American Airlines Gr Unusual Options Activity

American Airlines Gr Unusual Options Activity

Financial giants have made a conspicuous bearish move on American Airlines Gr. Our analysis of options history for American Airlines Gr (NASDAQ:AAL) revealed 9 unusual trades.

金融巨頭對美國航空集團採取了明顯的看跌舉動。我們對美國航空集團(納斯達克股票代碼:AAL)期權歷史的分析顯示了9筆不尋常的交易。

Delving into the details, we found 33% of traders were bullish, while 55% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $1,393,176, and 3 were calls, valued at $147,410.

深入研究細節,我們發現33%的交易者看漲,而55%的交易者表現出看跌傾向。在我們發現的所有交易中,有6筆是看跌期權,價值爲1,393,176美元,3筆是看漲期權,價值147,410美元。

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $12.0 to $25.0 for American Airlines Gr over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將美國航空集團的價格定在12.0美元至25.0美元之間。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

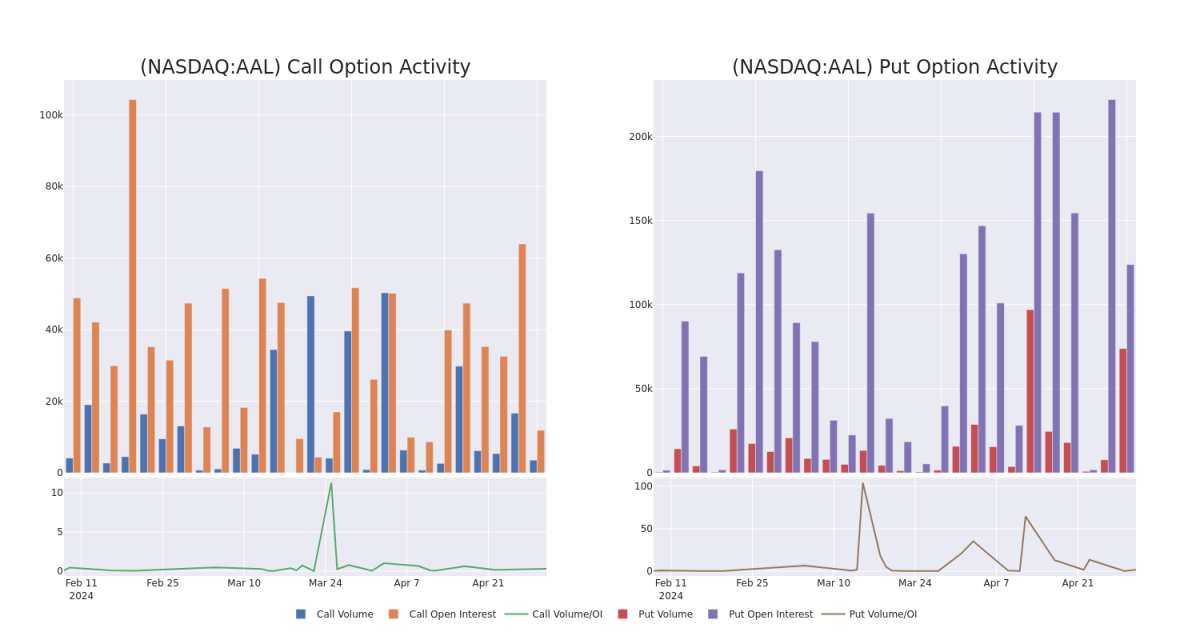

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for American Airlines Gr's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across American Airlines Gr's significant trades, within a strike price range of $12.0 to $25.0, over the past month.

