Bullish momentum is strong and continuous.

Today, a sector exploded.

Despite the collective opening of the three major indexes of the SSE, the SZSE and the CNI, the growth enterprise board and the ChiNext Board turned red in the afternoon under the impetus of a number of technology stocks, especially the SSE Science and Technology Innovation Board 50 Index, which has a higher proportion of semiconductor stocks, and the rise is still close to 2%.

Despite the collective opening of the three major indexes of the SSE, the SZSE and the CNI, the growth enterprise board and the ChiNext Board turned red in the afternoon under the impetus of a number of technology stocks, especially the SSE Science and Technology Innovation Board 50 Index, which has a higher proportion of semiconductor stocks, and the rise is still close to 2%.

Despite the recent collective pullback of U.S. technology stocks, the performance of China's A-share semiconductor segment has been particularly strong. Since July, with multiple positive news adding up, the cumulative rise of many semiconductor chip ETFs has already approached 10%.

Will the investment opportunities brought about by the semiconductor recovery become the new main theme in the third quarter?

01

Bullish events are emerging.

In terms of sectors, rail transit equipment, semiconductors, military electronic industry, photovoltaic sectors are among the top gainers, and precious metals, real estate, oil and gas, banking, and retail sectors are among the top decliners.

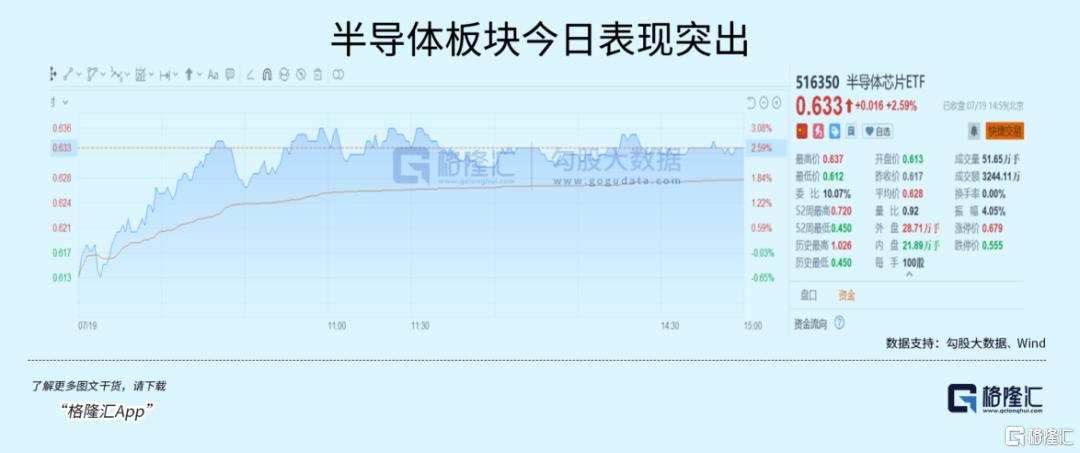

The semiconductor sector is trading extremely hot, with a rise of nearly 4% and a turnover of over 50 billion. YooTai Micro and KaiWit 20CM have hit the daily limit, and many individual stocks such as NaXin Micro and GuoXin Technology have risen more than 10%.

With the opening of the semi-annual report window, semiconductor companies with performance pre-increases have become the "brightest child" in China's A-share investors' eyes. Combined with the significant valuation adjustment in the past, the confirmation of the industry's recovery may gradually be reflected in the market price and usher in a wave of recovery.

As of now, there are 156 A-share listed companies in the Semiconductor sector of the SW level II industry, among which 40 have announced the semi-annual report performance forecasts; 35 companies expect the net profit to increase year-on-year, and 20 companies expect the net profit to increase by more than 100% year-on-year.

The primary reason for the high increase in performance is still the cyclical recovery of the industry.

According to the Semiconductor Industry Association (SIA) data, global semiconductor industry sales in May 2024 reached $49.1 billion, a year-on-year increase of 19.3% compared to May 2023's $41.2 billion, a month-on-month increase of 4.1% compared to April 2024's $47.2 billion. The Chinese region ranked second with a year-on-year increase of 24.2%, second only to the Americas market.

