Meme Stocks Mania Is Back: What Investors Should Know This Time

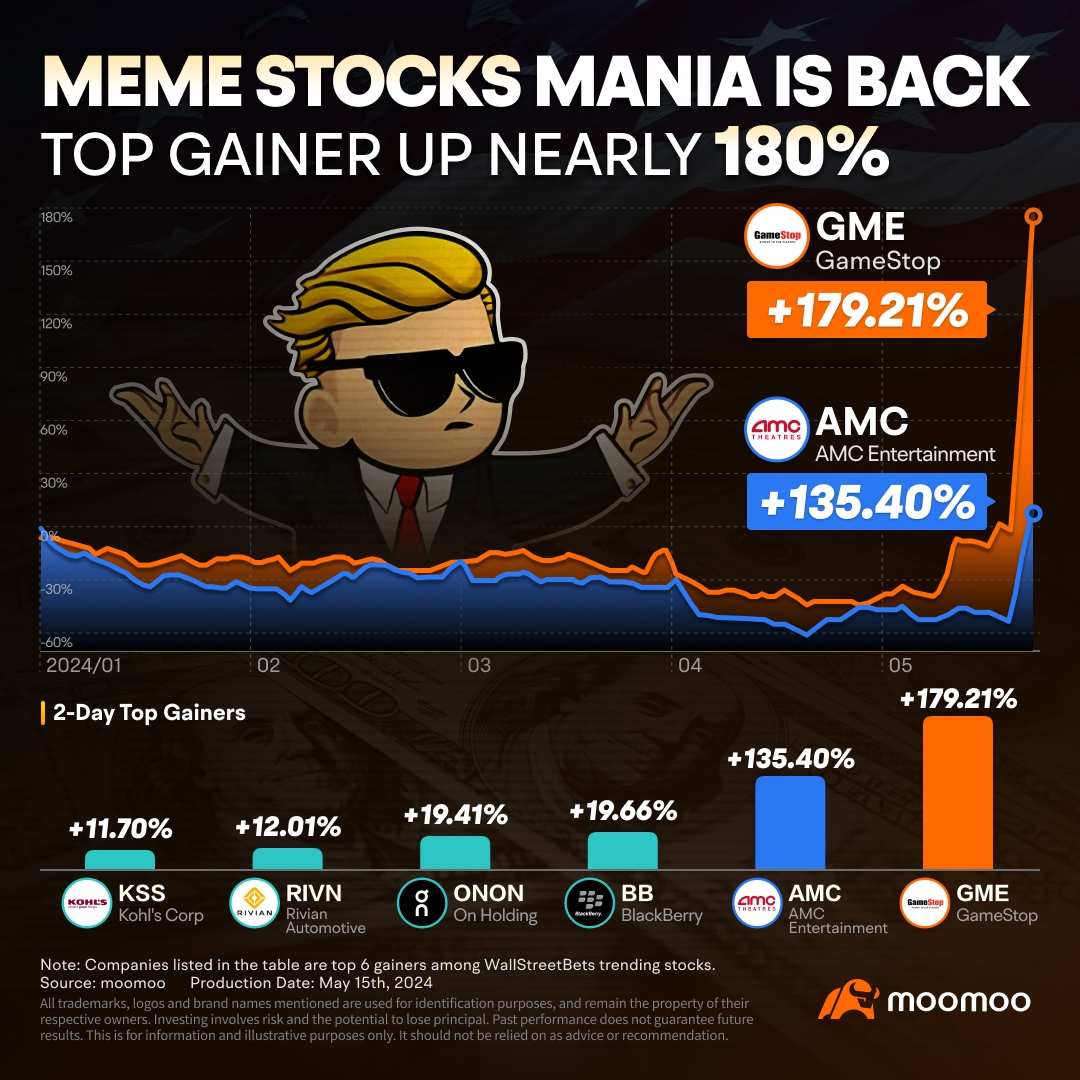

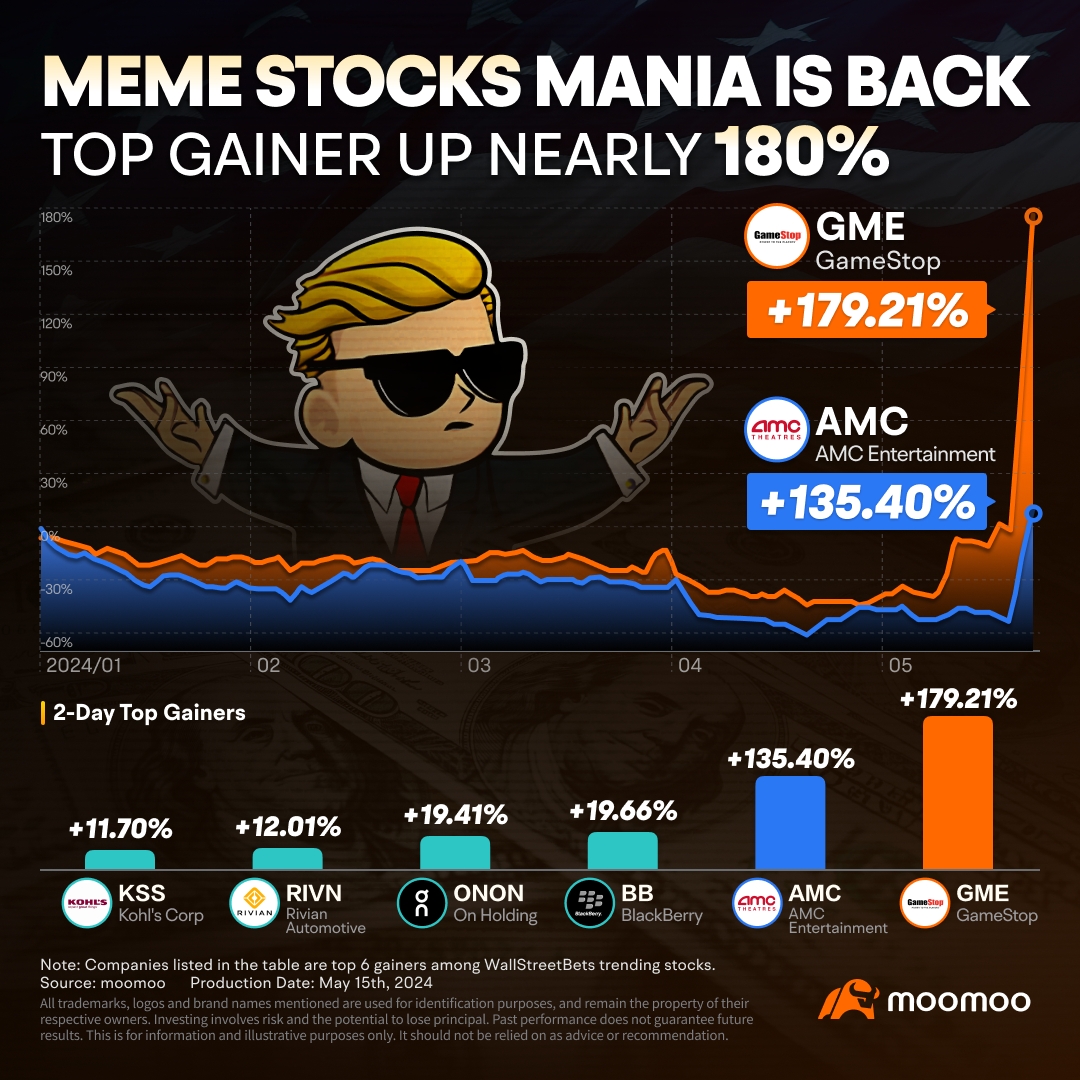

The stock market is currently amidst another frenzy over meme stocks, ignited by the online reappearance of a pivotal player from the 2020 and 2021 mania. $GameStop(GME.US$ has been one of the biggest winners of the frenzy this week, along with $AMC Entertainment(AMC.US$. Shares of other meme stocks, including $BlackBerry(BB.US$, $On Holding(ONON.US$, $Rivian Automotive(RIVN.US$ and $Kohl's Corp(KSS.US$ have followed suit.

