Track the latest developments in north-south funding

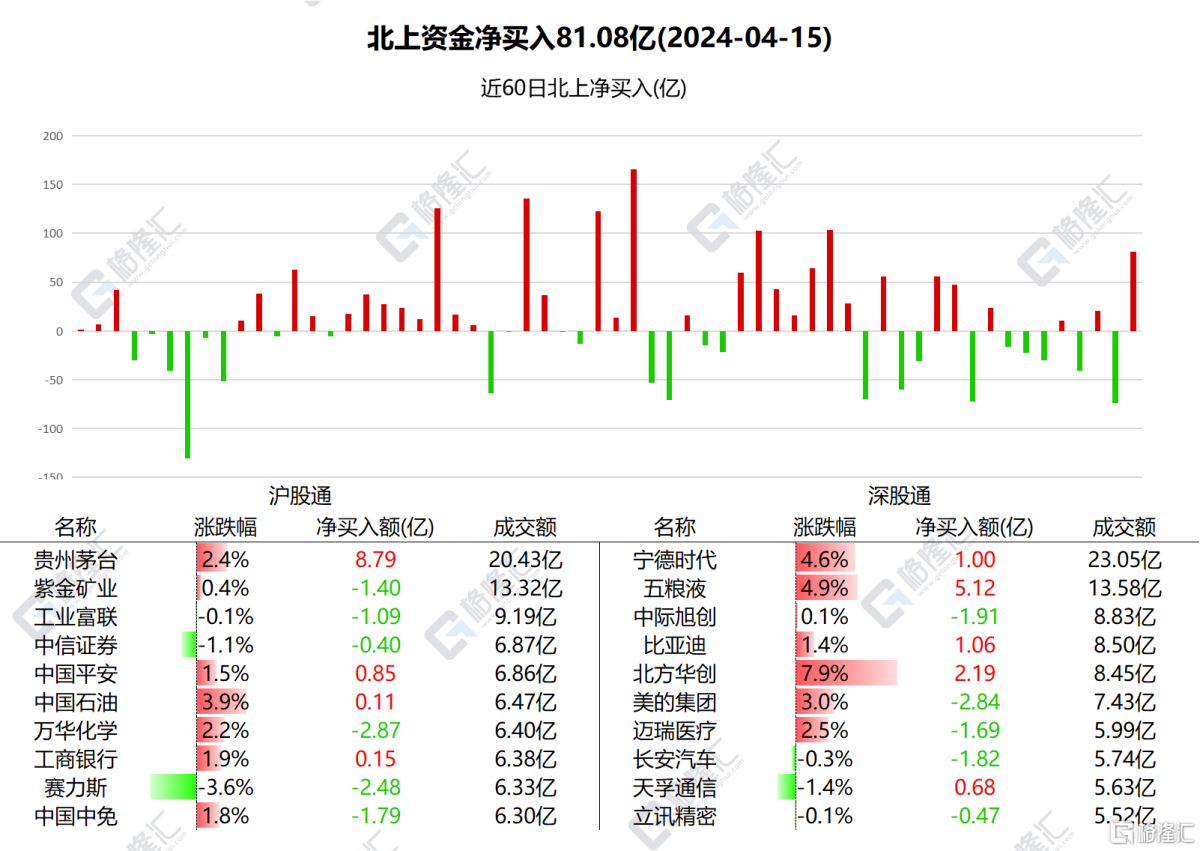

4/15,Northbound fundingNet purchases of $8.108 billion throughout the day. Among them, Shanghai Stock Connect had net purchases of 3.892 billion yuan and Shenzhen Stock Connect had net purchases of 4.216 billion yuan.

Among the top ten trading stocks, Kweichow Moutai, Wuliangye, and North China Huachuang ranked in the top three with net purchases of 889 million yuan, 512 million yuan, and 219 million yuan respectively.

Wanhua Chemical, Celis, and Zhongji Xuchuang had the top three net sales, which were 287 million yuan, 248 million yuan, and 191 million yuan respectively.

