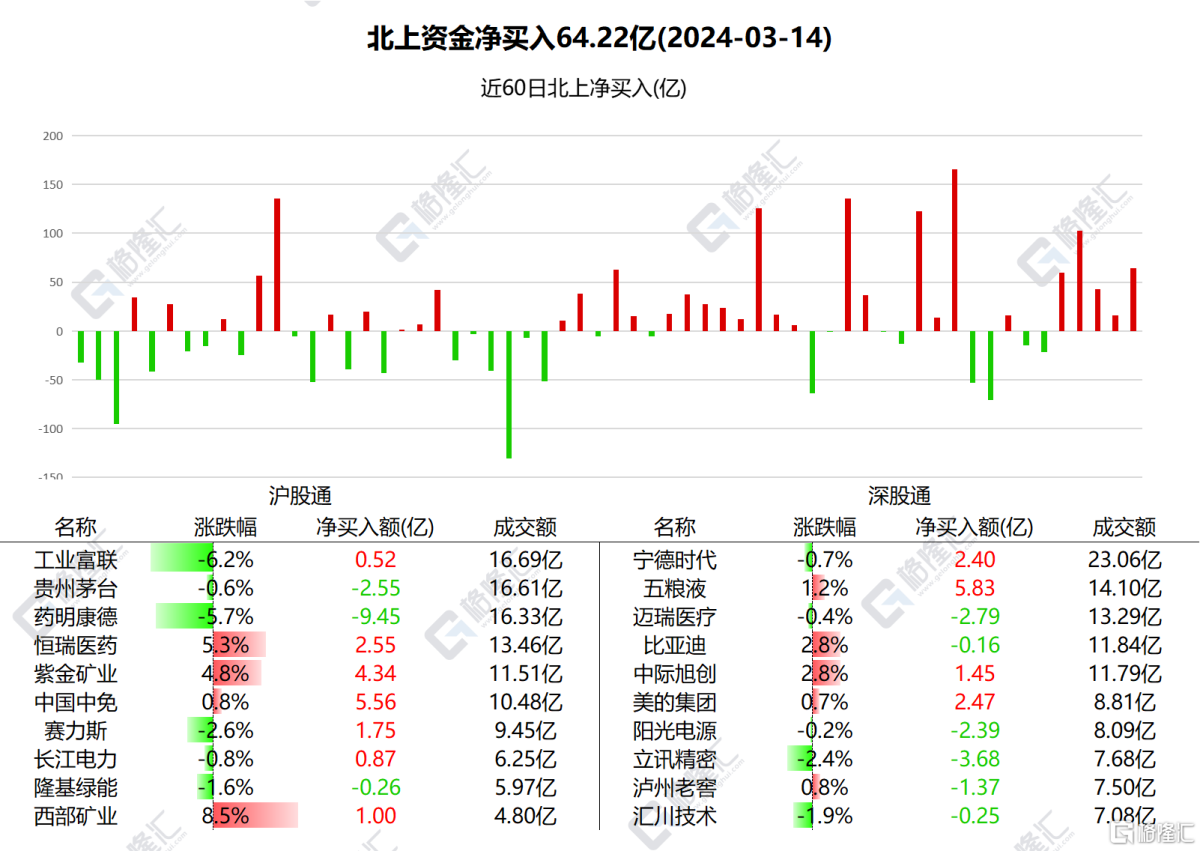

The net purchase of A-shares by Northbound Capital was 6.422 billion yuan, and the net purchase of Hong Kong shares was HK$2,602 billion by Southbound Capital.

Today, Beishang Capital made a net purchase of 6.422 billion yuan of A-shares, the 5th consecutive day of net purchases.

Among them, Wuliangye, China Zhongfen, and Zijin Mining received net purchases of 583 million yuan, 556 million yuan, and 434 million yuan respectively.

Pharmaceutical Kangde had the highest net sales volume, amounting to 945 million yuan. Lixun Precision, Mindray Healthcare, and Kweichow Moutai had net sales of 368 million yuan, 279 million yuan, and 255 million yuan.

