Earnings Season Kicks Off: Don't Miss These Key Themes

Banks kick off earnings season as $JPMorgan(JPM.US$, $Bank of America(BAC.US$, $Wells Fargo & Co(WFC.US$ and $Citigroup(C.US$ released earnings reports last Friday. This week, more companies are expected to announce their earnings reports.

The strong performance of the US stock market in 2023Q4 has amplified the importance of the upcoming earnings season, making it a crucial period for investors who are eager to review the latest financial reports.

Analysts suggest that investors should pay attention to the following key themes in the upcoming financial reports:

Is the Profit Slump Bottoming Out?

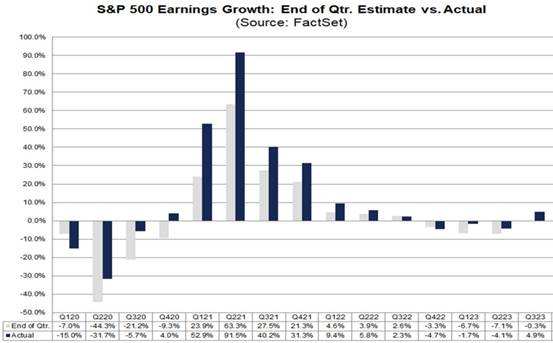

2023Q3 earnings have wrapped up, with S&P 500 companies reporting a third straight quarter of profit contraction. However, analysts are looking for explicit signs to confirm the profit slump has bottomed out.

The Q4 profit expectations have been deteriorating recently, and the current Q4 profit forecast data is rather modest. According to data compiled by Zacks, earnings for the S&P 500 are expected to be roughly +0.1% higher than the same period last year. In contrast, in early last October, analysts predicted that the Q4 earnings for the S&P 500 would increase more than 5%.

Despite expectations for growth to slow compared to Q3, the current market forecast for 2024 remains relatively robust. According to FactSet, it is expected that the earnings of the S&P 500 will increase by nearly 12% in 2024, which is significantly higher than the 10-year average of 8.4%. Nevertheless, if the financial report for Q4 of 2023 is significantly worse than expected, it may shake investors' confidence in the 2024 forecast.

How Is the Profit Margin?

Following three quarters of progress, net income margins are predicted to drop to around 11.7% as a result of high labor costs, higher interest rates, and other contributing factors.

The good news is that the situation is expected to improve soon, with FactSet predicting a median gross margin increase of approximately 8 basis points over the next 12 months compared to the previous 12 months.

How Is the Divergence of Sector Performance?

Although the earnings forecast for Q4 is relatively modest, there appears to be significant diverging performance among different sectors. FactSet predicted that five out of the eleven sectors will exhibit an increase in earnings compared to the previous year. The communication services and utilities sectors are expected to lead in this growth with an increase of over 30%. Conversely, five sectors are expected to report a decrease in earnings compared to the previous year, with the energy and materials sectors potentially declining by over 20%.

What Else to Expect Beyond AI?

Looking back, 2023 was the year of AI. How about 2024? According to a recent report from Goldman Sachs, "AI is poised to begin shifting from 'excitement' to 'deployment' in 2024." This shift will undoubtedly bring about more opportunities in areas such as chip suppliers and software companies.

Electric vehicles will continue to remain a significant and robust segment of the market. Despite the slowdown in sales growth, global passenger EV sales, including battery-electric and plug-in hybrid vehicles, are still poised to increase by 21% in 2024 to 16.7 million, according to Bloomberg NEF.

The biotech industry is showing signs of recovery, thanks to a surge of merger and acquisition deals, anticipation of interest rate cuts, and advancements in technology.

What Are the Macro Factors?

Eurasia Group, a prominent geopolitical risk research and consulting firm, has sounded an alarm for 2024, calling it "a year of grave concern". According to a report from the group, the United States versus itself and the Middle East on the brink top the list of geopolitical risks for 2024.

The most recent FOMC minutes indicate that Fed officials are still hesitant about implementing interest rate reductions and did not provide a specific timeline. Additionally, the latest sticky US inflation reduces the chances of an early Fed rate cut, which increases the uncertainty in the profit forecast for 2024.

Source: Bloomberg, Seeking Alpha, CBS, NYSE

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

BelleWeather : The US vs itself. Ugh. Wish I’d not read that before bed.

151477963 :