Investors with a lot of money to spend have taken a bearish stance on Trade Desk (NASDAQ:TTD).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with TTD, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 15 uncommon options trades for Trade Desk.

This isn't normal.

The overall sentiment of these big-money traders is split between 40% bullish and 53%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $126,380, and 12 are calls, for a total amount of $755,000.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $75.0 to $105.0 for Trade Desk over the last 3 months.

Volume & Open Interest Trends

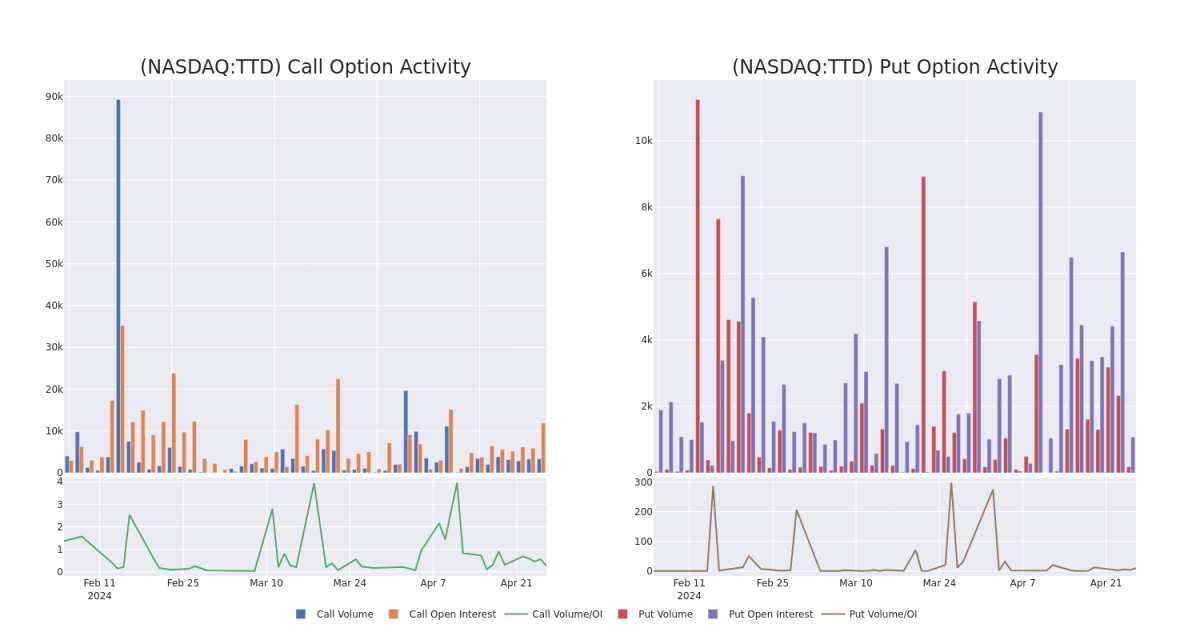

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Trade Desk's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Trade Desk's whale trades within a strike price range from $75.0 to $105.0 in the last 30 days.

Trade Desk Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TTD | CALL | TRADE | BEARISH | 06/20/25 | $21.6 | $21.45 | $21.45 | $82.50 | $117.9K | 2 | 0 |

| TTD | CALL | SWEEP | BEARISH | 04/26/24 | $3.55 | $3.0 | $3.05 | $82.00 | $92.7K | 1.6K | 22 |

| TTD | CALL | SWEEP | BULLISH | 04/26/24 | $3.95 | $3.25 | $3.3 | $82.00 | $88.1K | 1.6K | 327 |

| TTD | CALL | TRADE | NEUTRAL | 05/10/24 | $3.9 | $3.8 | $3.85 | $90.00 | $77.0K | 1.0K | 696 |

| TTD | CALL | TRADE | BULLISH | 05/10/24 | $3.8 | $3.75 | $3.8 | $90.00 | $75.6K | 1.0K | 495 |

About Trade Desk

The Trade Desk provides a self-service platform that helps advertisers and ad agencies programmatically find and purchase digital ad inventory (display, video, audio, and social) on different devices like computers, smartphones, and connected TVs. It utilizes data to optimize the performance of ad impressions purchased. The firm's platform is referred to as a demand-side platform in the digital ad industry. The firm generates its revenue from fees based on a percentage of what its clients spend on advertising.

Following our analysis of the options activities associated with Trade Desk, we pivot to a closer look at the company's own performance.

Trade Desk's Current Market Status

- Currently trading with a volume of 1,909,795, the TTD's price is up by 2.12%, now at $85.11.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 12 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Trade Desk options trades with real-time alerts from Benzinga Pro.