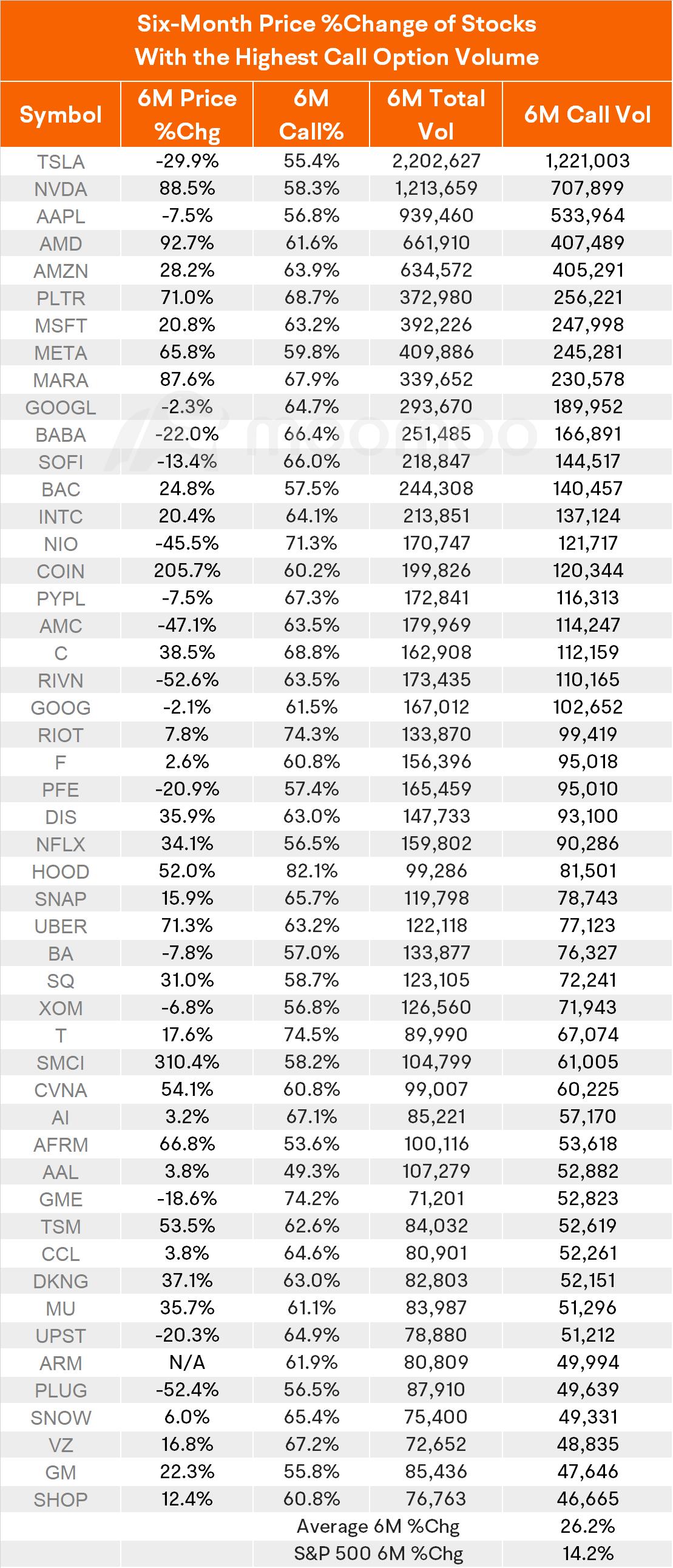

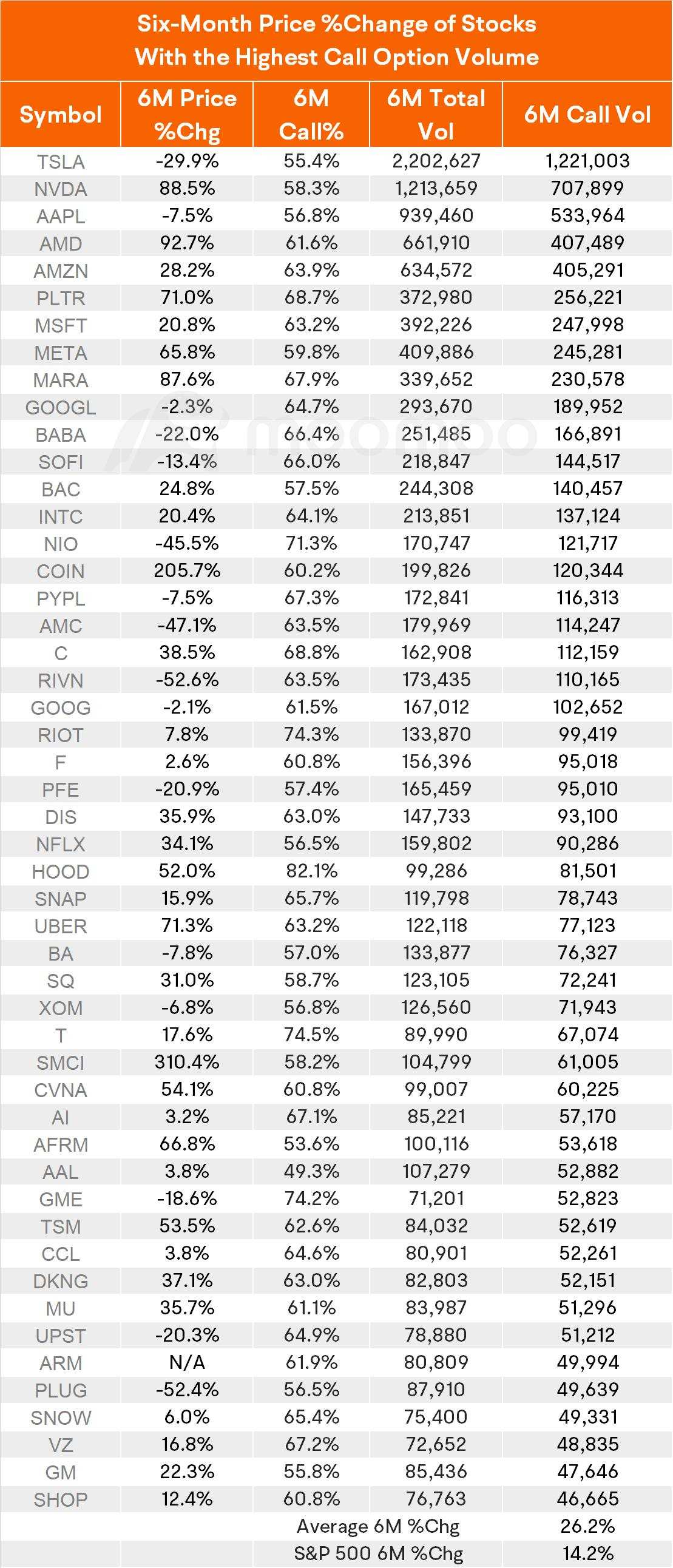

Bullish Options-Favored Stocks Keep Outperforming S&P 500 Index Returns

A group of 50 stocks with the most significant demand for bullish options has consistently outperformed the broader S&P 500 index, particularly since the outbreak of the coronavirus pandemic, according to a recent analysis by Citigroup's team of equity strategists.

The phenomenon, which dates back to December 2018, shows that these stocks with heavy call-buying activity have beaten the $S&P 500 Index(.SPX.US$ by a notable 7 percentage points.

Call options, which allow investors to purchase shares at a predetermined price within a specified period, are widely utilized as a way to speculate on a stock's upside potential. Conversely, put options offer the right to sell and are often employed to wager on a stock's decline.

Despite the strong correlation between high call option volumes and stock outperformance, the Citigroup analysts, led by Stuart Kaiser, the bank's head of U.S. equity trading strategy, cautioned that it is challenging to establish a direct causal link between the two. Nevertheless, they emphasized the importance of the trend, given the surge in options trading activity since the pandemic's onset, particularly among retail investors.

The strategists noted that this uptick in options trading, especially in calls, has been heavily concentrated in certain stocks, which in turn have demonstrated significant market outperformance during the early pandemic period.

In addition, single stock call options have outnumbered puts by a factor of 1.75:1 recently, according to Yahoo Finance's Brad Smith.

"An important characteristic of financial markets in the postpandemic era was the significant increase in options trading activity, particularly by retail investors," wrote a team of strategists led by Stuart Kaiser, Citi's head of U.S. equity trading strategy.

"These flows were skewed towards calls, and were largely concentrated in a select group of stocks. We find these stocks with high call volumes notably outperformed the broad market in the early years of the pandemic."

"While it is hard to accurately determine the causality of this relationship, we believe it to be an important metric for investors in the context of the uptick in options volumes," the team added.

Source: MarketWatch, Yahoo Finance

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Jalapenoterry65 : Strength in ARM.