Financial giants have made a conspicuous bearish move on Freeport-McMoRan. Our analysis of options history for Freeport-McMoRan (NYSE:FCX) revealed 31 unusual trades.

Delving into the details, we found 35% of traders were bullish, while 54% showed bearish tendencies. Out of all the trades we spotted, 14 were puts, with a value of $897,961, and 17 were calls, valued at $820,715.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $35.0 to $65.0 for Freeport-McMoRan over the last 3 months.

Volume & Open Interest Development

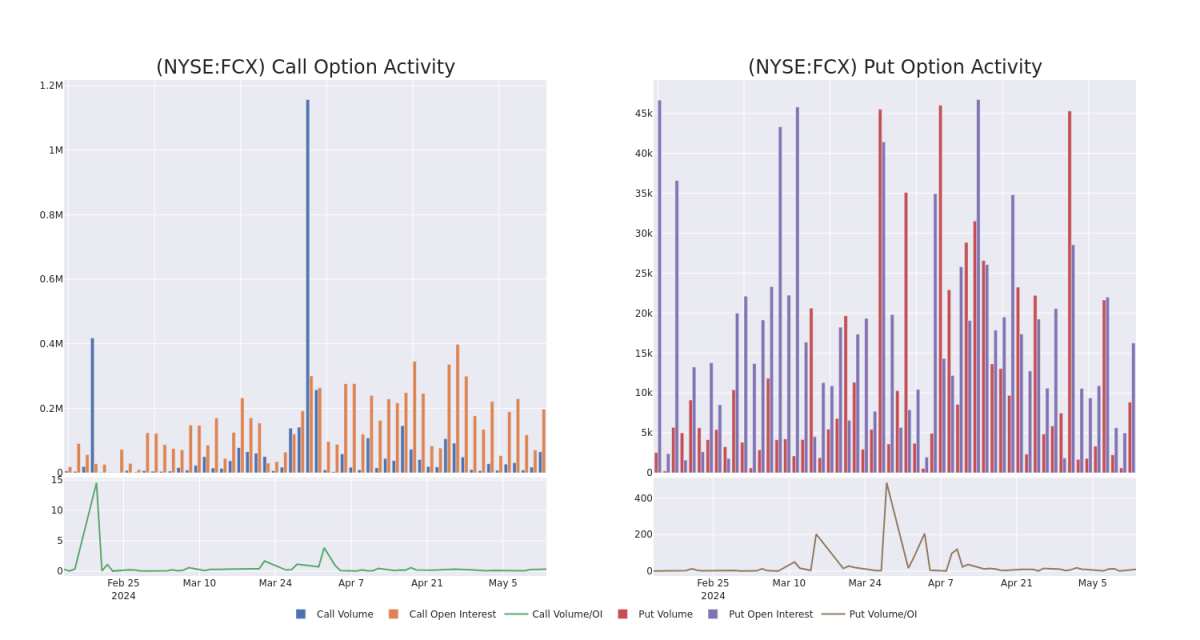

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Freeport-McMoRan's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Freeport-McMoRan's whale activity within a strike price range from $35.0 to $65.0 in the last 30 days.

Freeport-McMoRan Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FCX | CALL | TRADE | NEUTRAL | 06/21/24 | $1.16 | $1.14 | $1.15 | $55.00 | $172.1K | 104.0K | 2.5K |

| FCX | PUT | SWEEP | NEUTRAL | 06/20/25 | $5.9 | $5.8 | $5.85 | $50.00 | $137.5K | 539 | 295 |

| FCX | PUT | SWEEP | BEARISH | 06/20/25 | $5.85 | $5.8 | $5.83 | $50.00 | $99.9K | 539 | 494 |

| FCX | PUT | SWEEP | BEARISH | 01/16/26 | $7.45 | $7.4 | $7.44 | $50.00 | $90.8K | 406 | 479 |

| FCX | PUT | SWEEP | BEARISH | 06/21/24 | $1.1 | $1.08 | $1.1 | $50.00 | $82.5K | 8.4K | 850 |

About Freeport-McMoRan

Freeport-McMoRan Inc is an international mining company. It has organized its mining operations into four primary divisions: North America copper mines, South America mining, Indonesia mining and Molybdenum mines. Its reportable segments include the Morenci, Cerro Verde and Grasberg (Indonesia mining) copper mines, the Rod & Refining operations and Atlantic Copper Smelting and Refining. It derives key revenue from the sale of Copper.

Having examined the options trading patterns of Freeport-McMoRan, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Freeport-McMoRan Standing Right Now?

- With a trading volume of 5,880,448, the price of FCX is up by 0.64%, reaching $51.92.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 66 days from now.

Expert Opinions on Freeport-McMoRan

5 market experts have recently issued ratings for this stock, with a consensus target price of $52.8.

- Consistent in their evaluation, an analyst from Raymond James keeps a Outperform rating on Freeport-McMoRan with a target price of $54.

- An analyst from JP Morgan persists with their Neutral rating on Freeport-McMoRan, maintaining a target price of $51.

- An analyst from Scotiabank persists with their Sector Outperform rating on Freeport-McMoRan, maintaining a target price of $53.

- An analyst from Argus Research persists with their Buy rating on Freeport-McMoRan, maintaining a target price of $54.

- An analyst from JP Morgan has decided to maintain their Neutral rating on Freeport-McMoRan, which currently sits at a price target of $52.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Freeport-McMoRan with Benzinga Pro for real-time alerts.