Whales with a lot of money to spend have taken a noticeably bullish stance on Arista Networks.

Looking at options history for Arista Networks (NYSE:ANET) we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 63% of the investors opened trades with bullish expectations and 27% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $257,725 and 3, calls, for a total amount of $124,801.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $165.0 to $300.0 for Arista Networks over the last 3 months.

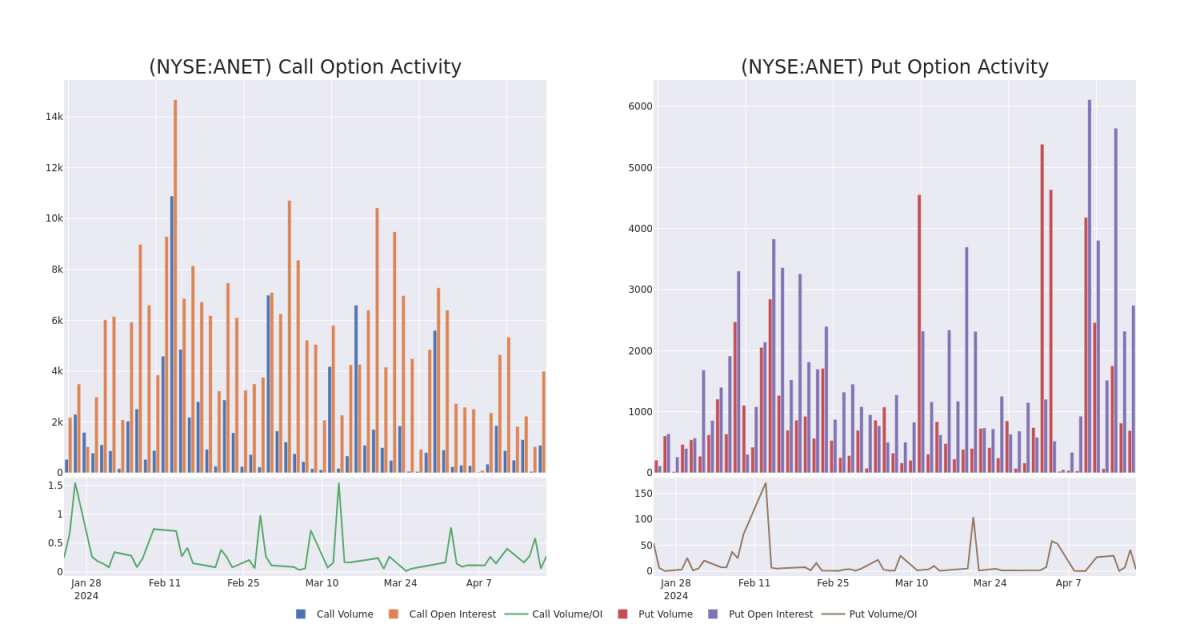

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Arista Networks's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Arista Networks's substantial trades, within a strike price spectrum from $165.0 to $300.0 over the preceding 30 days.

Arista Networks Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANET | PUT | TRADE | BULLISH | 05/10/24 | $56.4 | $53.0 | $52.94 | $300.00 | $52.9K | 13 | 0 |

| ANET | CALL | SWEEP | BEARISH | 05/10/24 | $5.3 | $5.1 | $5.1 | $270.00 | $51.6K | 140 | 101 |

| ANET | CALL | TRADE | BEARISH | 05/10/24 | $14.4 | $14.2 | $14.2 | $245.00 | $45.4K | 10 | 32 |

| ANET | PUT | SWEEP | BULLISH | 09/20/24 | $47.3 | $46.7 | $46.7 | $280.00 | $42.0K | 692 | 9 |

| ANET | PUT | SWEEP | BULLISH | 05/17/24 | $22.2 | $21.9 | $22.0 | $252.50 | $28.6K | 0 | 47 |

About Arista Networks

Arista Networks Inc is a networking equipment provider that primarily sells Ethernet switches and software to data centers. Its marquee product is its extensible operating system, or EOS, that runs a single image across every single one of its devices. The firm operates as one reportable segment. It has steadily gained market share since its founding in 2004, with a focus on high-speed applications. Arista counts Microsoft and Meta Platforms as its largest customers and derives roughly three quarters of its sales from North America.

Where Is Arista Networks Standing Right Now?

- Trading volume stands at 1,002,251, with ANET's price down by -2.12%, positioned at $240.87.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 15 days.

What The Experts Say On Arista Networks

In the last month, 3 experts released ratings on this stock with an average target price of $275.0.

- An analyst from Rosenblatt downgraded its action to Sell with a price target of $210.

- An analyst from JP Morgan persists with their Overweight rating on Arista Networks, maintaining a target price of $315.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Arista Networks, targeting a price of $300.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Arista Networks with Benzinga Pro for real-time alerts.