Roundhill Investments has just introduced two new exchange-traded funds (ETFs) to its lineup, providing investors with innovative avenues for inverse and leveraged exposure to the renowned Magnificent Seven stocks.

Recognized as the pioneer ETF issuer in this space, Roundhill Investments launched the Roundhill Magnificent Seven ETF (NYSE:MAGS) last year, featuring an equally weighted exposure to Microsoft Corp. (NYSE:MSFT), Apple Inc. (NASDAQ:AAPL), Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), Amazon Inc. (NASDAQ:AMZN), Meta Platforms Inc. (NASDAQ:META), NVIDIA Corp. (NASDAQ:NVDA), and Tesla, Inc. (NASDAQ:TSLA), with quarterly rebalancing.

Expanding the investment horizon within this select group of stocks, Roundhill has now unveiled the Roundhill Daily Inverse Magnificent Seven ETF (NYSE:MAGQ) and the Roundhill Daily 2X Long Magnificent Seven ETF (NYSE:MAGX). Both began trading on Thursday.

A Complete Toolkit For Traders To Express Views On Magnificent 7

"We wanted to offer a complete toolkit for investors and traders to express views on Magnificent Seven," Dave Mazza, chief officer strategist at Roundhill Investment, said Thursday in an exclusive interview with Benzinga.

According to the market expert, Magnificent Seven have been in the 'driver's seat' thus far, but he highlighted an increasing interest among traders in taking contrarian positions due to the significant market concentration, anticipating potential market shifts.

Both ETFs are structured around daily total return swaps.

The Roundhill Daily Inverse Magnificent Seven ETF aims to deliver the inverse daily return of the Magnificent Seven basket. For instance, a 2% decline in the underlying stocks would be translated into a 2% increase in MAGQ ETF value, and vice versa.

Conversely, the Roundhill Daily 2X Long Magnificent Seven ETF seeks to provide twice the daily total return of the group, amplifying gains or losses accordingly. For example, a 2% rise in the Magnificent Seven stocks would result in a 4% increase in MAGX ETF value, but likewise, negative performance would be magnified.

Mazza expressed confidence in attracting new inflows into these newly launched funds and reiterated Roundhill's commitment in the offering of innovative ETFs.

Over the past two months alone, the 'plain-vanilla' Roundhill Magnificent Seven ETF has garnered over $100 million if inflows, pushing its total assets under management to $152 million.

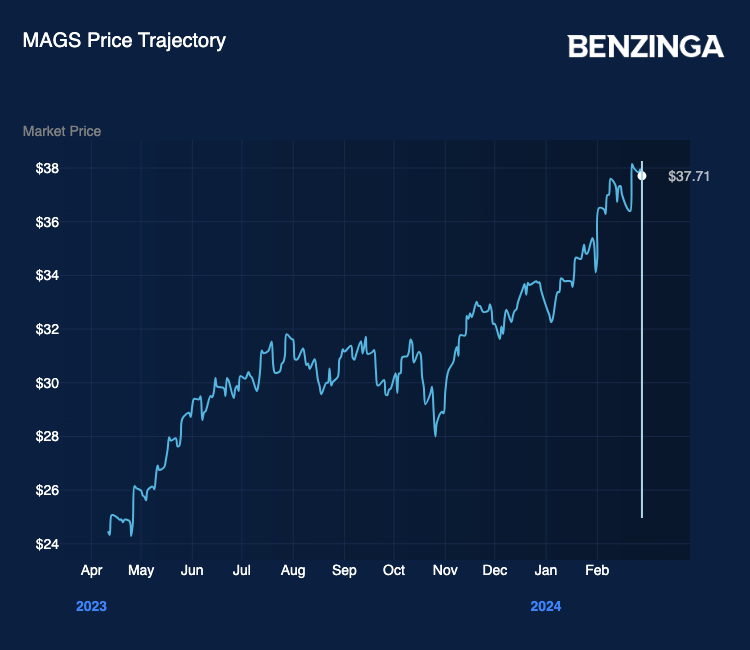

The fund has seen nearly a 14% increase year-to-date and more than a 50% surge since its inception in April 2023.

Read now: Beyond Tech And AI: Why The Sector Hedge Funds Prefer Is Not The One You'd Expect

Photo: Shutterstock