檢查交易量和未平倉合約爲股票研究提供了至關重要的見解。這些信息是衡量美國航空集團公司在特定行使價下期權的流動性和利息水平的關鍵。下面,我們簡要介紹了過去一個月美國航空集團重大交易的看漲期權和未平倉合約的趨勢,行使價區間爲12.0美元至25.0美元。

American Airlines Gr Option Volume And Open Interest Over Last 30 Days

過去30天美國航空的Gr期權交易量和未平倉合約

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AAL | PUT | TRADE | BEARISH | 09/20/24 | $0.71 | $0.66 | $0.7 | $13.00 | $703.0K | 11.0K | 10.5K |

| AAL | PUT | TRADE | NEUTRAL | 01/17/25 | $10.55 | $10.45 | $10.5 | $25.00 | $315.0K | 0 | 0 |

| AAL | PUT | SWEEP | BULLISH | 09/20/24 | $0.71 | $0.7 | $0.71 | $13.00 | $130.3K | 11.0K | 14.8K |

| AAL | PUT | SWEEP | BEARISH | 09/20/24 | $0.71 | $0.7 | $0.7 | $13.00 | $110.9K | 11.0K | 12.9K |

| AAL | PUT | SWEEP | BEARISH | 11/15/24 | $1.33 | $1.32 | $1.32 | $14.00 | $75.6K | 3.3K | 6.6K |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AAL | 放 | 貿易 | 粗魯的 | 09/20/24 | 0.71 美元 | 0.66 美元 | 0.7 美元 | 13.00 美元 | 703.0 萬美元 | 11.0K | 10.5K |

| AAL | 放 | 貿易 | 中立 | 01/17/25 | 10.55 美元 | 10.45 美元 | 10.5 美元 | 25.00 美元 | 315.0 萬美元 | 0 | 0 |

| AAL | 放 | 掃 | 看漲 | 09/20/24 | 0.71 美元 | 0.7 美元 | 0.71 美元 | 13.00 美元 | 130.3 萬美元 | 11.0K | 14.8K |

| AAL | 放 | 掃 | 粗魯的 | 09/20/24 | 0.71 美元 | 0.7 美元 | 0.7 美元 | 13.00 美元 | 110.9 萬美元 | 11.0K | 12.9K |

| AAL | 放 | 掃 | 粗魯的 | 11/15/24 | 1.33 美元 | 1.32 | 1.32 | 14.00 美元 | 75.6 萬美元 | 3.3K | 6.6K |

About American Airlines Gr

關於美國航空 Gr

American Airlines is the world's largest airline by aircraft, capacity, and scheduled revenue passenger miles. Its major US hubs are Charlotte, Chicago, Dallas/Fort Worth, Los Angeles, Miami, New York, Philadelphia, Phoenix, and Washington, D.C. It generates over 30% of US airline revenue connecting Latin America with destinations in the United States. After completing a major fleet renewal, the company has the youngest fleet of US legacy carriers.

按飛機、運力和定期收入乘客里程計算,美國航空是世界上最大的航空公司。其主要的美國樞紐是夏洛特、芝加哥、達拉斯/沃斯堡、洛杉磯、邁阿密、紐約、費城、鳳凰城和華盛頓特區。它創造了連接拉丁美洲和美國目的地的美國航空公司收入的30%以上。在完成重大機隊更新後,該公司擁有美國傳統航空公司中最年輕的機隊。

Present Market Standing of American Airlines Gr

美國航空集團目前的市場地位

- Currently trading with a volume of 13,903,820, the AAL's price is down by -2.93%, now at $14.22.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 72 days.

- AAL目前的交易量爲13,903,820美元,價格下跌了-2.93%,目前爲14.22美元。

- RSI讀數表明,該股目前可能接近超買。

- 預計業績將在72天后發佈。

Expert Opinions on American Airlines Gr

關於美國航空集團的專家意見

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $22.0.

在過去的30天中,共有1位專業分析師對該股發表了看法,將平均目標股價設定爲22.0美元。

- An analyst from Bernstein persists with their Outperform rating on American Airlines Gr, maintaining a target price of $22.

- 伯恩斯坦的一位分析師堅持對美國航空集團的跑贏大盤評級,維持22美元的目標價。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。