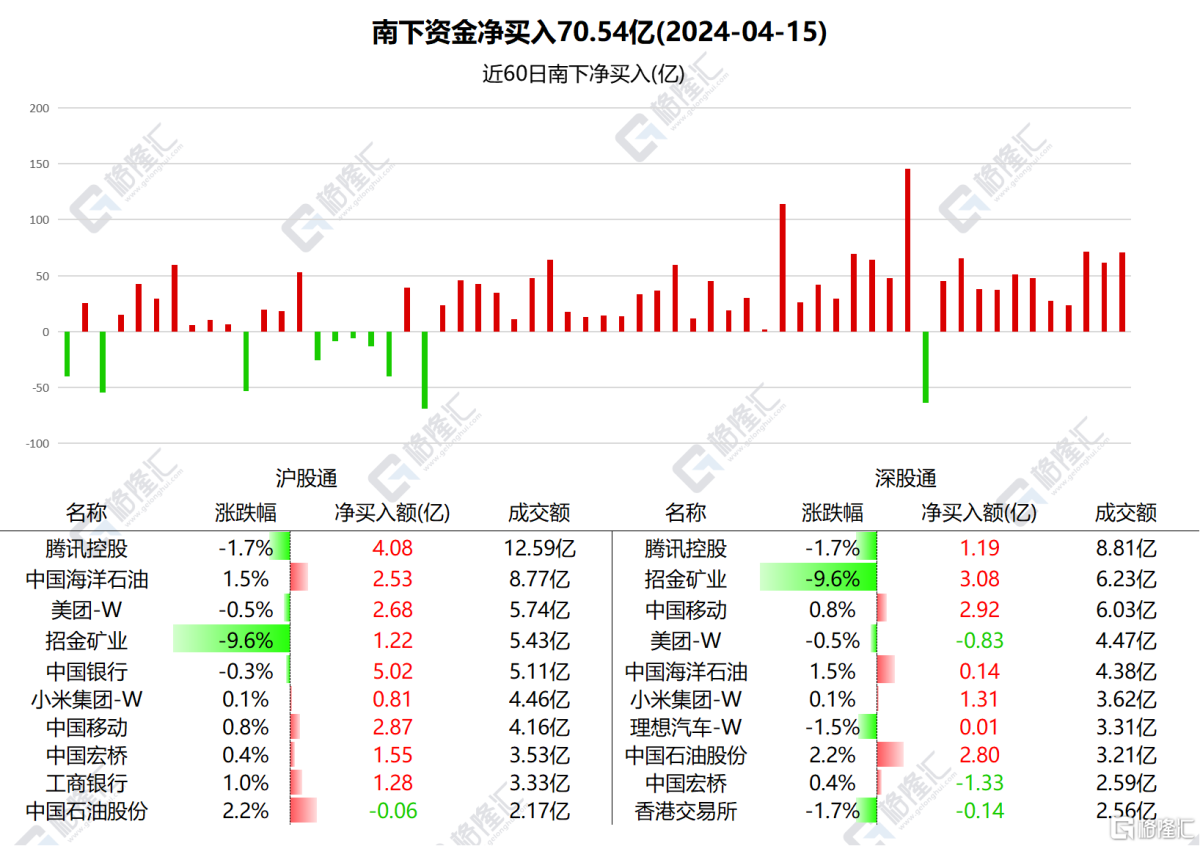

Southbound fundingNet purchases of HK$7.54 billion, of which Hong Kong Stock Connect (Shanghai) made net purchases of HK$3,745 billion and Hong Kong Stock Connect (Shenzhen) made net purchases of HK$3.309 billion.

Among them, net purchases of China Mobile were 579 million, Tencent 526 million, Bank of China 501 million, Zhaojin Mining 430 million, CNPC 273 million, CNOOC 266 million, Xiaomi 211 million, Meituan 185 million, and ICBC 127 million.

The Hong Kong Stock Exchange had a net sale of HK$13.81 million.

According to statistics, Southbound has increased China Mobile's holdings for 8 consecutive days, totaling HK$2,7497.2 billion; increased Bank of China's holdings for 5 consecutive days, totaling HK$1,909.47 million; increased CNPC's holdings for 4 consecutive days, totaling HK$8190.1 million; and increased CNOOC's holdings for 4 consecutive days, totaling HK$773.1 million.

Nanshui focuses on individual stocks

Maotai,Wuliangye:On April 12, the State Council issued “Certain Opinions on Strengthening Supervision and Risk Prevention and Promoting High-Quality Development of the Capital Market”. Shenwan Hongyuan Securities believes that changes in policy orientation contain clues to the next wave of investment trends, and investors are advised to explore the direction of “dynamic high dividends.” The agency pointed out that the content of high-dividend investment is constantly being enriched, and the dynamic high-dividend, that is, the dividend ratio and profit stability are all sectors where there is a lot of room for improvement. Dynamic high dividend returns mainly come from two aspects: opportunities for profit valuations to rise steadily after industry pattern optimization and fundamentals are cleared; opportunities for dividend rates to increase after more abundant cash and improved dividend habits. High-quality liquor stocks are worthy of investors' attention at this stage.

Northern Huachuang:On April 13, Beifang Huachuang successively released the 2023 Annual Results Report and the 2024 First Quarter Results Forecast. The company's revenue for the year 2023 was 22.079 billion yuan, up 50.32% year on year, and net profit was 3.899 billion yuan, up 65.73% year on year; the company's estimated revenue for the first quarter was 5.42 billion yuan to 6.24 billion yuan, up 40.01% to 61.19% year on year, and net profit to mother was 1.04 billion yuan to 1.2 billion yuan, up 75.77% to 102.81% year on year.

Wanhua Chemical:Wanhua Chemical announced that the company's 2023 equity distribution will be implemented: each share will be distributed a cash dividend of 1.625 yuan (tax included). The share registration date is April 19, 2024, and the exclusion (interest) date is April 22, 2024.

Zhongji Asahikawa:Guoxin Securities released a research report saying that AI is changing the computing power cluster network architecture. On the one hand, the scale of a single training cluster continues to expand, and the proportional relationship between connectivity requirements and acceleration units is expected to further increase; on the other hand, distributed computing power clusters are expected to promote 10-20km DCI interconnection requirements and accelerate “related decline.” Taken together, Marvell believes that the growth elasticity of demand for optical connectivity is expected to surpass acceleration units, and that the optical connectivity market is expected to maintain a high boom.

Beishui focuses on individual stocks

China Mobile:According to the news, Morgan Stanley recently published a report. In the context of state-owned enterprise reform, increasing shareholder returns is a long-term trend. The three major telecom companies will maintain healthy growth this year. Telecom companies, on the other hand, are on track to achieve their goal of saving capital expenses. Their new technology is also getting a lot of attention. The bank maintained the “gain” ratings of the three major telecommunications carriers.

Bank of China:According to the news, the Central Huijin Company has once again taken steps to increase its wealth. Through the Shanghai Stock Exchange trading system, Huijin increased its holdings of Bank of China A shares by a total of 330 million shares, accounting for 0.11% of the bank's total share capital; Huijin increased its holdings of ICBC A shares by 286 million through the Shanghai Stock Exchange system, accounting for 0.08% of the total share capital.

Tencent Holdings:Morgan Stanley released a research report stating that it maintains the “gain” rating of Tencent Holdings (00700), with a target price of HK$400. The bank expects revenue to increase by 5% year on year in the first quarter, while the market is expected to grow by 6%, mainly due to weak growth in the game business and a slowdown in the growth of fintech and corporate services, while the advertising business growth is still strong. Gross profit and net profit are expected to grow steadily, with year-on-year increases of 18% and 25%, respectively. Increased share repurchases will be sufficient to make up for the first quarter sell-off of Prosus, the majority shareholder.

Zhaojin Mining:Zhaojin Mining announced results for the first quarter of 2024, with operating income of about 1,981 billion yuan, an increase of 13.94% year on year; net profit attributable to the parent company's owners' equity was about 221 million yuan, an increase of 124.3% year on year. Notably, Zhaojin Mining announced that it will place up to 132 million new H shares; the net proceeds from the placement are expected to be approximately $1,725 million, which will be used to supplement working capital and repay bank loans.