On Friday, Nvidia, the number one in US stock turnover, closed 2.57% higher, and its stock price reached a record high of 44.274 billion US dollars, with a market capitalization exceeding 2.6 trillion US dollars. The company's revenue for the first fiscal quarter increased 262% year over year to US$26.044 billion. Data center revenue increased 427% year over year to US$22.6 billion, with market expectations of US$22.1 billion, a record high. Net profit increased 628% year over year to US$14.881 billion. At the same time, Nvidia also announced a stock split plan of 1 split of 10.

The company expects revenue of US$28 billion for the second fiscal quarter, which is higher than the average estimate of US$26.61 billion from the London Stock Exchange Group (LSEG) survey. This is an indication that Nvidia does not see strong performance growth slowing down. The market expects the company to earn $5.95 per share for the second fiscal quarter.

The second-place Tesla closed 3.17% higher, with a transaction of US$11.572 billion. Tesla recently officially announced that it has broken ground on its Shanghai energy storage gigafactory. This major project is not only Tesla's first overseas energy storage gigafactory, but also marks an important step in Tesla's global energy storage layout.

Furthermore, Tesla CEO Musk said on Thursday at VivaTech, Europe's biggest science and technology innovation event, that artificial intelligence will eventually replace all human jobs, but this is not necessarily a bad thing. In Musk's view, future jobs will be “optional.”

In third place, AMD closed 3.70% higher, with a transaction of US$8.968 billion. According to documents disclosed by the US Securities and Exchange Commission (SEC) on May 23 EST, AMD affiliate GRASBY PAUL DARREN plans to sell 15,000 common shares on May 23, with a total market value of about US$2,5279 million.

In fifth place, Apple closed 1.66% higher, with a transaction of US$6.867 billion. Investment bank Wedbush analyst Dan Ives raised Apple's target price from $250 to $275, mainly because considering the iPhone 16 supercycle driven by artificial intelligence technology, it will increase the company's value by 30 to 40 US dollars/share. He also emphasized that the upcoming Global Developers Conference (WWDC) is a critical moment for the company.

The 6th ultra-microcomputer closed 4.31% higher, with a transaction of US$5.977 billion. Chief Financial Officer David Weigand said on Monday that the ultra-microcomputer company believes the AI investment cycle has just begun and refuted concerns about the bubble.

He said the company sees huge potential for growth, particularly as investment in artificial intelligence infrastructure expands beyond the US. He emphasized the advantages of accelerated computing in various fields such as drug analysis and weather forecasting, confirming continued demand.

Seventh-place Meta Platforms closed 2.67% higher at $5.686 billion. According to media reports on May 24, Meta Platforms and Google are providing millions of dollars to Hollywood Pictures to reach a licensing agreement to further improve their artificial intelligence (AI) -generated video models. According to the latest media report, the offer proposed by the two companies has reached “tens of millions of dollars,” yet the final outcome of the negotiations is still unclear.

In 8th place, Microsoft closed up 0.74% with a transaction of US$5,058 billion. The Royal Bank of Canada reiterated the Microsoft rating on Friday, and adjusted it from being superior to the market rating, with a target price of $500.00.

The 10th Workday closed down 15.33%, the biggest one-day decline since February 2016, with a transaction of US$3.512 billion. The company's revenue for the first quarter was $1.99 billion, and analysts expected $1.97 billion. The company lowered its subscription revenue guidance for fiscal year 2025 from $7.725 billion to $7.725 billion.

In 11th place, Alibaba closed 0.57% higher, with transactions of US$3.325 billion. On the evening of May 23, Alibaba issued an announcement on the Hong Kong Stock Exchange stating that it plans to issue convertible senior notes with a total principal amount of 4.5 billion US dollars and due in 2031. According to reports, the current convertible senior note has an annual interest rate of 0.25% to 0.75%. The term is seven years, and the first five years are non-redeemable. The terms show that these notes will have a conversion premium of 30% to 35%. Citigroup, J.P. Morgan Chase, Morgan Stanley, Barclays, and HSBC are assisting in arranging the deal.

In 12th place, Pinduoduo closed 2.56% higher, with a transaction of US$3,064 billion. Goldman Sachs raised Pinduoduo's ADR rating from neutral to buy.

In 15th place, Dell closed 4.30% higher and traded $2,817 million. Evercore analyst Amit Daryanani maintained the stock's “buy” rating and raised the target price from $140 to $165.

The 16th Caijie closed down 8.35% and sold US$2,552 million. According to the results announced by Caijie, the adjusted EPS for the third fiscal quarter was 9.88 US dollars, higher than analysts' expectations of 9.38 US dollars; net revenue was 6.74 billion US dollars, up 12% year on year, higher than analysts' expectations of 6.64 billion US dollars. The adjusted EPS for the full year is estimated to be $16.79, higher than analysts' expectations of $16.42 billion; revenue for the full year is estimated at US$16.16 billion to US$16.20 billion, and the company originally anticipated US$15.89 billion to US$16.11 billion. Revenue for the fourth fiscal quarter is expected to increase by about 13%-14%.

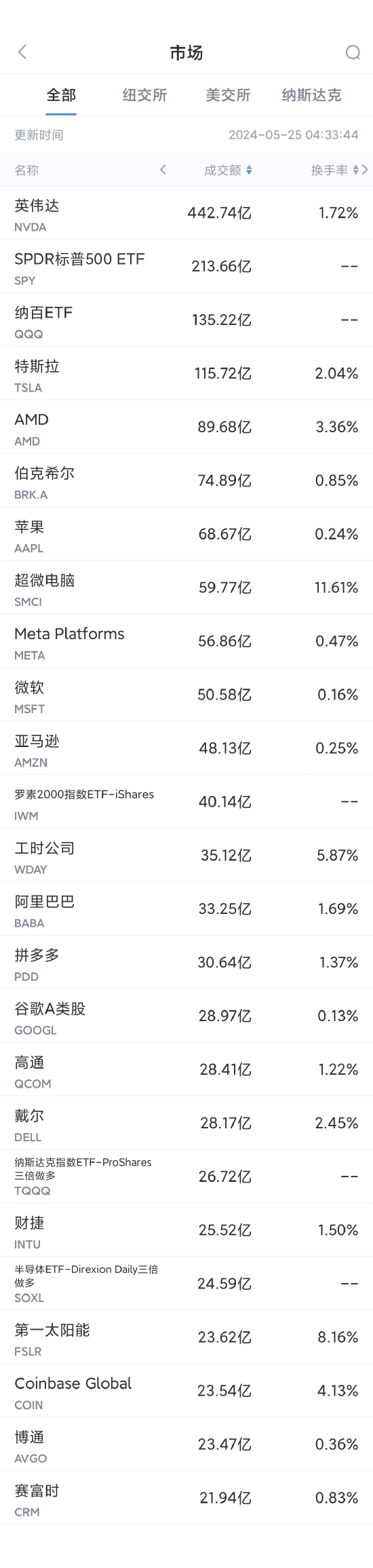

(Screenshot from the Sina Finance App Market - US Stocks - Market section, swipe left for more data) Download the Sina Finance App