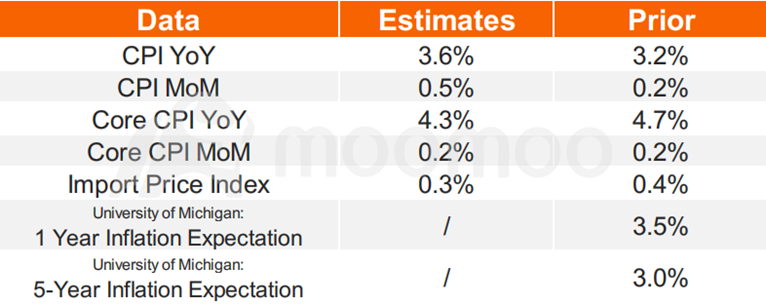

August CPI Preview: US Inflation Expected to Rise on Soaring Gasoline Prices

The Bureau of Labor Statistics will release the August CPI at 8:30 ET on Wednesday. The Federal Reserve will be on the lookout for signs that broader inflation trends continued to slow down in August—even as energy prices spiked. Bloomberg data shows headline CPI is expected to tick up to 3.6% year-over-year in August, up from 3.2% in July. This increase is mostly explained by higher global energy prices. Gasoline prices rose more than 10% month-over-month (on a seasonally adjusted basis) between July and August. And energy prices as a whole likely reported their steepest month-over-month growth since mid-2022.

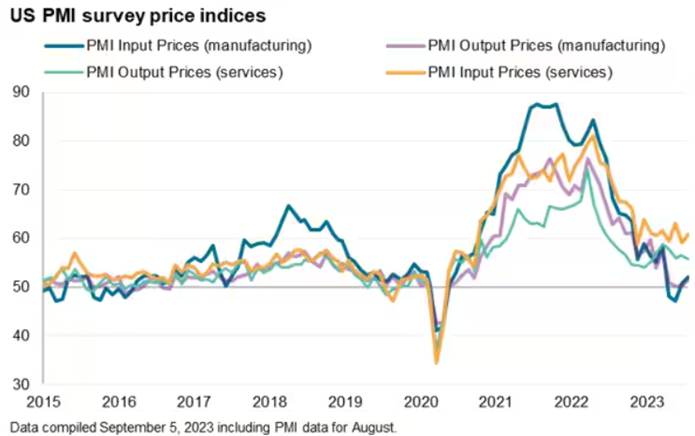

We can see stubborn inflation having persisted into August via PMI price indices. Headline US CPI aligns with the trend preluded by the S&P Global US PMI Prices Index. Some stickiness around the 3% is signaled in the coming months, and any surprise to the upside for the upcoming CPI release may trigger a repricing of assets.

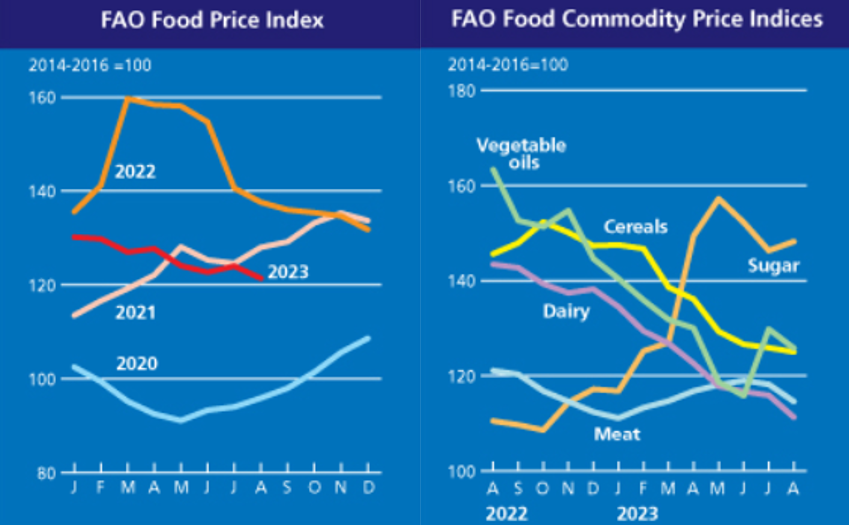

■ Food inflation

Food price growth has moderated sharply. The FAO Food Price Index compiled by the Food and Agriculture Organization of the UN returned to decline in August. Although sugar prices still rose, vegetable oil, grain, meat and dairy prices fell more sharply, becoming the key reason for the index's decline.

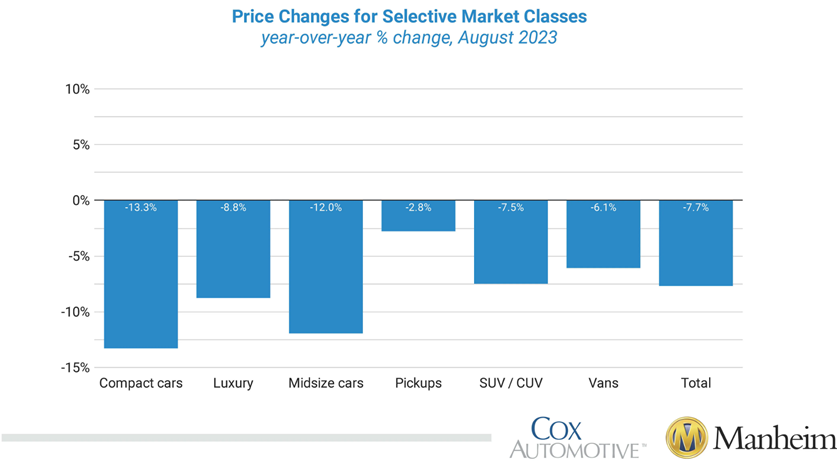

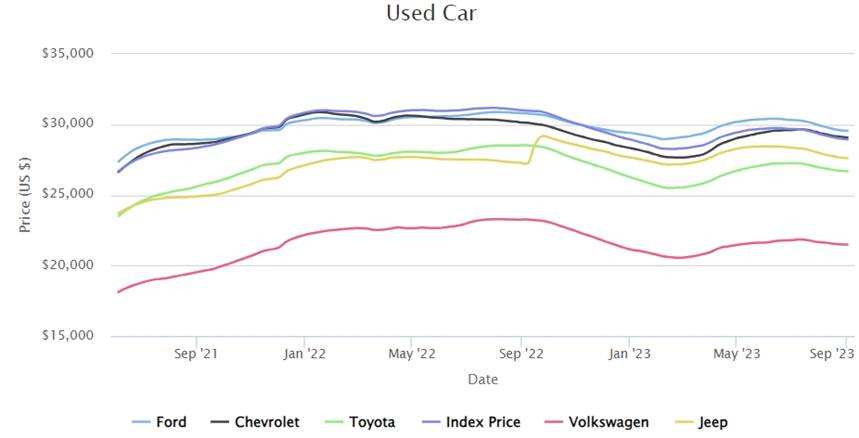

■ Used Car Prices:

The Manheim Used Vehicle Value Index reported the major market segments again saw seasonally adjusted prices that were lower YoY in August, down 7.7% from a year ago. Compact cars performed the worst year over year, down 13.3%, followed by midsize cars at 12.0%, and luxury down 8.8%.

CarGurus data also showed U.S. car prices ended its uptrend since the second quarter this year.

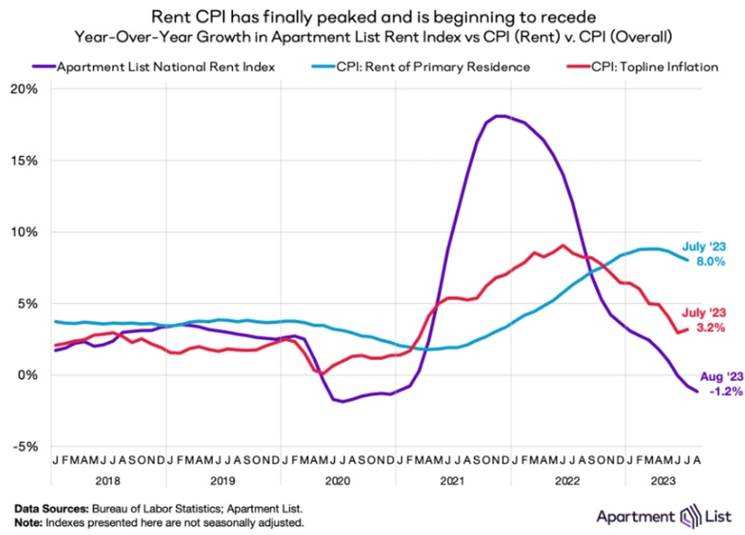

■ Residential inflation:

Residential/rental prices, which account for the largest proportion of the service category, fell month-on-month, accompanied by a further increase in the vacancy rate. Apartment List showed the national rent decrease by 0.1% MoM and 1.2% YoY.

■ Other data to watch

The import price index will be announced this Friday. Affected by the upward trend in shipping prices, the index is expected to rise in stages and then fall back.

