Nvidia, the number one in US stock turnover, closed down 2.04% and traded $42.385 billion on Tuesday. According to reports, Intel will release the Gaudi 3 artificial intelligence chip, which says the performance exceeds the Nvidia H100.

Intel said at a company event early Tuesday that the upgraded processor, called Gaudi 3, will be fully launched in the third quarter. The chip aims to improve performance in two key areas. One is to help train artificial intelligence systems, and the other is to run the finished software.

Strong demand for artificial intelligence services has prompted tech companies to rush to buy these so-called accelerator chips, but Nvidia has taken away most of the cake. Intel CEO Pat Gelsinger said that earlier versions of Gaudi failed to achieve the market share growth Intel had always hoped for. He expects the new version to have a greater impact.

After recently conducting in-depth research on the semiconductor industry, KeyBanc raised Nvidia's target price to 1,200 US dollars, believing that GB200 itself could generate 90 billion to 140 billion US dollars in revenue.

The second-place Tesla closed 2.25% higher, with a transaction of US$17.998 billion. An analyst at brokerage firm Robert W.Baird said that following an unexpected decline in the first quarter, Tesla's car sales may fall again this quarter. The bank's analyst Ben Kallo wrote in a research report on Tuesday that Tesla may still face the problem of a higher comparative base this quarter. He expects the company to deliver 44,4510 vehicles in the second quarter, down 4.6% from the same period last year. Kallo rated Tesla's stock the same as buying it.

According to another report, Tesla reached a settlement on Tuesday over a 2018 autonomous vehicle accident that led to the death of Apple engineer Walter Huang in Northern California. The settlement was not disclosed to the public, and Tesla has requested that the exact amount of the settlement be kept private to prevent other potential claimants from treating this amount as evidence that Tesla may be liable for similar cases.

Earlier, Tesla argued that Huang misused the autonomous driving function, and there was evidence that he was using his iPhone to play video games when the car hit the guardrail.

The third-place Berkshire A share (BRK.A) closed down 0.28% and traded US$8.171 billion. Berkshire Hathaway applied for the issuance of Japanese yen senior notes on Tuesday. Buffett's shareholders' meeting will be held as scheduled on May 4, 2024.

In fourth place, AMD closed up 0.52% and traded $7.25 billion. Blackberry announced a partnership with AMD on Tuesday. The two companies will jointly launch a platform to provide enhanced performance, reliability, and scalability for robotic systems in the industrial and healthcare sectors. The platform combines BlackBerry's real-time software tools with hardware powered by AMD architecture.

In fifth place, Apple closed up 0.72%, with sales of US$7.143 billion. The brokerage firm Wedbush reiterated that Apple's stock rating was superior to the market, and the target price was 250.00 US dollars.

Amazon, which ranked 6th, closed 0.26% higher and sold $6.74 billion. Amazon is seeking to challenge Allegro, the largest e-commerce platform in Poland, using its video streaming platform to attract customers. According to the report, Amazon plans to add more original Polish-language shows to the five original Polish-language shows launched on its Prime Video service since 2023. The annual fee for Amazon Prime in Poland is 49 PLN (approximately $12.51). The report shows that as of February this year, Allegro had 18.2 million users in Poland, while Amazon had close to 5.9 million users.

Seventh-place Meta Platforms closed down 0.45% to $5.483 billion. According to reports, Meta Platforms plans to release two small-parameter versions of the upcoming Llama 3 big models next week. These models will be the predecessor to the biggest version of Llama 3, and the entire Llama 3 is expected to launch in the summer of 2024. According to reports, the highest version of Llama 3 may have more than 140 billion parameters. Meta hopes that the overall performance of the Llama 3 model will catch up with OpenAI's latest GPT-4 Turbo version, but the Llama 3 release next week does not support multi-modal technology. Llama 2 was launched in July of last year, and since then, many companies, including Google, Musk's XAI, and Mistral, have released big open source models.

In 8th place, Microsoft closed 0.40% higher, with a transaction of US$5.298 billion. According to reports, Microsoft will invest about 2.9 billion US dollars in Japan over the next two years to strengthen its artificial intelligence (AI) business in Japan. Microsoft President Brad Smith said this is the company's largest investment in the country to strengthen basic conditions such as data centers for generative artificial intelligence.