Sure enough, since July, the performance of listed companies in many links of the chip industry chain has reflected a high degree of resilience in the recovery.

For example, Will Semiconductor, which mainly produces image sensors, announced first-half-year earnings on July 6, with net profits ranging from 1.308 billion yuan to 1.408 billion yuan, up 754.11% to 819.42% year on year. Hangzhou Changchuan Technology, which provides testing equipment, has a net profit attributable to shareholders of the listed company of 0.2 billion yuan to 0.23 billion yuan in the first half of the year, a year-on-year increase of 876.62% to 1023.12%.

Secondly, changes in the prosperity of the downstream market have driven the upstream semiconductor industry chain and spawned new logic themes. What is increasingly certain is the transformation of the AI industry. Recently, Taiwan Semiconductor and the two giants both showed very intuitive performance in this regard.

As for Taiwan Semiconductor, sales in the second quarter were TWD 673.51 billion, up 40.1% year on year, with net profit of TWD 247.8 billion, up 36.3% year on year; ASML Holding's second-quarter sales rose 18% year on year to EUR 6.24 billion, both surpassing market expectations. Although the stock price fell, institutions have expressed that the company's order situation remains healthy, and the stock price still has room to rise.

There are also outstanding performance of excellent stocks in A-shares, and many companies with large pre-tax profits in the semi-annual report.

In the first half of 2024, with the recovery of the storage industry and the rapid growth of AI server demand, Montage Technology's DDR5 penetration rate continued to increase, and new products of high-performance computing chips achieved mass shipments. The company expects to achieve operating income of RMB 1.665 billion in the first half of 2024, an increase of 79.49% year on year; and achieve net profit attributable to shareholders of the listed company of RMB 0.583 billion to RMB 0.623 billion, an increase of 612.73% to 661.59% year on year.

And this year, the downstream consumer electronics have shown signs of recovery, and the demand for chip products has clearly recovered.

Benefiting from the recovery of downstream mobile phone and PC demand and the rise in storage chip prices, Bainian Storage is expected to achieve revenue of 3.1-3.7 billion yuan in the first half of 2024, with a year-on-year growth of 169.97%-222.22%. The net profit attributable to the parent company will be 0.28-0.33 billion yuan, an increase of 0.577-0.626 billion yuan compared with the same period of the previous year, turning losses into profits.

In addition to concentrated release of performance, bullishness is also reflected in the policy level.

From a longer-term perspective, the country is still increasing its support for the development of the semiconductor industry. On May 24th of this year, the National Integrated Circuit Industry Investment Fund III was established, and integrated circuit companies received new long-term funding support.

Although the direction of investment has not been fully clarified, based on the fund-raising direction of the previous two rounds of funds, the investment of the first fund mainly focuses on IC manufacturing (63%), IC design (20%), packaging testing (10%) and equipment materials (7%) and other links. The investment direction of the second fund is more inclined to manufacturing, with the proportion of wafer manufacturing reaching 70%.

But currently, the supply chain links of advanced manufacturing and supporting equipment, materials, components, EDA, IP and other links all have "neck-blocking" problems, and links with low domestication rates include lithography machines, quantity/testing equipment, gluing/development equipment, and ion injection equipment, etc., so in the third round, investment in upstream key equipment materials and components that match the manufacturing process may continue to be increased, especially in the area of advanced processes and advanced packaging.

02

Strengthening the trend of localization

In our past articles, we have more than once emphasized the long-term logic of semiconductor localization.

No matter from which perspective, this long-term logic stands firm.

The high-profile meeting not only reinforces this long-term logic, but even has unexpected expressions.

Among them, there is such a sentence:"Facing the complex international and domestic situation, facing the new round of technological revolution and industrial transformation, facing the new expectations of the people, we must consciously put reform in a more prominent position, and focus on further deepening the reform around promoting China's modernization."

Understood, there are two points: changes in the external situation, and the new technological revolution and industrial transformation that have emerged globally, have become the new driving force for reform, which not only has urgent needs but also needs to follow the trend.

So, we must follow the trend and put the country's technological innovation in a more prominent position.

