China update. 8 things you need to know now with investor implications

1. Overnight China's State Council vowed to expand domestic consumption. We have been speaking about the need for China to introduce more country wide stimulus. But the world is still awaiting for this to materialize and for actual material details.

2. China's central bank cut its interest rates this week. I have humbly been saying this would happen. The cut was not expected by the market (Bloomberg Consensus). The PBOC lowered the rate on its 1-year loans (or medium-term lending facility) by 0.15% to 2.5%.

3. It's the 2nd rate cute since June and the biggest cut since 2020. It comes as June's cut had no impact and China wants to prop up its slumping property sector and weak consumer spending.

4. Overnight, China's biggest private sector property developer, Country Garden raised further alarm bells. It warned of 'major uncertainties'' in bond redemption, and will thus keep trading of some notes halted as it attempts to keep all the capital it can.

As I wrote last week, there are huge implication if Country Garden defaults like Evergrande did. It could not only impact China's economy but the US share market [ $S&P 500 Index(.SPX.US$, $Invesco QQQ Trust(QQQ.US$, $BetaShares NASDAQ 100 ETF(NDQ.AU$], as well individual US tech giants such as Telsa $Tesla(TSLA.US$, Apple $Apple(AAPL.US$ etc who make ~20% of their earnings from China.

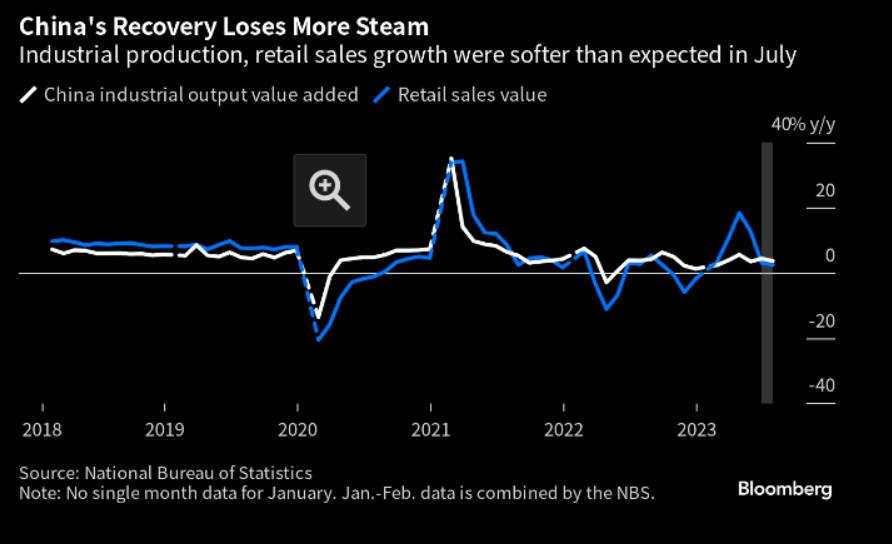

5. Chinese Industrial production fell. Earlier in the week, Chinese industrial production data show activity fell to 3.7% YoY growth in July, from 4.4% in June. That was weaker than Bloomberg and consensus expected

6. Chinese Retail sales slumped. Earlier in the week, Chinese retail data showed sales underwhelmed, falling to 2.5% YoY growth in July, from 3.1% in June. That was weaker than Bloomberg expected, 2.8%, and consensus of 4%.

Disappointing industrial production and retail sales numbers are further evidence that China will likely step up and deliver impactful stimulus soon. We think China talks the talk and will walk the walk and deliver significant stimulus soon, despite their economy being in significant debt (with a debt to GDP ratio that rivals the US).

7. Watch stocks exposed to China. Don't forget Tesla $Tesla(TSLA.US$ makes 22% of its revenue from China. Apple $Apple(AAPL.US$ makes 19% from China. Nike $Nike(NKE.US$ makes 14% of its revenue from China.

8. Watch mining companies who make the majority or a large chunk of their revenue from China. These include BHP $BHP Group Ltd(BHP.AU$ who makes 56% of its revenue from China, Rio Tinto $Rio Tinto Ltd(RIO.AU$ who makes 54% of its revenue from China, Fortescue $Fortescue Ltd(FMG.AU$ generate 89% of its revenue from China, and Mineral Resources $Mineral Resources Ltd(MIN.AU$ makes 25% of its revenue from China. These numbers are based on their prior full year earnings.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

MrJun : The economy continued to be sluggish after China opened up due to the pandemic. The exchange rate has been declining, and it will be difficult to see an economic rebound at 1:30. The Chinese government's dictatorship has allowed enterprises like Evergrande to grow barbarically, and eventually pay for their own corruption!

云龙入海 MrJun: Yes, I agree

Phoebeeeee : When will appl bottomed!