Includes major US listed cloud computing service providers. These companies provide IAAS, SAAS, and PAAS services, infrastructure, and solutions for companies and individuals, enabling them to quickly deploy and manage their own operations, applications, and systems. Cloud computing is a significant investment opportunity for its potential cost savings. By moving IT infrastructure to the cloud, companies can reduce capital expenditures on hardware and software and only pay for the services they use, freeing up resources to invest in other areas such as research and development or marketing. Increasing demand for storage and processing power is driving the growth of cloud computing. As more businesses move to digital platforms and adopt technologies like AI, the amount of data being generated is growing exponentially. Cloud computing offers a scalable solution to handle this data.

- 1121.975

- -0.998-0.09%

- 5D

- 1D

- 1W

- 1M

- 1Q

- 1Y

News

S&P 500 Marks a Loss for Holiday-shortened Week, but Finishes May With a Win

Adobe Unusual Options Activity

Investors with a lot of money to spend have taken a bullish stance on Adobe (NASDAQ:ADBE).And retail traders should know.We noticed this today when the trades showed up on publicly available options h

Check Out What Whales Are Doing With IBM

Investors with a lot of money to spend have taken a bearish stance on IBM (NYSE:IBM).And retail traders should know.We noticed this today when the trades showed up on publicly available options histor

Buying The Dip In Salesforce? Redditors Warn Against Catching The Falling Knife, Give 5 Reasons It Might Be 'Dead Money'

Salesforce Inc (NYSE:CRM) stock witnessed a 20% stock plunge following a messy quarter with disappointing revenue and weaker guidance.Reddit user GAMorgan- at r/stocks questioned whether the current d

'This Is What We Really Needed': NYSE Trader Reacts To Inflation Data And Its Impact On Stock Market

April's PCE report, the Federal Reserve's preferred measure of inflation, came in in-line with expectations as prices appeared to remain steady. While the SPDR S&P 500 Index Trust (NYSE:SPY) popped in

If You Invested $1000 In This Stock 10 Years Ago, You Would Have $13,000 Today

ServiceNow (NYSE:NOW) has outperformed the market over the past 10 years by 17.79% on an annualized basis producing an average annual return of 28.15%. Currently, ServiceNow has a market capitalizatio

Comments

At present, Pingtou Brother has already owned server CPU chip, AI reasoning chip, RFID chip and other products, among which RFID electronic tag chip "Featherarray 600" has been applied in a large-scale way in Cainiao log...

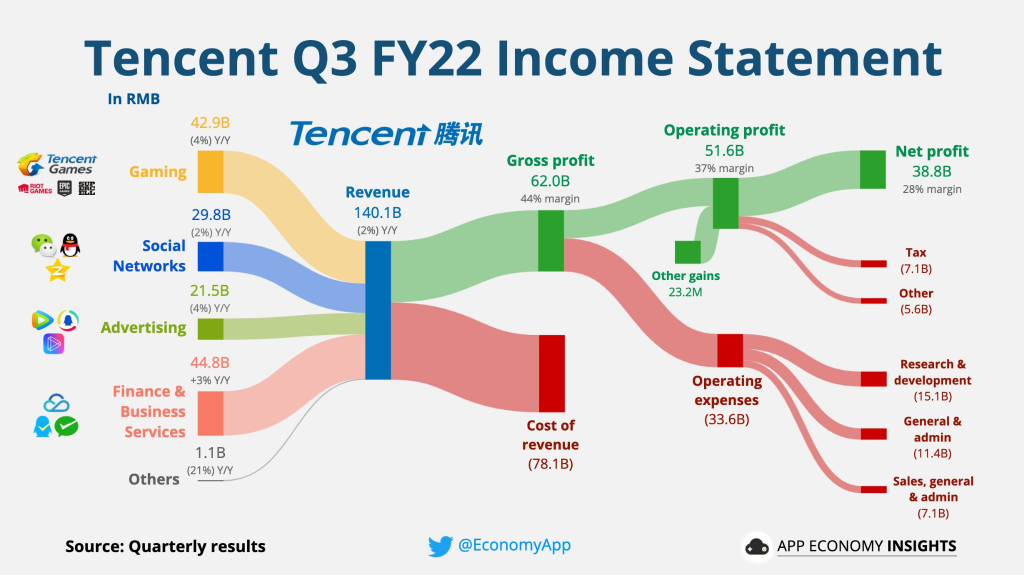

• Revenue -2% Y/Y to $19.7B.

• Operating margin 37%.

• Non-IFRS operating margin 29%.

• FCF margin 20%.

• Weixin/WeChat: 1,308M users (+4% Y/Y).

• QQ: 574M users (+0.1% Y/Y).

Meituan stake ($20B) will be distributed to shareholders.

$MEITUAN-W(03690.HK$ $Meituan ADR(MPNGY.US$ $Meituan(ADR)(MPNGF.US$

$Tencent(TCEHY.US$ $TENCENT(00700.HK$ $Hang Seng TECH Index(800700.HK$ $China Concept Stocks(LIST2517.US$ $Cloud Computing(LIST1289.HK$ $Cloud Computing(LIST2540.US$

The two brands will unite in a common cause: promoting the digital transformation of companies in some regions. These can be small a...

Once mature, system will improve efficiency of running park.

SkyWorlds also have real time visibility of how long the wait times are for all their rides, and using this key data to then, match it with itine...