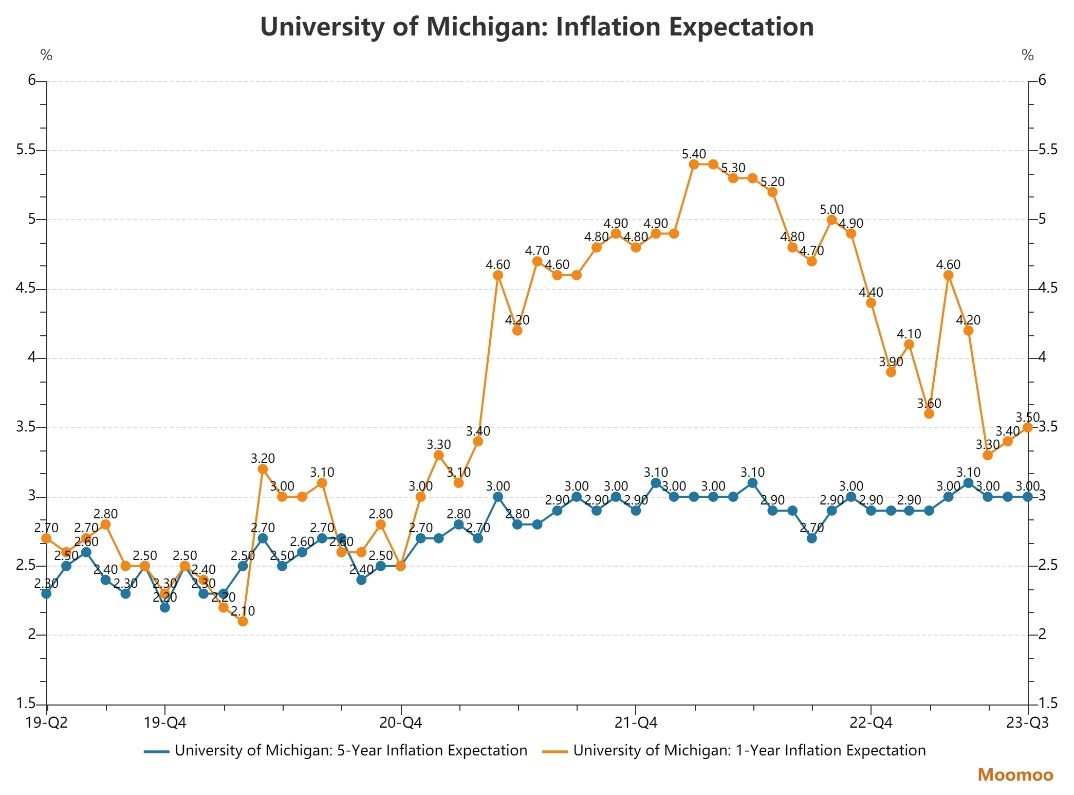

The University of Michigan will also renew its update on 1-Year/5-Year inflation expectation of September on Friday. In the last month, the 5-Year expectation remained at 3%, but the 1-Year inflation expectation increased to 3.5%.

■ Fed's next moves

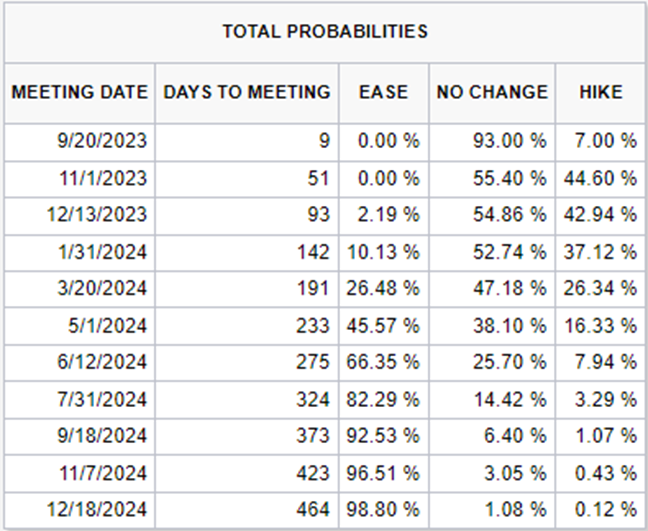

Recent data has shown a less overheated labor market. Fed officials appear to be in broad agreement to hold interest rates there at their Sept. 19-20 meeting, giving them more time to see how the economy is responding to increases. But the bigger debate is what would prompt them to raise rates again in November or December.

Projections to be released at the end of the September meeting will likely show that an additional increase is still on the table. But whether they deliver such an increase is an open question. The WSJ columnist Nick Timiraos wrote in his latest article that some policy makers worry about ending their tightening campaign only to discover in coming months that it didn't go far enough.“I don't think one more hike would necessarily throw the economy into recession if we did feel that we needed to do one,”Fed governor Christopher Waller said last week.

However, some officials worry that if one more increase proves unnecessary, reversing it would be more confusing and costly than their more hawkish colleagues appreciate. Atlanta Fed President Raphael Bostic last month said he would prefer to hold rates at current levels for the next year. As inflation comes down, inflation-adjusted, or “real,” rates will rise.

CME FedWatch shows that the market expects a 7% probability of raising interest rates in September, and the likelihood of a rate hike in November reaches 44.6%.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102568460 : This Oscillating balance between inflation and interest rate will likely continue till the late 2024, as many items in the CPI basket lags and takes time to compute.

Furthermore many items are daily essentials (commodities like food/feed and metals) and heavily dependent on energy costs, directly and indirectly.

73046361 102568460: yes please

102550477 : everything is clear on the Fed path towards interest rate...rally is on its way if there is no black Swan