The three major US stock indexes rose at least 1.5 per cent, S & P posted its biggest gain in eight months, materials and IT stocks rose more than 2 per cent, and Walgreens led the Dow up by more than 7 per cent, while Bank of America rose more than 4 per cent. The pan-European stock index hit a three-week high, the mining sector rose more than 3%, and the technology sector rose another more than 2%. Lunxi Zinc rose nearly 4% a day, breaking through US $3500 for the first time in 14 years, Lunxi Aluminum reached a 13-year high in five days, Lunxi Copper reached a four-month high of nearly US $10, 000, and Shanghai Zinc Night Trading, which rose by the daily limit on the inner market, rose nearly 3%. The yield on 10-year U.S. Treasuries hit a new low of more than a week by 1.51%. The dollar index hit its lowest level in more than a week. Gold hit another one-month high, failing to hold steady at $1800. Natural gas in Europe rose at least 8%; US oil hit a seven-year high in four days, and US gasoline hit a seven-year high in four days.

The number of US first-time jobless claims fell more than expected last week, falling below 300000 for the first time in more than a year and a half. PPI and core PPI accelerated in September compared with August, but at the slowest month-on-month growth this year. Us economic data are improving and the threat of inflation has temporarily eased. Yields on European and American government bonds fell collectively, with benchmark 10-year UK and US yields far from five-month and two-and-a-half-year highs, respectively, and two-year yields, which recently hit record highs of one and a half years, also fell.

Some listed companies reported better-than-expected third-quarter results, and U. S. stocks were encouraged to move higher. Leading technology stocks led by Alphabet Inc-CL C rose generally, and Apple Inc rebounded after days of falling production due to chip shortages that cut iPhone 13 production. The raw materials sector, which benefited from higher metals, led stock markets in Europe and the United States, while the technology sector continued to lead gains.

Benefiting from COVID-19 's vaccination and testing and a rebound in demand for over-the-counter drugs, retail drugstore giant Walgreens Boots Alliance (WBA) posted better-than-expected earnings and revenue in the third quarter, and its shares rose more than 9% in intraday trading, leading the Dow higher. UnitedHealth Group Inc, another Dow component that beat expectations and raised its full-year earnings guidance, rose more than 7 per cent at one point. Bank of America Corporation and Morgan Stanley, whose profits were both higher than expected, rose more than 4 per cent and 2 per cent respectively in intraday trading. Boeing Co, who has not yet resumed shipments of the 787 dream model and revealed quality problems, fell against the market.

Among commodities, industrial metals led by lun zinc rose, with the London Metal Exchange (LME) index tracking six industrial metals hitting an all-time high. The commentary said that tight supply in the market and energy shortages in Europe and Asia have led to higher costs of electricity and natural gas. After global non-ferrous metals giant Nyrstar announced on Wednesday that three European zinc smelters had cut production by up to 50 per cent, Deutsche Bank estimated that the three plants had a combined capacity of about 700000 tons per year; in addition, LME's zinc inventory has fallen to its lowest level in January this year.

Although US EIA crude oil inventories recorded the largest weekly increase since March last week, the International Energy Agency (IEA) raised its forecast for global oil demand for 2021-22, saying that energy supply shortages will force many power stations to switch to crude oil, and the rebound momentum of international crude oil has not changed. Us oil and cloth oil respectively refreshed the seven-year and three-year highs set earlier this week, US gasoline hit another seven-year high, and natural gas in Europe and the United States continued to recover.

As risky assets rose, the dollar index continued to fall, breaking its lowest level in more than a week, falling below 94.00. Supported by a weaker dollar and lower US bond yields, precious metals continued to climb and gold and silver hit another one-month high, but gold failed to reach the $1800 mark by the close. Cryptocurrencies also mostly rose when the dollar weakened, with Bitcoin breaking through $58000 in intraday trading for the first time in more than five months, but then falling more than $1000, giving up most of its gains.

S & P's biggest gain in eight months Materials and IT are up more than 2%. Pan-European stock index hit a three-week high. Mining sector rose more than 3%.

On the whole, the three major US stock indexes opened higher. At midday highs, the Dow Jones industrial average was up nearly 500 points, while the s & p 500 and the Nasdaq composite index were both up more than 1.7%.

In the end, the three indices closed higher for the first time since Thursday, Oct. 7. The Dow closed up 534.75 points, or 1.56%, up more than 500 points for the first time since Sept. 23, the biggest gain since July 20, to 34912.56 points, and closed above 34900 points for the first time since Sept. 8. The s & p 500 closed up 1.71%, the biggest gain since march 5, to 4438.26; the Nasdaq closed up 1.73%, the biggest gain since may 20, to 14823.43, and s & p both closed at new highs since Sept. 27, and both rose for two days in a row.

