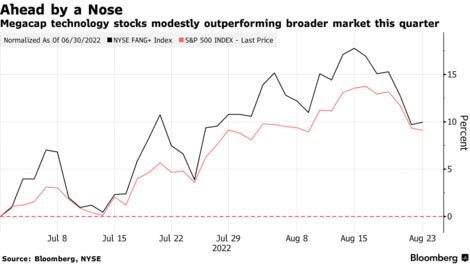

Goldman Says Hedge Funds Back Betting Big on Megacap Tech Stocks

$Goldman Sachs(GS.US$ Hedge funds ramped up bets on megacap US tech stocks and whittled down overall holdings to focus on favored names last quarter, with conviction climbing back to levels seen at the start of the pandemic, according to Goldman Sachs Group Inc.

The funds boosted tech and consumer discretionary holdings, while cutting energy and materials wagers, strategists including Ben Snider wrote in a note Tuesday. Separately, average weightings of top 10 holdings jumped to 70% in the three months ended June, the highest concentration since the first quarter of 2020.

$Amazon(AMZN.US$ supplanted $Microsoft(MSFT.US$ as the most popular long position, a timely call given that the former has rallied 26% this quarter versus an 8% climb in the latter. The funds also boosted bets on $NVIDIA(NVDA.US$ , $Apple(AAPL.US$ , $Atlassian(TEAM.US$ and $Tesla(TSLA.US$ , according to the report.

“Stymied by an uncertain market environment and poor recent returns, hedge funds have cut leverage, shifted back towards growth, and increased portfolio concentrations,” the Goldman team wrote. “Performance has recently improved, matching the typical experience during correction rebounds, though leverage has room to rise if the market remains resilient.”

The funds boosted tech and consumer discretionary holdings, while cutting energy and materials wagers, strategists including Ben Snider wrote in a note Tuesday. Separately, average weightings of top 10 holdings jumped to 70% in the three months ended June, the highest concentration since the first quarter of 2020.

$Amazon(AMZN.US$ supplanted $Microsoft(MSFT.US$ as the most popular long position, a timely call given that the former has rallied 26% this quarter versus an 8% climb in the latter. The funds also boosted bets on $NVIDIA(NVDA.US$ , $Apple(AAPL.US$ , $Atlassian(TEAM.US$ and $Tesla(TSLA.US$ , according to the report.

“Stymied by an uncertain market environment and poor recent returns, hedge funds have cut leverage, shifted back towards growth, and increased portfolio concentrations,” the Goldman team wrote. “Performance has recently improved, matching the typical experience during correction rebounds, though leverage has room to rise if the market remains resilient.”

Within the broader tech space, hedge funds lifted their net exposure in the application software sub-sector where they are overweight, as well as in underweight industries including hardware and semiconductors, the Goldman report found.

In another sign of conviction, position turnover for the funds fell to a record low of 23%.

$SPDR S&P 500 ETF(SPY.US$ $S&P 500 Index(.SPX.US$ $ARK Innovation ETF(ARKK.US$ $Tuttle Capital Short Innovation ETF(SARK.US$ $Nasdaq Composite Index(.IXIC.US$

In another sign of conviction, position turnover for the funds fell to a record low of 23%.

$SPDR S&P 500 ETF(SPY.US$ $S&P 500 Index(.SPX.US$ $ARK Innovation ETF(ARKK.US$ $Tuttle Capital Short Innovation ETF(SARK.US$ $Nasdaq Composite Index(.IXIC.US$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment