Northbound's net purchase of A-shares was $22.4 billion, and Southbound's net purchase of Hong Kong shares was HK$1,174 billion.

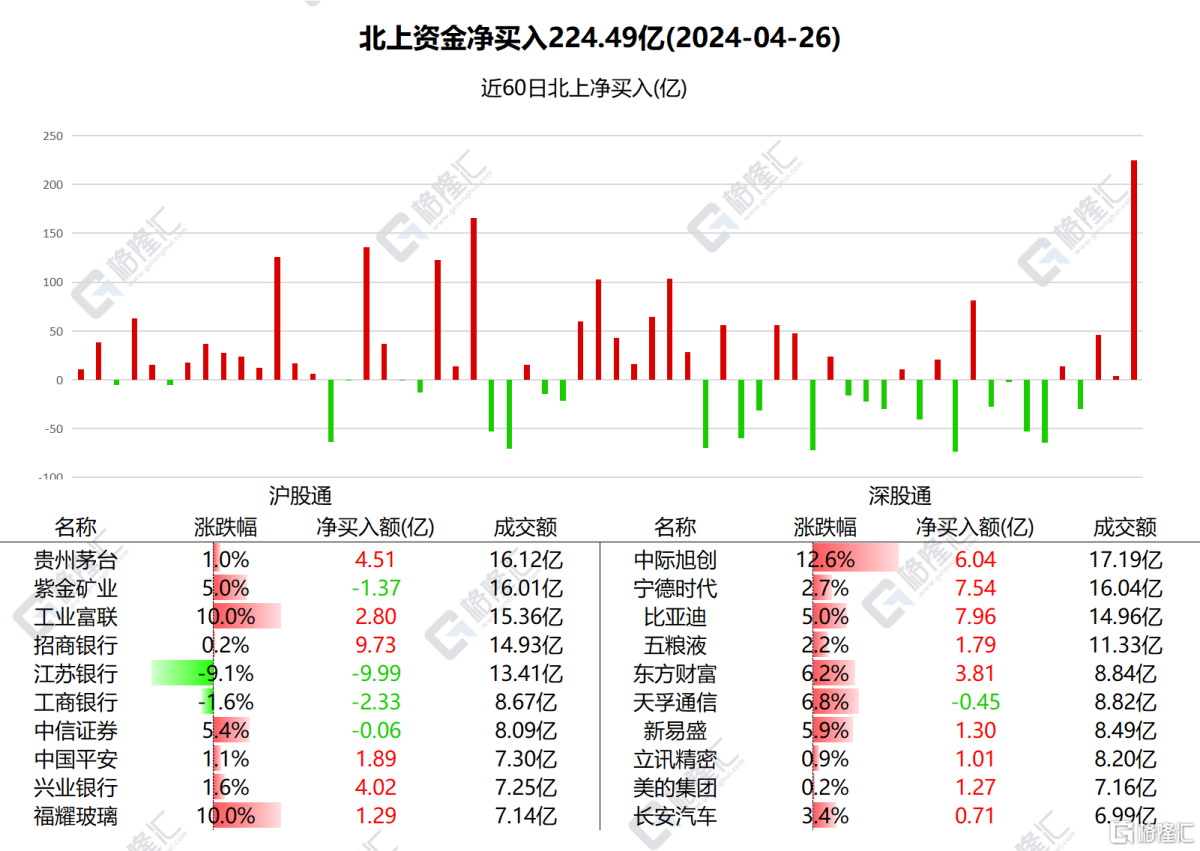

On April 26, Beishang Capital made a net purchase of 22.4 billion yuan of A-shares. The net purchase amount in a single day reached a new high since the opening of Land Port Connect.

According to statistics, up to today, there have been five times in history where the net purchase amount in a single day has exceeded 20 billion dollars, including 1 in 2019, 3 in 2021, and 1 in 2024.

Among them, China Merchants Bank, BYD, and Ningde Times received net purchases of 973 million yuan, 796 million yuan, and 754 million yuan respectively.

Bank of Jiangsu had the highest net sales volume, amounting to 999 million yuan, net sales of ICBC 233 million and Zijin Mining of 137 million yuan.

Southbound's net purchase of Hong Kong stocks was HK$1,174 billion.

Net purchases of the Bank of China at $888 million, Kuaishou 500 million, and the Hong Kong Stock Exchange at $116 million;

Net sales were Meituan at $760 million, HSBC Holdings at $344 million, Yingfu Fund at $243 million, and CNOOC at $167 million.

According to statistics, Southbound Capital has increased its holdings with the Bank of China for 7 consecutive days, totaling HK$5,235.13 billion; and on the Hong Kong Stock Exchange for 4 consecutive days, totaling HK$1,6514.6 billion.

Southbound Capital has reduced HSBC Holdings positions for 5 consecutive days, totaling HK$2,2613.8 billion; for 4 consecutive days, Meituan's positions have been reduced to a total of HK$3,578.68 billion.

Nanshui focuses on individual stocks

China Merchants BankIt once rose 1.37%, then fell back to 0.23%.

BYDUp 4.99%. Today, RMB 199 million was spent to repurchase 9171,000 A-shares, with a repurchase price of RMB 210.7-219.58 per share. The BYD Qin L debuted in the world at the Beijing Auto Show. The future price may be over 120,000 yuan, and it is expected to go on sale in the second quarter.

Ningde eraWith an increase of 2.73%, Ningde Times released a new lithium iron phosphate battery product, Shenxing PLUS, at the Beijing Auto Show. This battery has a battery life of 1,000 kilometers and ultra-fast energy charging characteristics of “1 kilometer per second”, once again setting a new performance record for lithium iron phosphate batteries.

Bank of JiangsuIt fell 9.12%. According to the Dragon Tiger List, the net purchase of exclusive seats for the 3 institutions was 541 million yuan.

Beishui focuses on individual stocks

Bank of ChinaThere was a slight decline of 0.86%. Haitong Securities pointed out that with the introduction of subsequent policies to stabilize the economy, the subsequent banks' revenue growth rate is expected to gradually stabilize, profit growth is expected to remain high, the non-performing rate remains low, provision coverage remains high, and the industry's “superior to the market” rating is maintained.

Quick handUp 7.01%, up 27.4% this week;MeituanUp 3.68% to 21.3% this week;TencentUp 2.65%, up 14.68% this week.