Countdown to US Government Shutdown: Potential Impacts on Financial Markets and Investments.

US government faces shutdown as extreme right-wing Republicans in the House of Representatives refuse to approve a new funding arrangement with their party and the Democrat-controlled Senate. If unresolved by October 1, around 4 million employees will go unpaid.

Key reason

The shutdown occurs when Congress fails to pass funding legislation, causing federal agencies to halt nonessential work and stop paying their employees until the issue is resolved.

The US Congress is divided between a Democratic-controlled Senate and a Republican-led House. The current budget stand-off arises from stark differences within the Republican party over taxation and spending, including whether to approve a significant additional aid package for Ukraine. While Democrats and Republicans in the Senate support the White House's call for a $24 billion military and humanitarian aid for Kyiv, some House members are fiercely opposed.

Highlighted events if a shutdown occurs

The potential US government shutdown could significantly impact the Defense, Veterans Affairs, and Homeland Security departments, where almost 60% of federal workers are employed. Other areas, such as air travel, airports, ports, rail, and road activities, which rely on government funding or operations, may also suffer disruptions. National parks may also close, causing losses in the $800 billion outdoor recreation economy. According to the US Travel Industry Association, the travel sector could lose up to $140 million per day.

If the US government shuts down, it would likely cause a delay in releasing vital economic data as agencies stop collecting, processing, and disseminating such information. During the 35-day government shutdown in December 2018 and January 2019, over ten crucial economic data releases were postponed, including trade, housing, and consumer spending data, leading to a data drought.

Despite the potential US government shutdown, the Federal Reserve's meeting on November 1 will proceed as scheduled. This means that interest rates could still be raised at the meeting.

Impact on the economy and investors

The potential US government shutdown's economic impact depends significantly on its duration. According to Bloomberg's chief U.S. economist, Wong, each week of federal funding lapse could lead to a -0.2% reduction in quarterly U.S. GDP, further slowing down the economy already expected to underperform. A more extended shutdown risks triggering a recession.

Investors usually don't react strongly to government shutdowns, as these events have a low overall impact on the stock market. Though defense firms, some healthcare companies, and government contractors may be affected directly, broader market movements tend to be driven more by corporate earnings trends, interest rates, and other macro-level factors. Truist Advisory Services' co-chief investment officer and chief market strategist Keith Lerner observed, "Government shutdowns tend to be high profile though low-impact market events," with minimal lasting market effects despite short-term volatility. White House officials have warned of potential airport delays and other disruptions in case of a shutdown. It could further contribute to challenges for airlines and hotel companies.

Moreover, in previous US government shutdowns, investors usually turned to safe-haven government debt, causing Treasury yields to fall. However, according to JPMorgan Chase, this time could be different due to the Federal Reserve's commitment to hawkish policies. The bank suggests that investors may not seek refuge in Treasuries and instead drive yields higher if they perceive a lack of government's ability to govern effectively during the shutdown.

Historical data about US government shutdown

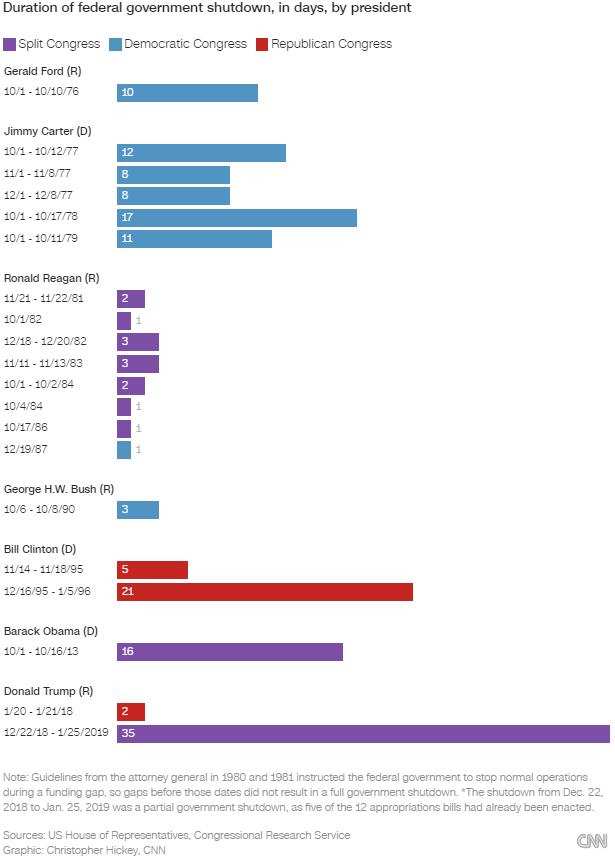

Over the past 45 years, the US government has experienced 22 funding gaps, with ten resulting in worker furloughs. Most significant shutdowns have occurred since Bill Clinton's presidency, mostly sparked by demands for budget cuts by conservative lawmakers like former Speaker Newt Gingrich. While previous shutdowns have typically been brief, lasting an average of eight days, the most extended closure occurred between 2018 and 2019 when President Trump and congressional Democrats clashed over funding for a border wall. The shutdown lasted 35 days, including the holiday season, but was only partial because Congress had already passed some appropriations bills to fund specific parts of the government.

Government funding lapses did not lead to significant closure of operations before the 1980s. The S&P 500 index delivered an impressive performance during the last 35-day US government shutdown, rising by 13%. While the S&P 500 Index showed some volatility leading up to and during previous government shutdowns, it typically remained constant afterward, posting positive returns in 12 out of the 21 past cases, averaging at 0.1%.

In previous US government shutdowns, workers have received back pay once a funding bill was approved. However, no payment period has caused significant issues for many households. Hardline Republicans are currently opposing any temporary bills and instead pushing for an extended shutdown until Congress negotiates all 12 government funding bills. This is typically a time-consuming process not resolved until at least December.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

wiseone : about time the GOP took control, Biden is a failure and his administration a failure.

Tiggerpepper : Bad times to be a investor

70854386 : This is why inflation is a problem because the government cannot manage our tax dollars! We work we pay taxes, we spend we pay taxes, we on property we pay taxes, every time anyone gets a bonus, makes a profit the market, every time someone wins a jackpot they pay taxes some how it’s never it’s never enough for the wasteful spending of our government so they print more money with nothing backing it. This is the reason behind our economic decline.

Maxima957 : help our people not Ukraine

FearGreed : Interesting. It seems they are exploring the limit of the length of shutdown.

KingNY-Life wiseone: Just return aid to Ukraine1000Billions of dollars, this government is terrible.

Hengist : "extreme right wing Republican" disregards the entire article as farce