Northbound Capital made a net purchase of 4.606 billion yuan of A-shares, while Southbound made a net purchase of HK$1,995 billion in Hong Kong shares.

Recently, both Northbound Capital and Southbound Capital have shown a trend of increasing positions with high dividends.

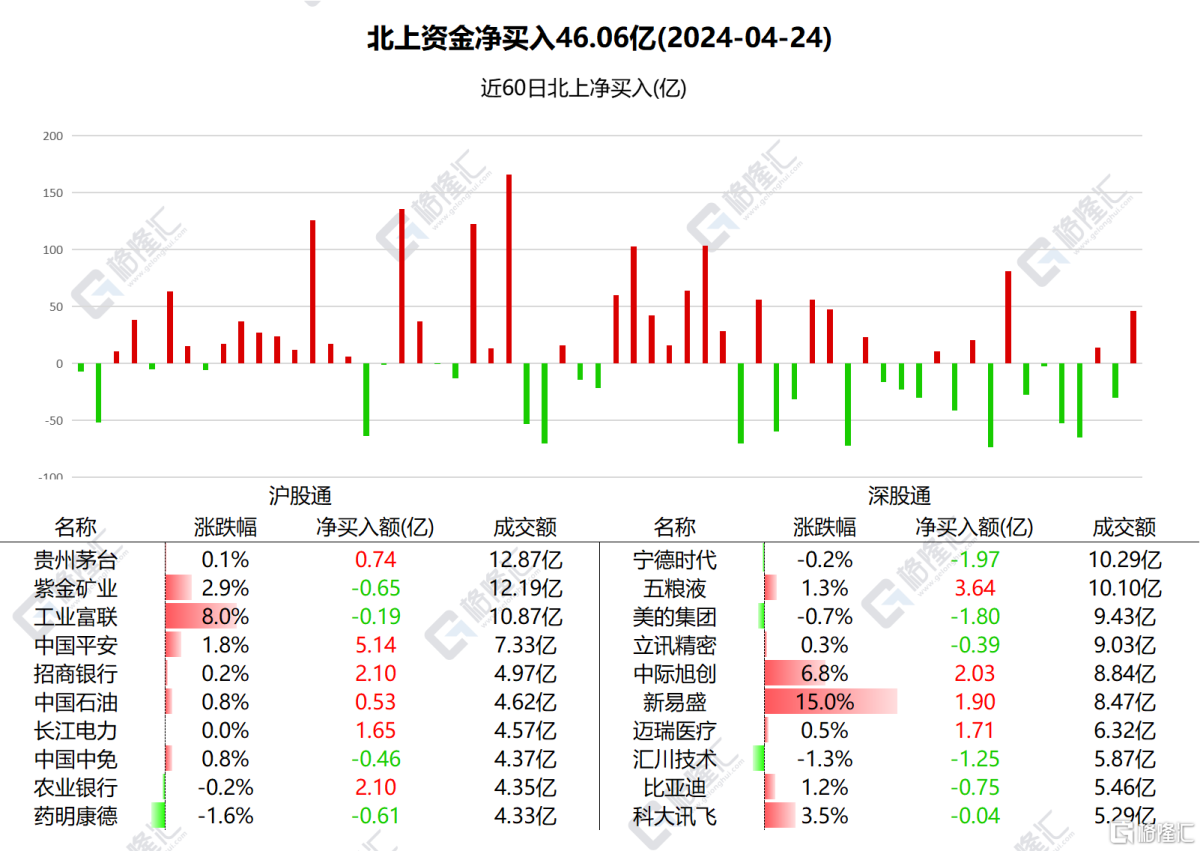

April 24,The net purchase of A-shares by Beijing Capital was 4.606 billion yuan.

Among them, Ping An of China, Wuliangye, China Merchants Bank, and Agricultural Bank received net purchases of 514 million yuan, 364 million yuan, 210 million yuan, and 210 million yuan respectively, while Zhongji Xuchuang and Xinyisheng received net purchases of 203 million yuan and 190 million yuan.

Ningde Era had the highest net sales volume, amounting to 197 million yuan, while Midea Group and Huichuan Technology had net sales of 180 million yuan and 125 million yuan.

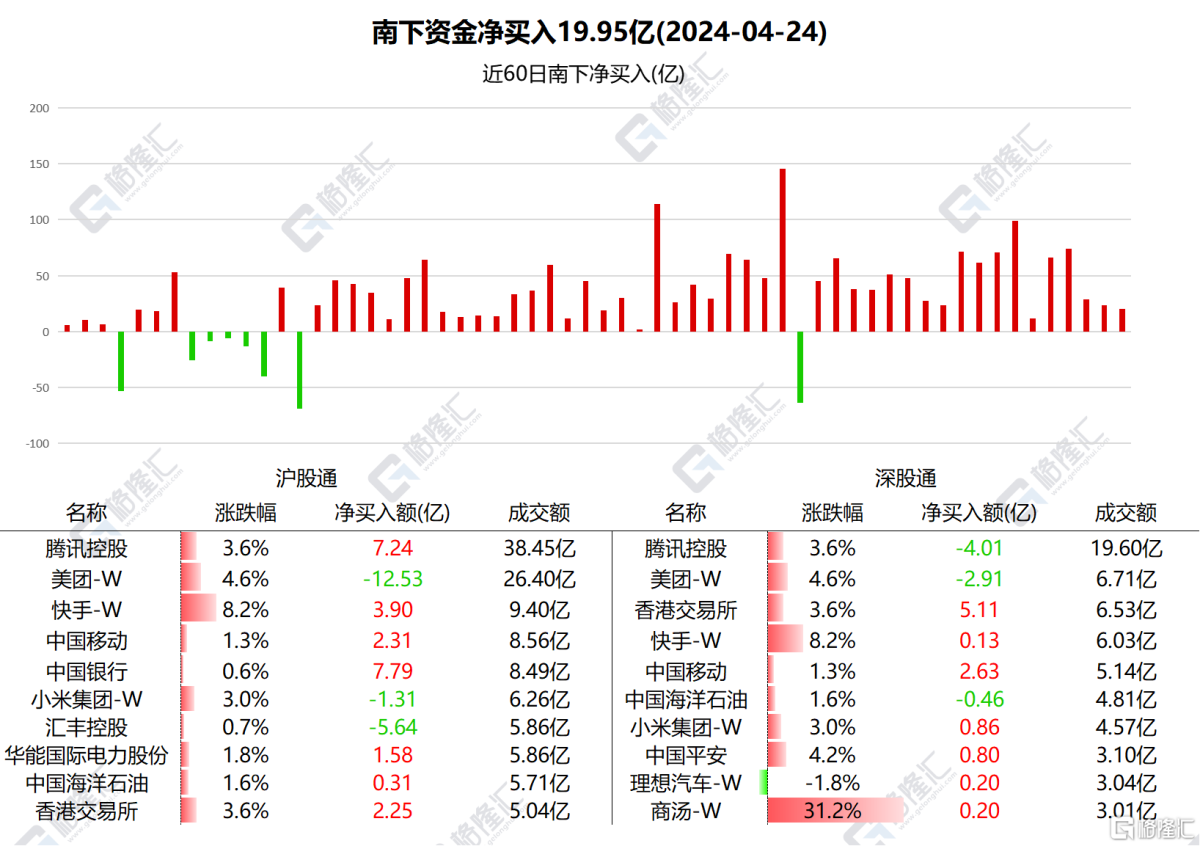

Southbound's net purchase of Hong Kong stocks was HK$1,995 million.

Among them, net purchases of Bank of China amounted to 778 million yuan, Hong Kong Stock Exchange of 735 million, China Mobile 493 million, Kuaishou 402 million, Tencent 322 million, and Huaneng International Electric Power of 158 million yuan;

Net sales were $1,544 million for Meituan and $563 million for HSBC Holdings.

According to statistics, Southbound Capital has increased its holdings on China Mobile for 15 consecutive days, totaling HK$5.408.2.6 billion; increased Tencent's holdings for 8 consecutive days, totaling HK$5.134.52 billion; and increased Bank of China's holdings for 5 consecutive days, totaling HK$3,8329.7 billion.

Southbound Capital has reduced its holdings of HSBC Holdings for 3 consecutive days, totaling HK$1,495.3 million; for 2 consecutive days, it has reduced its positions with Meituan, totaling HK$2,0227.8 billion.

Nanshui focuses on individual stocks

Peace in ChinaUp 1.78%, the company's net profit for the first quarter was 38.709 billion yuan. Among them, the three core businesses of life insurance and health insurance, property insurance, and banking resumed growth. The total operating profit of the three businesses attributed to shareholders of the parent company was 39.816 billion yuan, an increase of 0.3% over the previous year.

WuliangyeIt rose 1.33%. It received net purchases from Beijing Capital for 3 consecutive days, and received a cumulative transaction of 2.171 billion yuan from Shenzhen Stock Connect, with a total net purchase of 355 million yuan.

Ningde eraWith a slight decrease of 0.17%, the company will hold the 2024 Ningde Era passenger car new product launch conference on April 25.

Beishui focuses on individual stocks

Bank of ChinaIt fell slightly by 0.58%. Liu Liange, the former chairman of the Bank of China, opened the first trial in the bribery and illegal loan disbursement case. He was charged with illegally soliciting and accepting more than 121 million yuan in property.

Hong Kong Stock ExchangeUp 3.55%. Profit attributable to shareholders of the company in the first quarter was 2,970 billion yuan, down 13% year on year and up 14% month on month.

TencentIt has been profitable for 5 consecutive trading days. Bank of America Securities released a report predicting that Tencent's annual repurchase amount may exceed HK$130 billion, far exceeding market expectations. Coupled with the dividend announced last year, Tencent's shareholder return is expected to exceed 5% this year.