CPI Release Puts Options Traders on High Alert for Potential Swings

In the wake of an unexpected decline in the $S&P 500 Index(.SPX.US$ following the latest Consumer Price Index (CPI) figures, traders in the US equity options market are on edge as the market awaits the Tuesday release of fresh inflation data.

The S&P 500 Index is predicted to move 0.9% in either direction on Tuesday, the largest shift ahead of a consumer price index announcement since April 2023, according to Citigroup's Stuart Kaiser. It's derived from a trading strategy called an at-the-money straddle, which occurs when a trader purchases an equal number of options and puts with the same strike price and expiration.

Additionally, the reading exceeds the suggested move for the Federal Open Market Committee meeting next Wednesday.

With the advent of zero-day-to-expiry options, traders can now open bets against particular events. According to Citi strategists, the majority of the increase in options pricing on the S&P 500 is focused in the very near future.

In January, US consumer prices climbed at a rate surpassing forecasts, driven largely by a significant increase in rental housing costs. This news triggered a 1.4% fall in the benchmark stock index on February 13, the day the figures were made public. "Following the unexpectedly robust report from last month, there's definitely a heightened sense of apprehension about the upcoming figures. This anxiety is likely to contribute to today's jitteriness in the options market," commented Matthew Tym, the chief of equity derivatives trading at Cantor Fitzgerald.

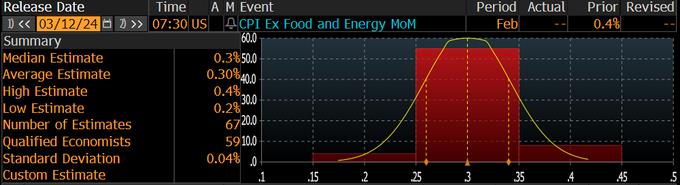

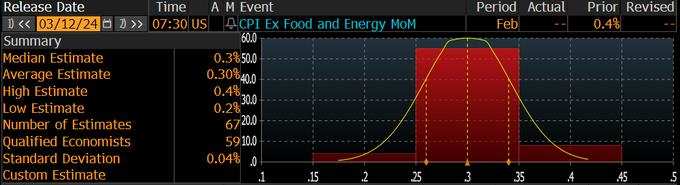

The Consumer Price Index is expected to rise to 0.4% MoM in February from 0.3% in January, which would be the largest increase since last September, according to the data provided by Bloomberg. February's year-over-year CPI gain is expected to remain at 3.1% for the second consecutive month.

The S&P 500 has only experienced declines on four occasions coinciding with the release of CPI reports over the past year. There has been a notable uptick in trading day volatility, according to Bloomberg's Rita Nazareth. Specifically, in the last six months, the index has consistently witnessed movements of at least approximately 0.8% in either direction on CPI days. This is a significant increase compared to the sub-0.5% fluctuations recorded for the period ending in September of the previous year.

This pattern reflects a growing responsiveness in the market to inflation data. In contrast, last year saw a more subdued response from the stock market to CPI updates, during a phase when inflation appeared to be easing.

Analysts at Citi have recommended purchasing options on the index to attain positive gamma. By maintaining this position through the CPI report release, traders can benefit from anticipated stock volatility, which is likely to increase both the price of options and market volatility. Subsequently, traders can potentially repurchase their positions at lower prices if the market adjusts after the initial reaction. Then repurchasing the option position at lower levels.

Source: Bloomberg

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

CᖇYᑌI᙭ : @104025852 @CashbenderGG

104025852 CᖇYᑌI᙭: Sus tmr all moon

CᖇYᑌI᙭ 104025852: