Buying the Dips! US Treasury Traders Stand Firm on 2024 Rate Cut Bet Once Again

Despite the pullback in the US Treasury market due to adjustments in expectations of rate cuts in 2024, bond bulls remain unfazed. In a chorus of voices calling for"buying the dip before the Fed cuts rates", funds have once again poured into the US Treasury market. Analysts are currently suggesting that any yield ranging from 4% to 4.2% for the 10-year Treasury should be considered a favorable purchase opportunity.

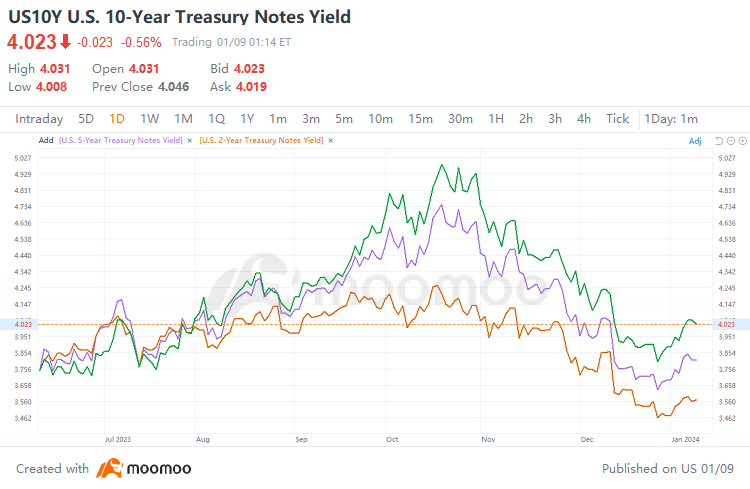

The $U.S. 10-Year Treasury Notes Yield(US10Y.BD$ has remained hovering around 4% despite experiencing a rise since the start of 2024, which indicates that this level seems well-supported. A series of indications suggest that bond traders have not lost confidence; instead, more and more market participants view this pullback as a buying opportunity before the Fed's rate cuts.

1. After Surprisingly Strong Jobs Report, Bond Buyers Continue to Flood In

Last Friday's non-farm payroll data showed that both job growth and wage increase in December were stronger than expected. On the previous day, the US December ADP employment figures also rose for the fourth consecutive month to 164,000, exceeding expectations and reaching a new high since August 2023. Meanwhile, the number of initial jobless claims in the US as of December 30 fell to 202,000, the lowest level since mid-October 2023. Multiple reports indicate that the job market remains strong, challenging the previously optimistic pricing of interest rate cuts.

However, the bond market's reaction last Friday is worth noting. The data showed that the $U.S. 10-Year Treasury Notes Yield(US10Y.BD$ rose briefly after the non-farm payroll report, but quickly plummeted after reaching a daily high of 4.099% and a high point since mid-December, with a large influx of funds. Traders began to realize that the non-farm payroll report may not be as strong as it initially appeared, and concerns about economic slowdown risks were reignited by the unexpected drop in the ISM services data released later.

“The bond market is not ready to give up on their optimistic assessment for Fed rate cuts this year; A narrative of buying on the dips will remain, and it will take more than one jobs report to change that,” said Kevin Flanagan, head of fixed-income strategy at WisdomTree.

2. Growing Number of Analysts and Large Investment Firms Express Optimism Toward US Treasuries

As pointed out by Bloomberg analysts Ira F. Jersey and Will Hoffman, while the market is digesting some of the already priced-in interest rate cuts, Treasury yields may experience a short-term increase in the coming months. However, an increasing number of analysts believe that yields will decrease by the end of the year.

Priya Misra, portfolio manager at JPMorgan Asset Management also said, any yield level between 4% and 4.2% is considered a buy for the 10-year Treasury.

According to Rick Rieder, chief investment officer of global fixed income at BlackRock Inc,

“The market got way too ahead of the Fed”, but he further suggested that investors “can start owning interest rates, this back up is great.”

According to TD Securities' strategists, although bonds may still experience further declines in the near-term, they remain convinced that the labor market is cooling and predict that the 10-year Treasury yield will end 2024 at 3%.

Gene Tannuzzo, global head of fixed income at Columbia Threadneedle Investments also said:

“As we go through the course of the year, the 10-year can get below 3.5% and that is dependent on inflation moving lower and growth becoming a little weaker.”

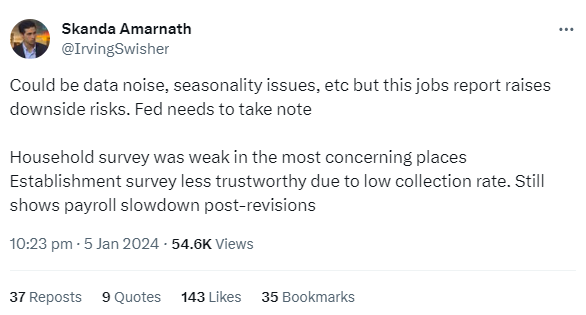

1. Surprising Employment Data May Not Be As Hot As It Seems

In addition to the significant drop in the employment sub-index of the ISM to a new low not seen in over two years, last Friday's December non-farm payroll data showed signs of weakness, including:

● The household survey has reported a significant monthly contraction in the number of employed individuals, with a decrease of 683,000 people;

● Additionally, the labor force participation rate in the household survey sharply dropped to 62.5%;

● Furthermore, 10 out of the 11 months in 2023 saw down revisions in the number of new job additions.

According to Skanda Amarnath at Employ America:

2. Fed's Slowing of QT May Happen Sooner Than Expected

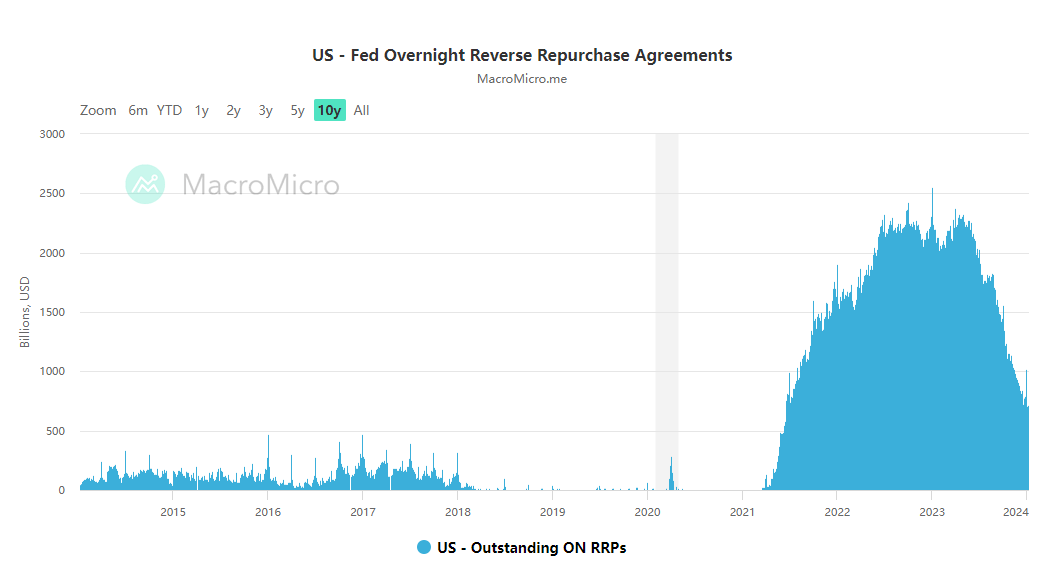

The scenario of slowing and ending the balance sheet reduction has been under discussion in December Fed meeting. Some participants suggested that the Fed could slow and eventually halt the reduction of its balance sheet when reserve balances were slightly above the level deemed sufficient, and recommended that the committee should start discussing the technical factors to guide a slower pace of balance sheet reduction before making a decision. This suggests that the current round of quantitative tightening, which has been ongoing for 18 months, may end earlier than initially anticipated.

Dallas Federal Reserve President Lorie Logan also stated over the weekend that due to signs of a shortage of liquidity in financial markets, the Fed may need to slow down the pace of its balance sheet reduction. This move further intensifies speculation in the market about the Fed halting its Quantitative Tightening policy. In fact, given that the Fed is now aware of the risks that a reduction in reverse repos could bring to liquidity, the probability of the Fed slowing down its balance sheet reduction will increase as reverse repos continue to decline in the next phase.

3. The Recent Dovish Comments from the Fed Suggest That an Earlier-Than-Expected Rate Cut Is Still Possible.

Some analysts believe that given the need to hedge against liquidity tightening from quantitative tightening (QT) and the potential cost savings from bond issuance, it is not impossible for the Fed to cut interest rates as early as March of this year. This sentiment is seemingly supported by dovish remarks made by Fed officials this week.

This week, a staunch hawkish member of the Federal Reserve, Governor Bowman, slightly adjusted her monetary policy stance and indicated that rate hikes may be over.

She stated,“Should inflation continue to fall closer to our 2% goal over time, it will eventually become appropriate to begin the process of lowering our policy rate to prevent policy from becoming overly restrictive.”

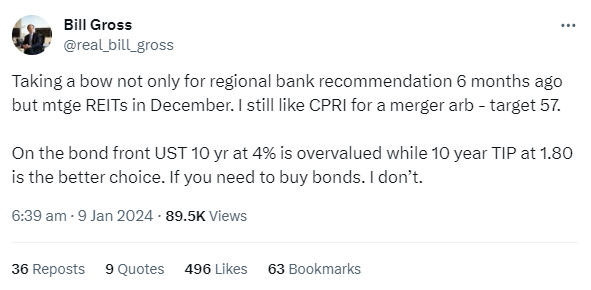

However, there are still some cautious analysts who believe that the decline in US bond yields may not be a smooth ride. They are concerned that the significant drop in bond yields since October last year has already fully reflected the expectation of rate cuts, and the market's anticipated 150 bp rate cut is twice the 75 bp implied by the FOMC dot plot. In addition, their concerns also include the possibility of a resurgence in inflation, widespread concerns over the fiscal deficit, expectations of an increase in bond supply, and the diminished urgency of the Fed to implement rate cuts.

One of them is Bill Gross, who was once known as the "bond king":

Source: Bloomberg, MacroMicro, Reuters, moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

72914002 :