Small-cap stocks continued to rise but failed to outperform the market, with the value-dominated small-cap stock index Russell 2000 closing up 1.44 per cent. The technology-heavy Nasdaq 100 index closed up 1.88%, beating the market for the second day in a row.

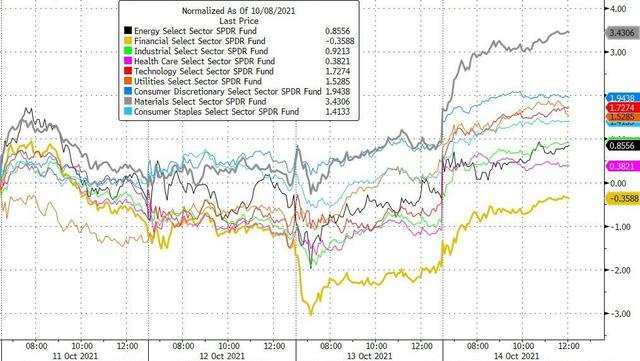

The 11 major sectors of the S & P 500 rose across the board, led by materials and information technology sectors that rose about 2.4% and 2.3%, respectively. With the exception of nearly 1% of non-essential consumer goods, all sectors rose more than 1%, industry rose about 1.9%, and communications services and finance rose more than 1.7%.

Among Dow stocks, Walgreens (WBA) closed up more than 7.4 per cent, UnitedHealth Group Inc (UNH) rose more than 4 per cent and Boeing Co fell nearly 2 per cent.

Among the stocks that reported results, Bank of America Corporation closed up more than 4.5 per cent, Morgan Stanley rose more than 2.5 per cent, and Taiwan Semiconductor Manufacturing Co Ltd, whose profits surged 13.8 per cent in the third quarter, rose more than 2 per cent; but Wells Fargo & Co, whose revenues and profits were higher than expected due to the release of provisions for bad debts, fell more than 1.5 per cent; although third-quarter revenues and profits were higher than expected, US Bancorp (USB) fell more than 2 per cent.

Leading technology stocks all closed higher, while Tesla, Inc. closed up nearly 0.9 per cent. Among the six major technology stocks in FAANMG, Alphabet Inc-CL C's parent company Alphabet closed up nearly 2.6%, the best performance. Microsoft Corp also rose more than 2%, Apple Inc rose about 2%, and at the end of four consecutive days of decline, Facebook Inc rose more than 1%, Nai soared more than 0.6%, and Amazon.Com Inc rose nearly 0.5%.

Among the volatile stocks, Caterpillar Inc, who was first covered by Cowen and given an overweight rating, closed up nearly 2.9 per cent, UPS, which was upgraded by Stifel to buy, rose about 4 per cent, and car rental company Avis Budget Group (CAR), which was downgraded by Morgan Stanley to reduce its holdings, fell nearly 1.8 per cent.

Most popular US-listed stocks fell, with ETF KWEB and CQQQ closing down more than 1.7 per cent and 0.5 per cent, respectively. IQIYI fell by more than 5%, RLX Technology Inc. by more than 4%, Pinduoduo by more than 3%, Bilibili Inc. and TAL Education Group by more than 2%, XPeng by more than 1%, Tencent ADR by about 1%, Baidu by 0.7%, Alibaba by about 0.4%, Li Auto by more than 2%, New Oriental Education & Technology by more than 0.8%, JD.com by nearly 0.6%, and NIO Inc Motor by more than 0.1%.

In terms of European stocks, the pan-European stock index rose for two days in a row, and the European Stoxx 600 index rose more than 1%, its biggest gain in a week and its highest close since September 23. Stock indexes of major European countries rose across the board for the first time since last Thursday, while German, French and Italian stocks rose more than 1% in a day after last Thursday. All sectors closed higher, with the basic resources of mining stocks rising more than 3.3%, and technology, which led the rise on Wednesday, rose more than 2% for the second day in a row.

Lunxi history new Gauren zinc rose nearly 4 per cent a day for the first time in 14 years, surpassing US $3500 for the first time in five days and setting a new high for 13 years and a four-month high for copper.

London base metal futures rose across the board on Thursday. Lun Zinc rose for five days in a row, rising more than 3.7% after rising more than 4% on Wednesday. For the first time since 2007, it broke through US $3500 to close at US $3528 per tonne. After breaking through 3000 US dollars for the first time in 13 years on Monday, Lun Aluminum, which closed flat on Wednesday, stood at 3100 US dollars to close at 3117 US dollars per ton, setting a 13-year high on the fourth day of the last five trading days.

Lun copper and lun lead rose for two days in a row, rising more than $300, or more than 3%, for the first time since Sept. 22, closing near the $10, 000 mark for the first time in four months. Lun lead hit an one-month high on the third day of this week. Lunni ended a three-day losing streak, hitting a nearly three-week high. Lunxi, which has just ended seven days of gains, rebounded to close at US $36923 per tonne, closing at close to US $37000 for the first time in history.

