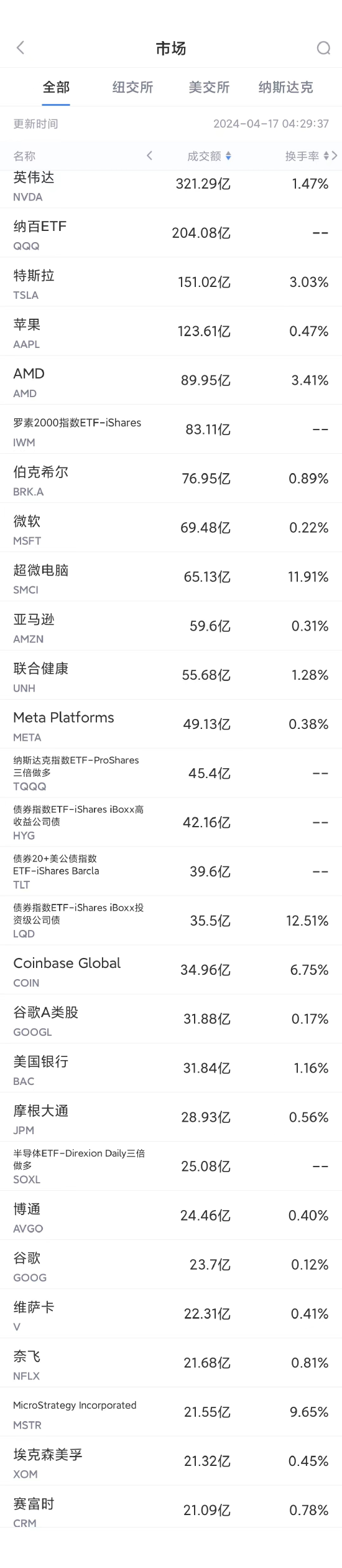

Nvidia, the number one in US stock turnover, closed 1.64% higher on Tuesday, with a transaction of US$32.129 billion. According to TrendForce (TrendForce), the previous generation of the Nvidia GB200 was the GH200, and the estimated shipment volume only accounts for about 5% of Nvidia's high-end GPUs.

Currently, the industry has high expectations for the Nvidia GB200. It is estimated that shipments in 2025 may exceed one million units, accounting for nearly 40 to 50 percent of Nvidia's high-end GPUs. It is expected that products such as GB200 and B100 will have an opportunity to be officially released from the fourth quarter of this year to the first quarter of 2025. Since the Nvidia B series, including GB200, B100, and B200, will consume more CowOS production capacity, TSMC will also increase CoWOS production capacity requirements for the full year 2024. It is estimated that the monthly production capacity will approach 40,000 by the end of the year, an increase of more than 150% compared to 2023.

The second-place Tesla closed down 2.71%, with a transaction of US$15.102 billion. Musk said on Tuesday that Tesla is streamlining the sales and delivery system.

According to another report, two of Tesla's top executives have left their jobs. On April 15, after posting an internal email announcing 10% global layoffs, Drew Baglino and Rohan Patel, two Tesla executives, also announced their departure. Baglino is one of Tesla's early employees. He has been working for 18 years. He is Tesla's senior vice president of powertrain and energy engineering, reporting directly to Musk. Patel joined Tesla in 2016 and was Tesla's vice president of public policy and business development.

In third place, Apple closed down 1.92% and sold $12.361 billion. Apple CEO Cook said on Tuesday that he hopes to improve the quality of investment in Vietnam. Furthermore, according to media reports, Apple is in in-depth negotiations with Tata Group (Tata Group) Titan (Titan) and Murugappa Group (Murugappa Group) to assemble and even manufacture sub-components for iPhone camera modules.

According to data released by Canalys, global smartphone shipments increased 11% year-on-year in the first quarter of 2024 as the global macroeconomic recovery and consumer demand picked up. Samsung returned to the top of the list with 20% market share. Apple is in second place, with a market share of 16%, facing challenges in its strategically focused markets.