It should be easy for everyone to guess that the most important area of independent technological innovation is in the field of semiconductors.

If there was still some time for us to catch up with the previous semiconductor domestication substitution, because we have matured in the areas of PC, mobile phones, and the Internet.

But now it's completely different, because the new industrial revolution, AI has already developed rapidly, and we have almost been cut off from the channels for critical chips, such as GPUs and NPUs. The NVIDIA H20 we can get is also a castrated version, with only 20% performance of the H100. Such performance will only widen the gap.

Recently, things over there are happening again, and the situation is more urgent than ever before.

From this perspective, we can understand why the meeting elevated independent technological innovation to an important position in the reform task.

More importantly, the conference has already determined from the overall outline that in the foreseeable future, there will be more specific measures to support the domestication of semiconductors, including policies, fiscal measures, basic research, and so on.

This is a major benefit for domestic semiconductor companies.

Looking back at the cases of semiconductor development in Japan, South Korea, and other areas in Asia, they all used the national system, which was one of the most critical factors for their success.

Others' successful experience can be used to improve ourselves.

To some extent, we are also replicating this successful experience. Although the results are still unclear, with previous successful experiences and a huge domestic market, the probability of success is relatively high as long as various critical factors work together.

In fact, the market share of domestic semiconductors has been steadily increasing, as shown below in the industrial field.

We should have confidence in the future.

03

What to buy?

Returning to the stock market, investors have been hotly discussing:

Previously, the two major themes, high dividend stocks have been rising for more than a year, and with recent downturns in the stock prices of Apple and Microsoft, funds that previously focused on consumer electronics (AI PC, AI mobile phones) also have switching requirements. Where is the new theme?

Now, semiconductors, which have integrated many favorable factors, are the most likely new theme in the third quarter.

From a cyclical perspective, the domestic semiconductor sector is currently in a window period of bottoming out and reversing;

In terms of valuation, it is not expensive because it is still in the bottom of the cycle;

In terms of performance, semiconductor companies are also releasing good news in succession;

Now, there is confirmation of the major reform direction of the country.

The trend of localization of semiconductors is being strengthened again, and the cost-effectiveness of semiconductors is becoming more apparent due to low valuation and turning performance, and investment value is also becoming clearer.

Today's sharp rise in the semiconductor sector is the best proof. What is more important is that this rise still has sustainability because it is difficult to find another sector with so many favorable factors as semiconductors.

Therefore, funds are likely to continue to flow into the semiconductor sector.

However, because the semiconductor industry is relatively obscure and difficult to understand due to heavy research and development and technology, research requirements are also high. For investors, there are two strategies that are relatively good:

If investing in individual stocks, stick to the principle of focusing on leading companies in the semiconductor industry chain, these companies have relatively solid fundamentals, high technical strength, and relatively good ratings in terms of business models, operating indicators, and financial data.

If investing in indices, you can consider ETFs, such as semiconductor chip ETFs (516350), whose weight stocks basically include leading domestic semiconductor companies in various subdivisions of the industry chain, including Naura Technology Group and Advanced Micro-fabrication Equipment Inc. China in the equipment sector, Semiconductor Manufacturing International Corporation in the manufacturing sector, JCET Group Co. Ltd. in the packaging and testing sector, Will Semiconductor in the image sensor sector, and Gigadevice Semiconductor Inc. in the storage sector.

Among the semiconductor chip theme ETFs in the current market, the management fee of the semiconductor chip ETF(516350) is the lowest, only 0.15%, with lower investment costs. OTC users can also make regular investments and subscriptions by linking the funds (Class A: 018411; Class C: 018412).

If you don't want to miss the trend of domestic semiconductors and want to make investment easy, semiconductor chip ETF(516350) is worth taking a look at. (End of article)

尽管沪指三大指数集体低开,但在一众科技股带动下,深成指、创业板午后翻红,尤其以半导体股占比较多的科创50,涨幅依然接近2%。

尽管沪指三大指数集体低开,但在一众科技股带动下,深成指、创业板午后翻红,尤其以半导体股占比较多的科创50,涨幅依然接近2%。

Comment(0)

Reason For Report