The net sale of A-shares was $2,997 billion, and the net purchase of Hong Kong shares was HK$2.34 billion by Northbound Capital.

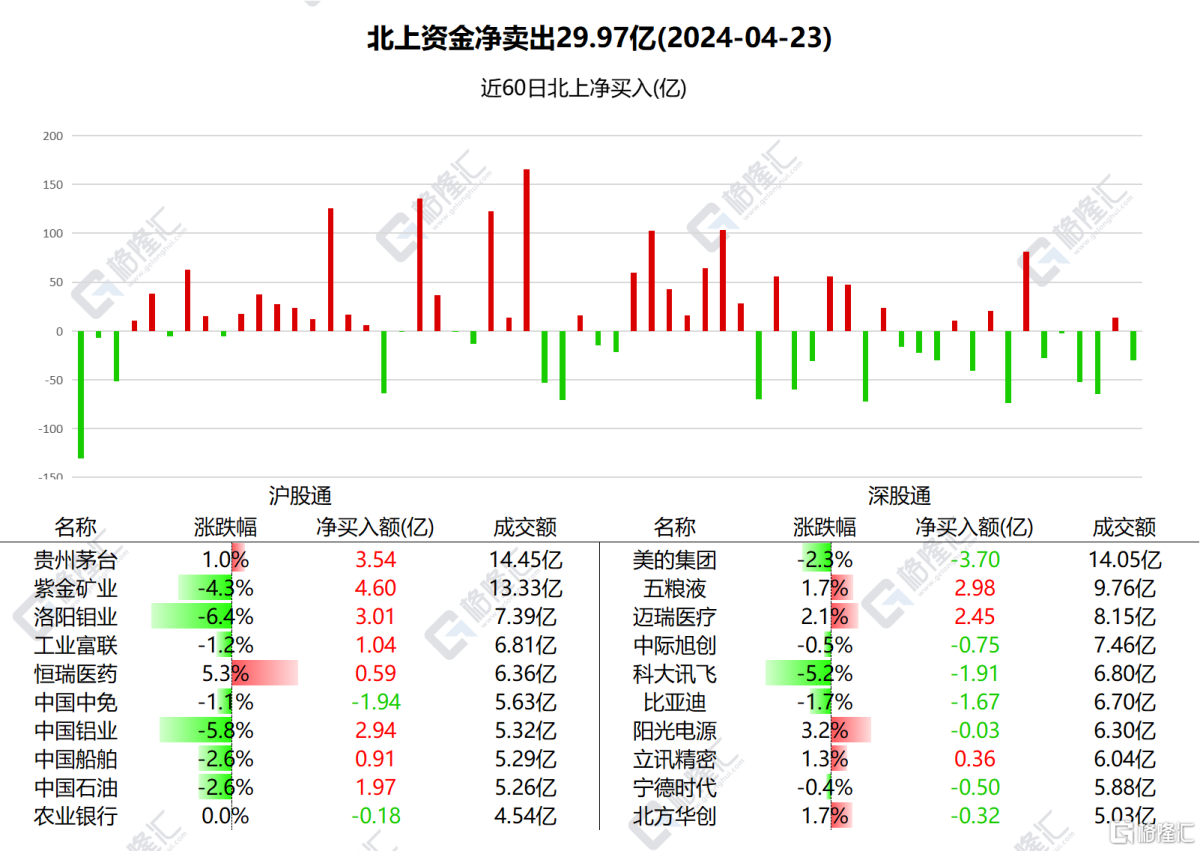

On April 23, Beishang Capital sold a net sale of 2,997 billion yuan of A-shares.

Among them, Midea Group, and iFLYTEK received net sales of 370 million yuan, 94 million yuan, and 191 million yuan respectively;

Zijin Mining, Kweichow Moutai, and Luoyang Molybdenum received net purchases of 460 million yuan, 354 million yuan, and 301 million yuan respectively, while Wuliangye and China Aluminum received net purchases of 298 million yuan and 294 million yuan respectively.

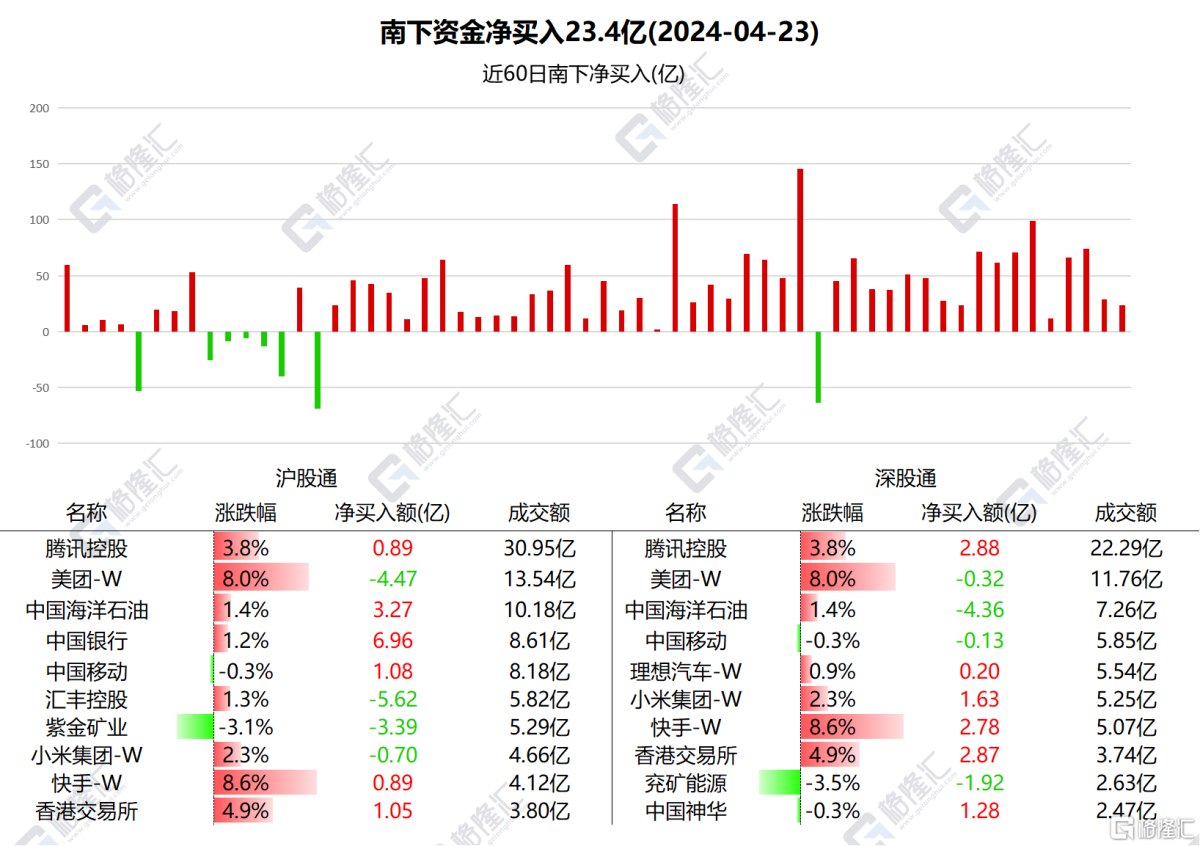

Southbound's net purchase of Hong Kong stocks was HK$2.34 billion.

Among them, net purchases of Bank of China amounted to $696 million, Hong Kong Stock Exchange of 392 million, Tencent 377 million, Kuaishou 366 million, and China Shenhua of $128 million;

Net sales of HSBC Holdings at $562 million, Meituan at $478 million, Zijin Mining at $338 million, Yankuang Energy at $191 million, and CNOOC at $108 million.

According to statistics, Southbound Capital has increased China Mobile's holdings for 14 consecutive days, totaling HK$4,9146.3 billion; added Xiaomi's inventory for 8 consecutive days, totaling HK$1,5724.5 billion; increased Tencent's holdings for 7 consecutive days, totaling HK$4,8120.9 billion; and increased Bank of China's holdings for 4 consecutive days, totaling HK$3,541.2 billion.

Nanshui focuses on individual stocks

Midea Group fell 2.27%, Zijin Mining fell 4.27%, and Kweichow Moutai rose 1.03%.

The first quarterly public fund report has been disclosed. As of the end of the first quarter of 2024, Kweichow Moutai and Ningde Times were the first and second largest stocks, while Zijin Mining, Midea Group, and China Merchants Bank entered the top ten most heavily held stocks. Five stocks, Wuliangye, Luzhou Laojiao, Hengrui Pharmaceutical, Mindray Healthcare, and Shanxi Fenjiu, are still among the top ten heavy-held stocks.

Beishui focuses on individual stocks

China MobileWith a slight decrease of 0.9%, Morgan Stanley maintained its “gain” rating on China Mobile, with a target price of HK$80.

TencentAfter rising for two consecutive days, the stock price returned above HK$330, a new high since November 21 last year.

Bank of ChinaWith an increase of 1.18%, CITIC Securities believes that due to factors such as heavy pricing, the bank's first quarter results are expected to be relatively low in the middle of the year. While we wait for the performance to warm up, we can pay attention to the market's allocation needs for dividend types.