In fourth place, AMD closed 1.96% higher, with a transaction of US$8.995 billion. AMD officially launched a new generation of AI PC innovation products for the commercial computing field, that is, new processor products for the commercial market. Speaking about the new products, Ronak Shah, AMD's global commercial product marketing manager, said, “They are arguably the best products in the industry for desktops, workstations, and laptops in the commercial field. These products, which are about to be officially released, can be said to have surpassed previous achievements and will take another big step forward in the fields of product performance and energy efficiency.”

In 6th place, Microsoft closed 0.23% higher with a transaction of US$6.948 billion. Microsoft invested 1.5 billion US dollars in UAE AI company G42 and won a seat on the board of directors. On the evening of April 15, local time, Microsoft published an official blog post announcing that Microsoft will invest 1.5 billion US dollars in G42, an AI company headquartered in the UAE, to obtain minority shares and a seat on the board of directors of G42. The two companies will jointly develop AI products and support the construction of a $1 billion fund for developers to improve AI skills in the UAE and the wider region.

The 7th ultra-microcomputer closed 10.60% higher, with a transaction of US$6.513 billion.

Amazon, which ranked 8th, closed down 0.16% and sold US$5.96 billion. Amazon Music launches Maestro, a new artificial intelligence playlist generator.

According to another report, Amazon announced that starting May 15 (local time), it will reduce sales commissions for low-customer unit-price clothing products at 11 sites around the world.

The 9th place UnitedHealth closed 5.22% higher, with a transaction of US$5.568 billion. The healthcare giant said in a statement Tuesday that Q1 adjusted earnings per share of $6.91 were above analysts' average expectations of $6.59 per share. Q1 revenue was US$99.8 billion, up 8.6% year over year, and also exceeded analysts' expectations of US$99.3 billion. UnitedHealth expects earnings per share to be between $17.60 and $18.20, mainly due to cyber attacks and the sale of the Brazilian business; however, it maintains its 2024 adjusted earnings per share guide of $27.50 to $28.00.

UnitedHealth reported first-quarter profits that surpassed Wall Street expectations and confirmed this year's development prospects, even though a cyber attack on one of the company's subsidiaries led to turmoil in the healthcare industry, causing related losses. Analysts have warned that as the February cyber attack impeded the flow of data and payments across the US healthcare industry, the results could be difficult to predict. The incident made investors, already frightened by rising health care costs, wonder if insurers would clearly understand their medical expenses.

The 10th Meta Platforms closed down 0.09% to $4.913 billion. Meta Platforms said on Tuesday that it will suspend Threads' visit in Turkey to comply with the country's competition watchdog's temporary order prohibiting the app from sharing data with Instagram. Meta said the suspension would be temporary as the company plans to appeal the Turkish Competition Authority's order.

The 13th Bank of America closed down 3.53% and traded $3.184 billion. Bank of America's first fiscal quarter profit and revenue both exceeded analysts' expectations, and interest income and investment banking business were better than expected. Revenue was $25.98 billion, down 1.8% year over year, and analysts expected $25.46 billion. Net profit was $6.7 billion, or 76 cents per share, down 18% year over year. Excluding the $700 million FDIC special assessment fee, adjusted earnings per share were 83 cents. Analysts expected 76 cents.

The 14th J.P. Morgan closed down 1.14% and traded $2,893 million. J.P. Morgan CEO Jamie Dimon announced plans to sell 1 million shares of the bank last year. After selling nearly $33 million of shares on Monday, the total sales volume reached this level.

According to Monday evening's announcement, Dimon sold 178,222 shares at a price of approximately $184 each. During his tenure, J.P. Morgan Chase's stock performance outperformed the market and peers, and reached a record high at the end of last month.

The 18th place, Netflix closed up 1.71%, with a transaction of US$2,168 billion. Netflix will announce its results for the first quarter of 2024 on April 18. The market expects Netflix's revenue for the first quarter to be around US$9.3 billion, which is expected to increase by about 14% year over year, slightly higher than the company's guiding target of US$9.24 billion. Earnings per share are expected to remain at $4.50, compared to $2.88 for the same period last year.