Industrial metals also rose on the inner plate. During the day, Shanghai zinc rose by the daily limit, Shanghai copper and Shanghai lead rose more than 3%, Shanghai zinc closed up 2.93%, Shanghai copper rose 2.6%, Shanghai lead, Shanghai nickel and Shanghai tin all rose more than 1%.

The London Metal Exchange (LME) index tracking the prices of six industrial metals rose 2.6 per cent to 4623.4, a record high for revenue, up 35 per cent so far in 2021.

The yield on 10-year US Treasuries hit a new low of more than a week by 1.51%.

European bond prices continued to rise, led by Italian bonds, with yields rising more than 7 basis points a day. The yield on UK 10-year benchmark government bonds fell 4.7 basis points to 1.042% on the day, continuing to stay away from the intraday high since May 2019, which was close to 1.22% on Monday, giving up 3 basis points. Over the same period, the yield on German bunds fell 6.3 basis points to-0.191%, far from Tuesday's high of-0.09% since May 19, and rose more than 1 basis point when it reached-0.112% during the intraday session.

The yield on benchmark US 10-year Treasuries basically fell during the European and American trading session, with US stocks falling below 1.51 per cent at the beginning of midday, the lowest since Wednesday, Oct. 6, and down more than 10 basis points from the high set at nearly 1.63 per cent in the second session of the week since late May.

By the close of US stocks, the yield on 10-year Treasuries was about 1.52 per cent, down about 2 basis points on the day, while the yield on 2-year Treasuries was about 0.364 per cent, up less than 1 basis point on the day, away from the highest level since March last year, which broke through 0.39 per cent on Wednesday. On the 4th of this week, the two-year yield still rose by 3 to 4 basis points, while the 30-year yield fell by about 15 basis points.

The dollar index hit a new low in more than a week

Apart from a few hours of morning trading in Asia, the ICE dollar index (DXY), which tracks a basket of the dollar's six major currencies, fell most of Thursday, with European stocks falling below 93.80 at one point, the lowest since Monday, Oct. 4, and down more than 0.3% on the day, before narrowing the decline. U. S. stocks were back at 94.00 in morning and midday trading.

By Thursday's close, the dollar index was just below 94.00, down about 0.1% on the day; the Bloomberg dollar spot index was almost flat, falling below 1159 points at the close of trading on Wednesday, the lowest since Monday.

At 05:59 Beijing time on the 15th, the offshore RMB (CNH) was trading at 6.4359 yuan against the dollar, down 78 points from late trading in New York on Wednesday, ending two days of gains. The overall intraday trading was in the range of 6.4268-6.4398 yuan, falling off the intraday high since Sept. 15, which broke through 6.43 on Wednesday.

Gold hit another one-month high and failed to hold steady at $1800.

Gold and silver futures in New York rose for three days and two days respectively. Gold briefly rose above $1800 in early trading in both European and US stocks, but in the end, COMEX December gold futures closed up 0.2% at $1797.90 an ounce, the highest since Sept. 14 and the highest since Sept. 15 on Wednesday.

COMEX December silver futures closed up 1.3% at $23.477 an ounce, the second consecutive high since Sept. 15. Platinum and palladium rose for three consecutive days, closing up 2.7% and 2.1%, respectively.

European natural gas rises at least 8% US oil hit a seven-year high in five days and US gasoline hit a seven-year high.

European natural gas rose across the board for the third day in a row, and the increase continued to expand, the second day in a row, the biggest increase since Tuesday, October 5.

On Thursday, ICE UK natural gas futures closed 9.27 per cent higher at 257.61 pence per kcal, nearly 37 per cent below the intraday high set last Wednesday, and traded in the 244.21-259.04 pence range. TTF benchmark Dutch natural gas futures rose 8.01 per cent to 101.800 euros per megawatt in late trading, down about 36 per cent from Wednesday's intraday high and trading in a range of 96.500-102.600 euros.

Us gasoline and natural gas futures rose for three days in a row, rising for six days and three days respectively. NYMEX November gasoline futures closed 1.2 per cent higher at $2.435 a gallon, the fourth consecutive high since October 2014, while NYMEX November natural gas futures closed 1.7 per cent higher at $5.687 per million British thermal units, about 10 per cent below the high set on Tuesday since December 2008.

International crude oil futures rebounded, erasing Wednesday's decline. Us WTI November crude oil futures closed 1.08 per cent higher at $81.31 a barrel, the highest monthly contract close since Oct. 29, 2014, and the third consecutive high since Oct. 31, 2014. Brent December crude oil futures closed up 0.98% at $84.00 a barrel, breaking Monday's high since Oct. 9, 2018.

Edit / irisz