Surging commodities yet to paralyze the economy: Here's why

G7 has just rejected the requests put forth by president Vladimir Putin, who insists "unfriendly' countries use rubles to purchase natural gas from Russia. Considering Russia accounts for 32% of gas supply to the United Kingdom and the EU, this will undoubtedly stoke up the boom in gas prices further, which have already climbed up over 20% since the war erupted. Other commodities, such as crude oil, gasoline and wheat, are moving in sync, shooting up smartly amidst disruptions and turmoil caused by geopolitical crises.

The stock market shivered initially, then quickly recovered most of the losses in a decisive fashion. Yet prices of commodities still show no signs of cooling off, prompting investors to fret about a stagflation-related recession. Thus let's dive into historical data in search of some insights into the relationships between commodities and the economy.

Commodities see no economic slowdown in sight

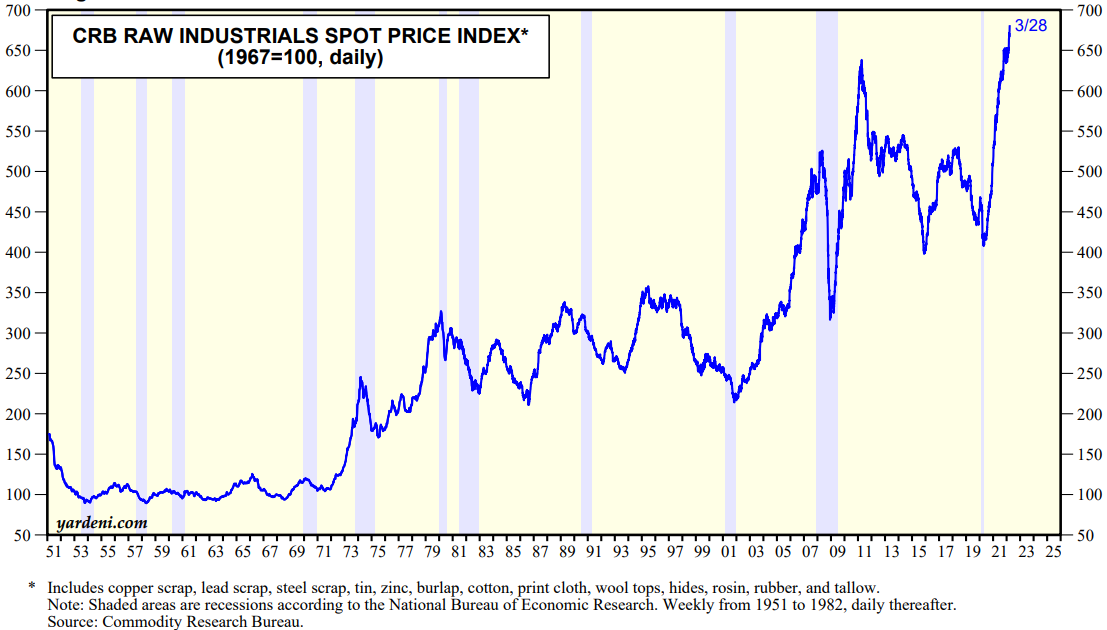

Commodity prices will rise when the economy is functioning smoothly and drop during periods of economic dysfunctions. Analysts concoct some commodity indices in order to better reflect economic activities, one of which stands out as a stellar economic indicator. It is the CRB index.

The CRB index, abbreviated for Commodity Research Bureau index, depicts the spot prices of 13 industrial commodities. It reflects the current economic conditions directly since it doesn’t use the futures market to gauge prices, which can be manipulated through speculative forces instead of the fundamental supply-demand balance. It also excludes the oil price, which has its own dynamics of supply and demand.

As is shown above, sharp nosedives in the index coincide with recessions while increases represent economic growth. The current level just breaks into a new high territory, signaling the continuous strength of the US economy now. Yet precautions should be taken for a sudden inflection point of the index since acute price surges tend to stifle consumer expenditure.

The CRB index also shows a strong correlation with S&P 500 revenues. This helps to ease some investors’ concerns about a near-term economic slowdown, let alone a recession.

Oil is soaring, but not lethal

Crude oil is undoubtedly the king of commodities. It’s an integral part of the economy. Even though the dynamics between crude oil and the economy are intricate, useful insights can still be derived from historical footprints. We found that it is almost inevitable that soaring oil precedes a falling economy and sharp drops in oil prices imply recessions, with an exception occurring in 2015, which is because of a glut of oil from Iran, not suppressed demand.

The current oil price keeps marching toward the historical peak, yet this level, which is a little above previous highs in the first half of the 2010s, is not lethal enough to halt the progress of the economy for reasons listed in the following paragraphs. Nonetheless, oil prices in the future may go higher to explode the economy.

Consider dethroning crude oil

More and more countries have been endeavoring to limit their reliance on crude oil as much as possible, not only for environmental causes but for economic resilience since market forces of crude oil are pretty volatile. Dethroning crude oil is a trend considering more electric cars are being produced and clean energies are on their way to emerging. Thus the global economy will be more resistant to oil turmoil. Below are two charts telling the diminishing role of crude oil.

The uptrend in gasoline efficiency enables people to use less oil while completing the same business activities.

Gasoline usage hovers near the same level as 15 years ago, suggesting that economic growth will not generate oil demand much more, yet vehicle miles traveled, a proxy for economic activities for the sake of simplicity, will continue to rise from the pandemic shock into higher degrees.

Conclusion

Commodities correspond closely to the economy, and the economy reacts timely to commodities. When commodity prices shoot up into the stratosphere, economic recessions will likely ensue. Current commodities are experiencing speedy inflation caused by Russia-Ukraine conflict, yet the US economy has shown strong resilience and its reliance on crude oil has decreased. Therefore, there’s no need, at least right now, for investors to panic.

Disclaimer: Past performance can't guarantee future results. Investing involves risk and the potential to lose principal. This article is for information and illustrative purposes only.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Stuka II : Like! Subscribe! And Share!

CraCra665 : Stuka what is the amount difference between an usd and a rubel???