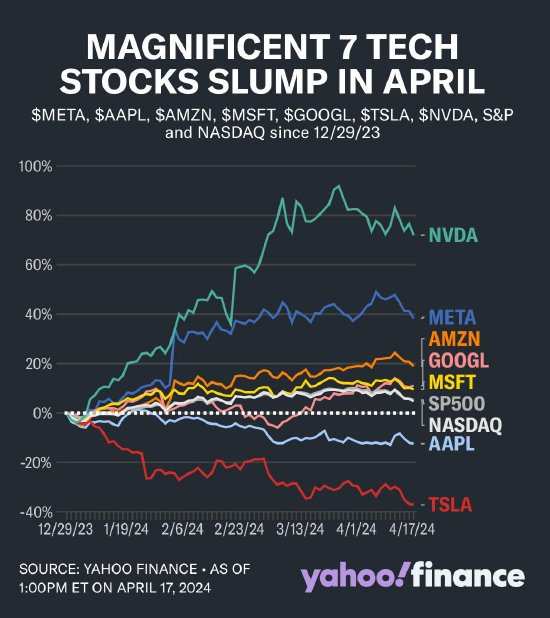

The gains of the 7 stocks that drove the stock market up in the past year may have come to an end.

Jonathan Golub (Jonathan Golub), chief US stock strategist at UBS Investment Bank (UBS Investment Bank), downgraded the six ratings of Apple (Apple), Google (Google, GOOG), Microsoft (MSFT), Amazon (Amazon), Meta, and Nvidia (Nvidia) “Big Seven” from increased holdings to neutral in a new research report on Monday.

His appeal comes as the Magnificent Seven, including Tesla (Tesla), has just experienced the biggest loss in weekly market capitalization in history. All seven big tech giants have retreated from recent highs. Nvidia dropped 10% in a single day on Friday, the worst single-day price performance since March 2020.

Golub rated industries within the S&P 500 index rather than individual stocks, and he still increased his holdings in technology stocks in addition to the 6 stocks mentioned in his report.

However, for large companies whose profits have increased dramatically over the past year, Golub believes the trend may be changing, and performance in other sectors will surpass the biggest stocks in the S&P 500 (S&P 500).

Golub wrote, “We downgraded the six ratings from increased holdings to neutral, not based on expanded valuations or doubts about artificial intelligence.”

Instead, it's an acknowledgement of the difficulties and cyclical forces these stocks face. These forces don't apply to other technology+ companies or other segments of the market in the same way.”

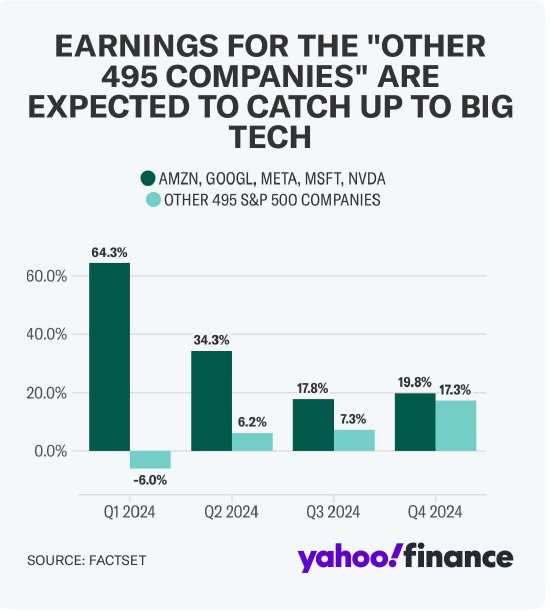

The profits of S&P 500 companies are largely driven by the profit growth of large technology companies. This is expected to be repeated in the first-quarter report, and FactSet expects combined earnings growth for Amazon, Google, Meta, Microsoft, and Nvidia to be around 64%. Meanwhile, 495 other companies in the S&P 500 are expected to report a 6% decline in profits.

However, this situation is expected to change over the course of this year.

FactSet's consistent forecast shows that the profit growth of these five companies in the fourth quarter of this year will be slightly less than 20% year over year, reflecting a significantly lower growth rate than before.

At that point, the consensus expects the profits of the other 495 companies to increase by about 17% over the previous year, which is a significant increase from the current growth rate.

“Investors attribute the rise in large-cap stocks to biological instincts and the influence of artificial intelligence,” Golub wrote. However, our work shows that a spike in earnings momentum (changes in long-term growth forecasts) is driving this upward trend. Unfortunately, this momentum is collapsing.”

Tesla, Meta, Microsoft, and Google are expected to report quarterly results later this week.

Golub added that this shift in revenue growth could be “disruptive in the short term.”

However, given growing signs that the US economy is growing faster than expected this year, Golub believes that the expansion of earnings performance in the coming year will keep him calling for the Standard & Poor's 500 (S&P 500) to reach 5,400 points by the end of the year. The benchmark index traded just under 5,000 points on Monday afternoon.

Golub wrote, “This goal is still supported by broadly positive fundamentals and a strong economy.

”