Let's take a look at their crazy gains in the past two days:

How It Started and What Is Happening

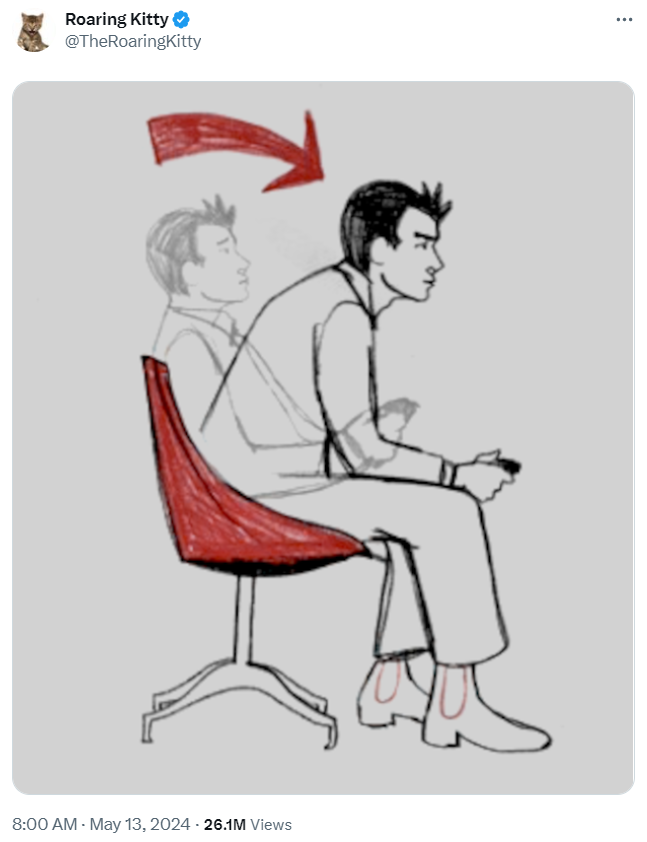

The X account for TheRoaringKitty, which had been inactive since June 18, 2021, posted a meme on Sunday evening depicting a person shifting from a relaxed to an attentive posture while playing a video game. Social media users interpreted this as a cue, leading to a flurry of activity on forums with individuals claiming they were purchasing GameStop shares. Subsequently, people began sharing screenshots purportedly displaying the profits they were earning from trading GameStop stock.

It's been manic. After the market opened on Monday, GameStop's stock experienced such volatile fluctuations that its trading had to be paused nine times within a little over an hour. The following day, AMC Entertainment's stock demonstrated even more erratic behavior, leading to a total of 18 trading halts by the early afternoon. However, GameStop quickly more than doubled in the morning, topping $64, before paring much of the gains in afternoon trading and regressing to $48.75.

What Is Different This Time

• Unusual Options Activities

Options activity in GameStop began picking up in late April according to Unusual Whales, a well-known financial account on X.

We've provided $GME, GameStop updates since April 24th, when unusual options flow started hitting. We will continue highlighting $GME's options. Right now $GME's $40 overnight price means its ENTIRE options chain is once again ITM. Last time that happened, $GME sky-rocketed," Unusual Whales tweeted on Monday.

GameStop's call option volume was the second highest on May 10, only behind May 3. The stock has seen increased discussion on platforms like WallStreetBets and StockTwits, coinciding with rising trading volumes similar to levels from April 2022 during a brief meme stock revival and news of a GameStop stock split.

I find it quite interesting that the volume and open interest in upside calls expiring May 17th steadily rose during the week," Interactive Brokers Chief Strategist Steve Sosnick told Bloomberg. "It all seems a bit convenient."

• Less Chances of "Short Squeeze"

Meme-stock companies have more shares trading in the market than they did in 2021, which could lessen the chances of what's called a "short squeeze," according to Nick Battista, director of market intelligence at tastylive.

In March, GameStop's market presence expanded significantly, with approximately 305.9 million shares traded—over four times more than the number traded in March of the previous year. According to Battista, this substantial increase in available shares means that it will require much more trading activity to trigger a price surge, or 'squeeze', for GameStop and other meme stocks. While it's possible for their prices to rise, Battista suggests that achieving such a squeeze will be more challenging than before.

Risks of Joining In

Such a short squeeze likely contributed to meme stocks' thrilling ascent, but it's critical to understand that the momentum can reverse with equal swiftness. In 2021, GameStop's stock skyrocketed from under $5 to over $120 in a mere four weeks. However, the stock has not reached that peak again since. Despite its notable surge in recent days, GameStop shares remain available for purchase at a price below $50. Also, after briefly reaching $390 during the summer of 2021, AMC's stock was drifting below $3 last week. It's now closer to $7.

Moreover, the financial prospects of most meme stocks, including GameStop, did not change over the weekend before the dizzying ascent of their stock prices. The video game retailer did report a small profit in its most recent fiscal year after facing five years of significant losses, which led to substantial cost reductions and job cuts.

Source: REUTERS, APNEWS, Investopedia

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment