Berkshire Hathaway Earnings Preview: Will The Financial Behemoth's Operating Profits Hit A New High?

In the fourth quarter, Berkshire Hathaway is expected to post a 24% increase in earnings per share (EPS) and a 3.2% rise in revenue year-over-year, reaching $3.79 and $80.68 billion, respectively.

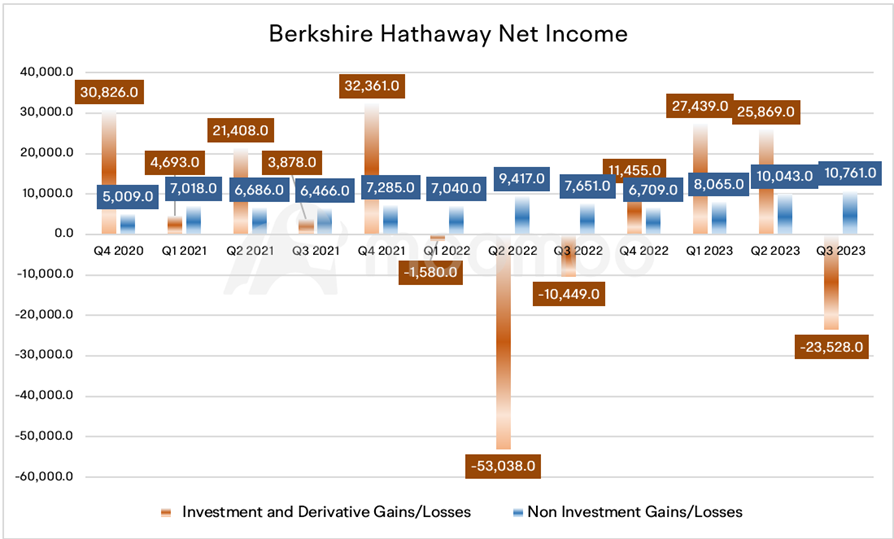

The company previously announced its latest positions, and Apple remains its largest position. Due to the rise in Apple's stock price in the fourth quarter, it is expected to drive a rebound in investment income.

In addition to the company's recently disclosed investment holdings, its own operating conditions are also the focus of investors' attention.

1) Insurance segment: The conglomerate's insurance operations are anticipated to report a substantial profit boost for Q4 2023. This expected growth is attributed to a combination of factors: the rise in interest rates, a reduction in catastrophic loss events, and an enhanced underwriting performance, particularly from its subsidiary Geico. As noted in Business Insurance, average U.S. commercial insurance rates saw a 5.6% increase in the last quarter.

In the highly competitive sector of property insurance, which includes auto coverage, firms typically hover around the break-even point. Consequently, even a minor uptick in pricing can significantly enhance their operational flexibility and financial outcomes.

2) Manufacturing and retail segment: The sector includes many types of businesses, the largest of which is the supply chain management company McLane, that Warren Buffett acquired. McLean’s major clients include Walmart, 7-11, Yum Brands, etc. The company has more than 80 distribution centers across the United States and one of the largest transportation fleets in the United States. Buffett's acquisition of McLean was mainly based on the scalability, synergy and stability of its business.

The segment's earnings outlook is closely related to the prosperity of the US retail industry. Walmart's recent better-than-expected earnings report means that the U.S. retail industry is picking up, which could boost Berkshire Hathaway's revenue in this sector.

3) Railway segment: Berkshire Hathaway's railroad sector may face challenges due to a dip in freight volumes coupled with increased non-fuel operating expenses. Nevertheless, the impact of these issues is expected to be somewhat mitigated by the lower fuel costs during the period.

4) Energy division: The segment is poised to benefit from increased profits. These gains are likely driven by improved earnings from various energy-related ventures, including tax equity investments and the Northern Powergrid operations, as well as robust performance from the natural gas pipeline segment.

5) Pilot Truck Services: In 2017, Buffett acquired truck stop operator Pilot. There's no doubt that Pilot is the kind of “boring business” Warren Buffett likes. But like many of his best investments, beneath the boring exterior lies a story of corporate growth.

Pilot's vast network of truck stops and travel service centers—which provide food, fuel, and showers to weary travelers from coast to coast—could one day become a vast network of electric vehicle (EV) charging systems.

One of the biggest challenges facing the electric vehicle industry is that current battery technology limits most use cases to local driving.

Pilot acknowledged that third-party research shows that "the vast highway charging network is a significant barrier to mass adoption of electric vehicles." So, with its vast network of travel service centers across the country, Pilot could end up becoming an integral part of the future of electric vehicles.

Pilot has partnered with General Motors to develop a national network of electric vehicle fast chargers that is expected to have 2,000 charging stations in 500 locations across the U.S. by 2026. Pilot has also signed a letter of intent with Volvo in 2022 to develop a nationwide public charging network to support the spread of electric trucks.

Pilot accounted for 14% of Berkshire Hathaway's total revenue and 1.7% of non-investment income in the third quarter, and it is destined to contribute even more profits in the future.

Overall, Berkshire Hathaway's diversified layout across various industries allows this financial giant to smooth out economic cycles, continuously generate cash flow, and thus provide a sustained source of funds for its vast investment landscape.

Appendix: Berkshire Hathaway Top 10 Holdings:

Source: Berkshire Hathaway

By Moomoo News Calvin

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Jalapenoterry65 : What a wallet.

Kosmic Ki : Thank you

纽约炒家 : Close your eyes

Derek Kiser : Well we are steel looking to Expand for chick A DEE'S, Super Proud of ALL, We have EVOLVED TOO