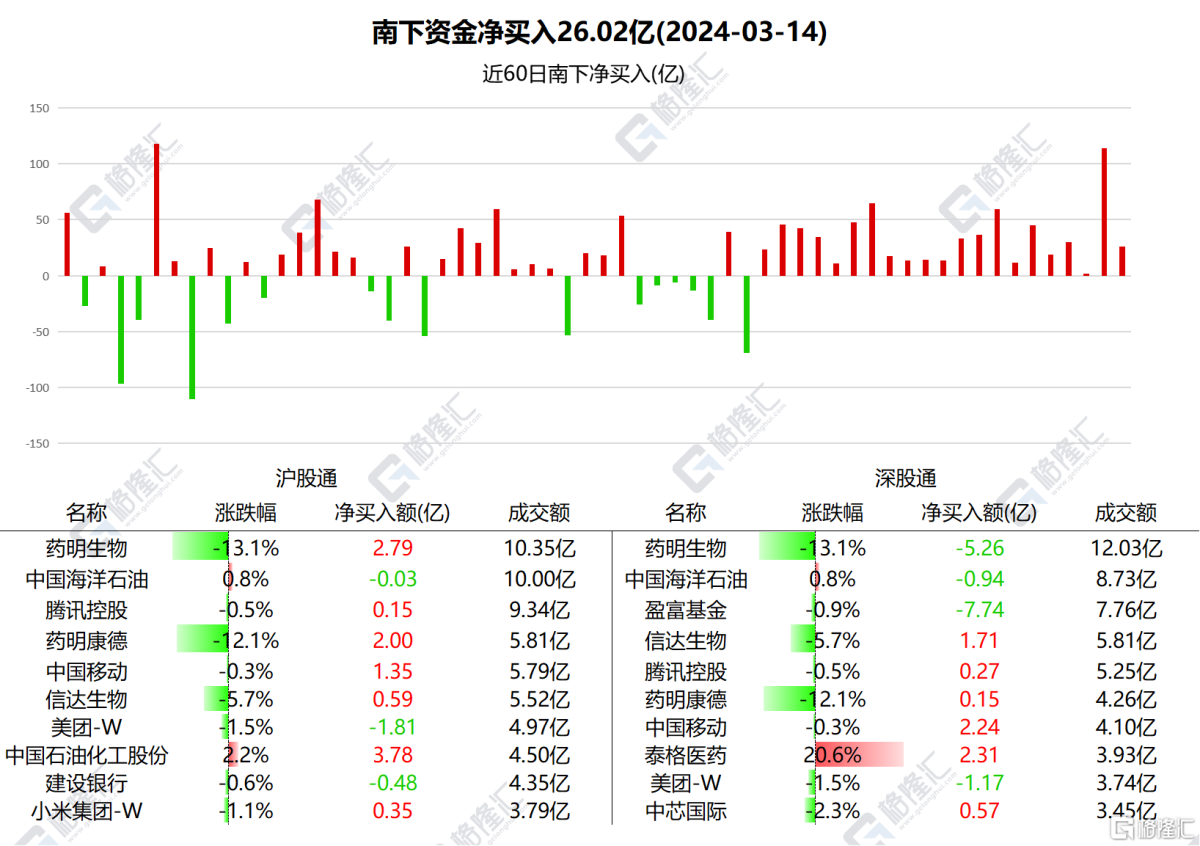

Southward Capital made a net purchase of HK$2,602 billion in Hong Kong stocks, making net purchases for 21 consecutive days.

Among them, net purchases of Sinopec were 377 million yuan, China Mobile 358 million, Tiger Pharmaceuticals 231 million, Cinda Biotech 229 million, and Pharmaceutical Kangde 215 million yuan;

Net sales of Yingfu Fund amounted to $774 million, Meituan to $297 million, and Pharmaceutical Biotech to $247 million.

According to statistics, Southbound Capital has increased its positions in Tencent for 8 consecutive days, totaling HK$2,828.6 billion.

Nanshui focuses on individual stocks

Medicine, Ming Kang DeIt fell 5.71%. BIO's official website published a press release on biotechnology and national security. The article mentioned that BIO is taking steps to remove PharmacomingKangde's membership in the organization. BIO said it supports the US Biosafety Act and will cooperate with Congress as the bill progresses.

WuliangyeIt rose 1.22%. According to the Everbright Securities Research Report, the liquor sector's valuation has been repaired, and the market's confidence in this year's off-season price increase was once again moved. Phenomena such as relieving inventory pressure on the channel side, verifying consumption at festive banquets, reducing pressure on dealers, and wine companies optimizing cost investment and controlling price order have occurred. The increase in price prices for mainstream single products may be the core driving force for the liquor sector to further achieve valuation repair in the second quarter.

Exemption from ChinaA slight increase of 0.81%.

Beishui focuses on individual stocks

SinopecUp 2.22%, the IEA said that since OPEC+ is likely to continue to cut production in the second half of this year, the global oil market will face a shortage of supply this year rather than the oversupply previously predicted.

China MobileIt fell 0.3%, and the company plans to hold a 2023 performance briefing from 19:00-20:15 on March 21.