investments, capital expenditures (capex), and expansion. These grants are reflected in the original equipment manufacturer's (OEM's) profit and loss statement (P&L). In 2022, government grants accounted for approximately 10-20% of carmakers' bottom line, though contributions from these grants to the bottom line can vary depending on the OEM and year.

Why does the EU market matter?

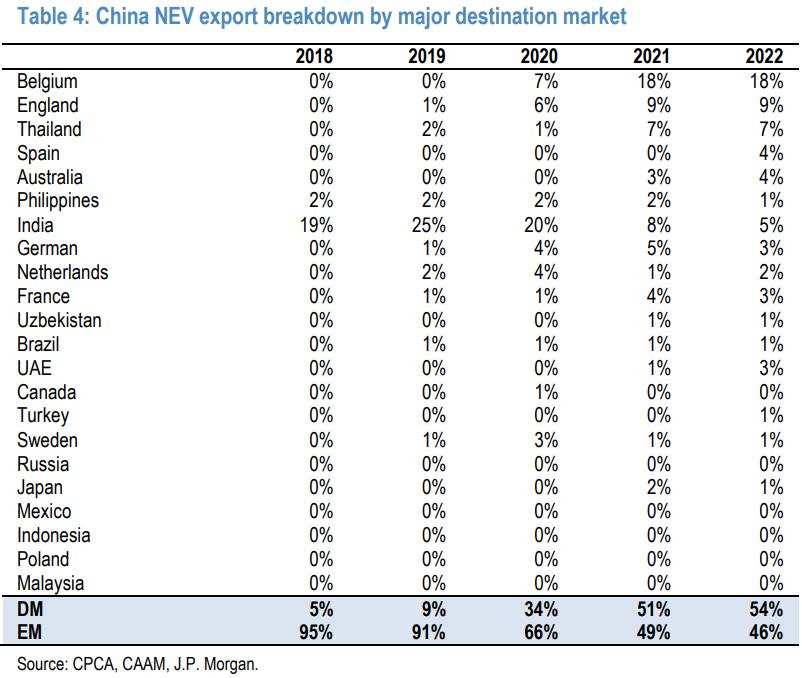

The European Union (EU) is a significant export opportunity for China's new energy vehicle (NEV) industry, accounting for 41% of China's total NEV exports in 2022. Belgium serves as a key destination, receiving 18% of China’s total NEV exports, followed by England at 9%.

$Tesla(TSLA.US$ and $SAIC Motor Corporation(600104.SH$ (own brand) are the main players exporting NEVs to the EU, with other companies having less significant exposure. For SAIC, NEVs exported to the EU account for approximately 3% of its total sales volume (ICE+NEV), and around 15% of its NEV sales volume in 2022 due to the size of their domestic market in China.

What's the impact?

According to analysts from J.P. Morgan, export businesses in the Chinese new energy vehicle (NEV) market still carry higher profit margins or higher per-unit profit than the same vehicle in the domestic market. In most cases, this difference is estimated to be around 5-15%. This suggests that Chinese original equipment manufacturers (OEMs) could lower prices or sacrifice profit margin by this amount to gain market share in overseas markets.

However, analysts suggest that Chinese carmakers may not initiate price wars to gain market share;

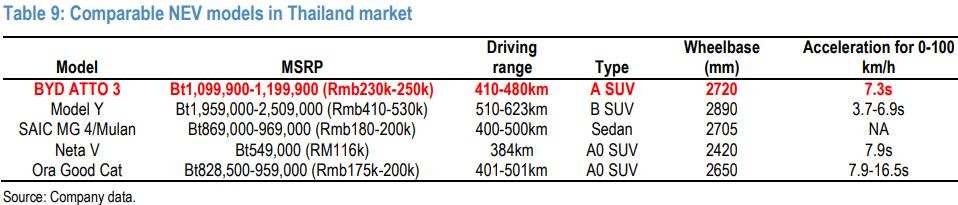

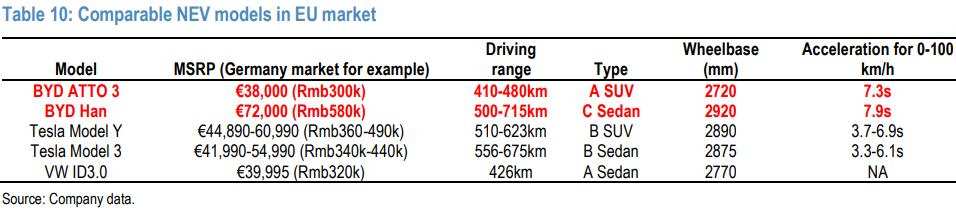

1) Facing the brand awareness and recognition challenges facing Chinese brands in overseas markets, Chinese carmakers are likely to compete on content, such as in-car connectivity, rather than price at this early stage of development. In fact, most Chinese NEVs are priced at similar levels as comparable foreign brands' products.

2) Establishing comprehensive and robust sales and service networks will be critical to the long-term success of Chinese car brands.

Analysts suggest that attempting to compete on price before building these networks and increasing brand awareness may not be a viable strategy. Therefore, it is expected that Chinese carmakers will take time to build these networks while focusing on developing their brand recognition and reputation in overseas markets.

The short-term outlook for Chinese Electric Vehicle (EV) manufacturers and suppliers seems unfavorable, according to J.P. Morgan report. An instance can be seen in CATL, a battery supplier that encountered the Inflation Reduction Act (IRA) imposed by the United States government in August 2022.

On Wednesday, shares of leading Chinese EV makers were weak. $BYD Company Limited(002594.SZ$ was down by as much as 1.21%. Similarly, $XPeng(XPEV.US$ shed as much as 3.11%, and $NIO Inc(NIO.US$ fell by 4.73%. Furthermore, Shanghai-listed shares of state-owned car giant $SAIC Motor Corporation(600104.SH$, whose MG brand is the best-selling Chinese-made brand in Europe, fell 0.34%. $Contemporary Amperex Technology(300750.SZ$, a Shenzhen-listed battery maker, also faced 0.77% decline in its share prices.

The outlook for Chinese EV names is not looking good. One of the major growth markets for Chinese EV makers could be curtailed if the European Union (EU) decides to impose duties. While their sales in Europe are still relatively small compared to market leaders like Volkswagen AG, Tesla Inc., and Stellantis NV, they are growing at a rapid pace. If duties are imposed, it would be a significant blow to Chinese EV makers' expansion plans.

A conclusive decision may not come soon; however, it is expected that the EU's policy move could accelerate Chinese OEMs' plans to build capacity within the EU instead of exporting from China. This move will enable them to compete more fairly with European OEMs on cost and other relevant measures.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment