Financial giants have made a conspicuous bearish move on Johnson & Johnson. Our analysis of options history for Johnson & Johnson (NYSE:JNJ) revealed 9 unusual trades.

Delving into the details, we found 44% of traders were bullish, while 55% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $139,175, and 6 were calls, valued at $274,963.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $105.0 to $150.0 for Johnson & Johnson during the past quarter.

Volume & Open Interest Development

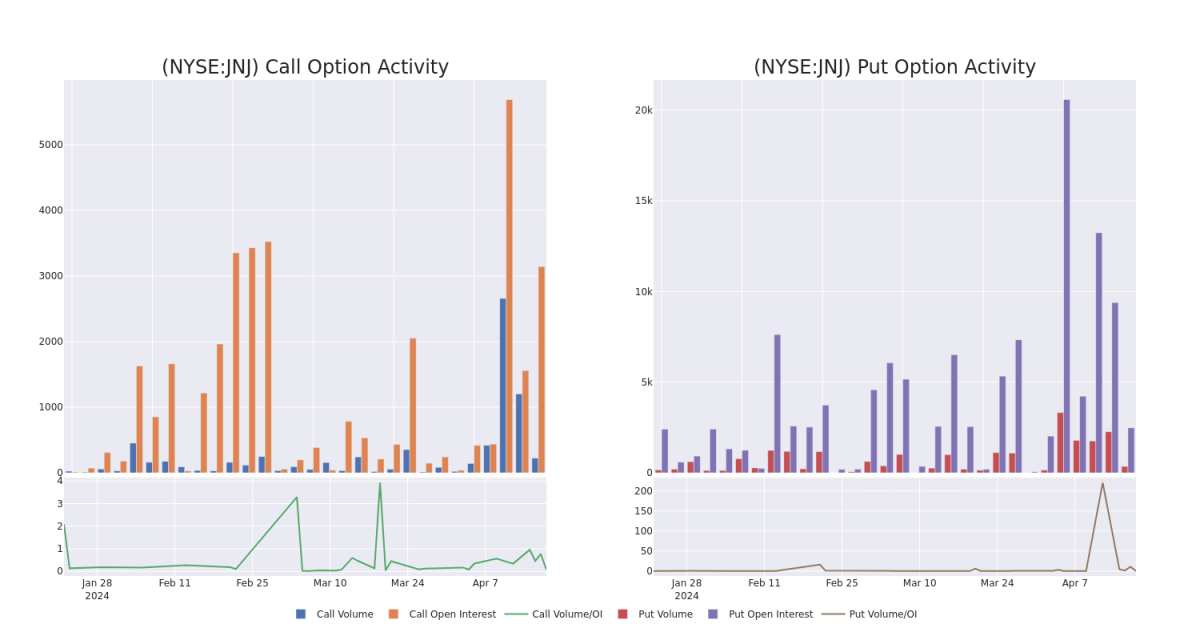

In today's trading context, the average open interest for options of Johnson & Johnson stands at 703.0, with a total volume reaching 579.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Johnson & Johnson, situated within the strike price corridor from $105.0 to $150.0, throughout the last 30 days.

Johnson & Johnson Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JNJ | CALL | SWEEP | BEARISH | 07/19/24 | $2.77 | $2.56 | $2.76 | $150.00 | $78.9K | 575 | 57 |

| JNJ | PUT | SWEEP | BULLISH | 05/17/24 | $1.13 | $1.05 | $1.13 | $140.00 | $77.9K | 1.7K | 327 |

| JNJ | CALL | SWEEP | BULLISH | 01/17/25 | $10.3 | $9.55 | $9.7 | $145.00 | $41.7K | 420 | 103 |

| JNJ | CALL | SWEEP | BEARISH | 01/17/25 | $41.15 | $39.6 | $40.54 | $105.00 | $40.2K | 71 | 10 |

| JNJ | CALL | TRADE | BULLISH | 06/21/24 | $3.95 | $3.9 | $3.95 | $145.00 | $39.5K | 1.2K | 48 |

About Johnson & Johnson

Johnson & Johnson is the world's largest and most diverse healthcare firm. Three divisions make up the firm: pharmaceutical, medical devices and diagnostics, and consumer. The drug and device groups represent close to 80% of sales and drive the majority of cash flows for the firm. The drug division focuses on the following therapeutic areas: immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. The device segment focuses on orthopedics, surgery tools, vision care, and a few smaller areas. The last segment of consumer focuses on baby care, beauty, oral care, over-the-counter drugs, and women's health. The consumer group is being divested in 2023 under the new name Kenvue. Geographically, just over half of total revenue is generated in the United States.

Present Market Standing of Johnson & Johnson

- Trading volume stands at 1,686,302, with JNJ's price up by 0.1%, positioned at $144.91.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 91 days.

What The Experts Say On Johnson & Johnson

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $188.4.

- Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Johnson & Johnson, targeting a price of $175.

- Consistent in their evaluation, an analyst from B of A Securities keeps a Neutral rating on Johnson & Johnson with a target price of $170.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $215.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on Johnson & Johnson with a target price of $167.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $215.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.