9th place Google Class A shares (GOOGL) closed 1.13% higher and traded US$4.817 billion. Bank of America Securities published a rating report. Google, a subsidiary of Alphabet, dropped slightly by 25 basis points to 91.4% month-on-month in March. As for the global smartphone search market, its share fell 128 basis points year-on-year to 95.4%.

According to the Bank of America Research Report, Alphabet's AI website has limited traffic. It was noted that ChatGPT's daily web traffic has been relatively stable over the past 6 months, but it is still below the May 2023 high. The bank gave Alphabet a target price of $173, and its rating was “buy.”

Bank of America Securities pointed out that Alphabet's March data was mixed. One of the biggest concerns investors have about Google is downgrading the valuation of its search business because users can generate information through artificial intelligence. The bank also indicated that the potential performance of Google I/O (Internet Developers Annual Meeting) could be a positive catalyst for the stock.

The 12th Intel closed 0.92% higher, with a transaction of US$2.96 billion. Intel CEO Gersinger proposed on Tuesday that by 2030, the semiconductor market will reach 1 trillion US dollars, and artificial intelligence is the main driving force. Intel is expected to ship 40 million AI PCs and more than 230 designs in 2024, covering thin and light PCs and gaming handheld devices.

In 13th place, TSMC closed up 1.83% and traded US$2,674 billion. TSMC received US$11.6 billion in financial support from the US Department of Commerce. The US government plans to provide TSMC with direct grants of up to 6.6 billion US dollars and loans of up to 5 billion US dollars to support the company to establish 5nm and below advanced chip factories in Arizona, USA, to help build more chip factories in the US to expand production capacity and accelerate the “return of chip manufacturing to the US” expected by the Biden administration.

#15 MicroStrategy closed down 4.76% to $2,357 million. Affected by lower Bitcoin prices, US cryptocurrency concept stocks generally declined on Tuesday.

In 20th place, Eli Lilly closed down 2.58% and traded $1,859 million. Eli Lilly has begun construction of a factory to boost the production of its weight loss drugs, which are popular but have yet to gain a foothold in Europe. Eli Lilly said on Monday that the plant will open in 2027 and ship globally.

According to information, Eli Lilly plans to invest 2.3 billion euros (about 2.5 billion US dollars) in the factory and create 1,000 jobs in production and R&D. Construction will begin this summer, and the plant will produce injectable drugs and injection pens.

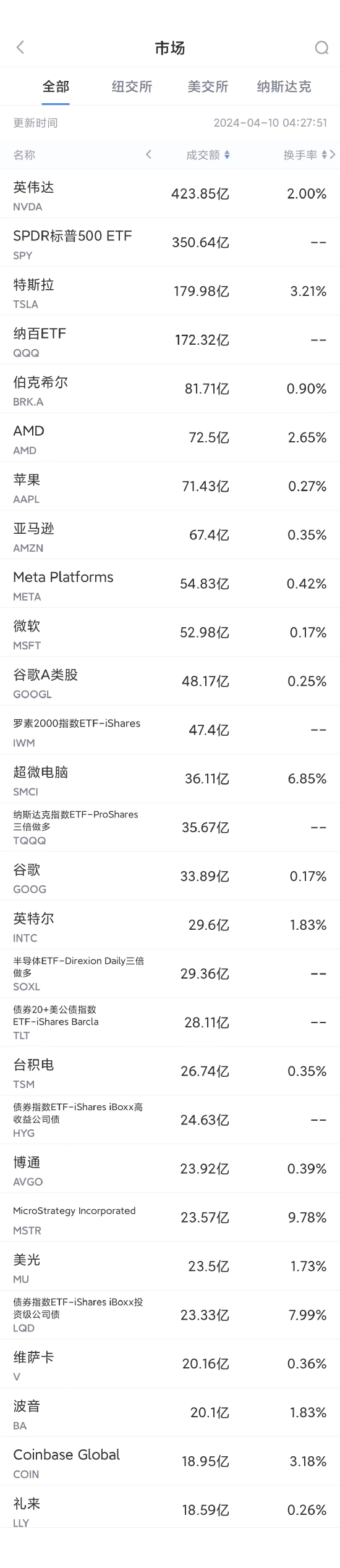

(Screenshot from the Sina Finance App Market - US Stocks - Market section, swipe left for more data) Download the Sina Finance App