Chegg, Inc. (NYSE:CHGG) shareholders should be happy to see the share price up 28% in the last quarter. But that is meagre solace in the face of the shocking decline over three years. Indeed, the share price is down a whopping 89% in the last three years. So it's about time shareholders saw some gains. But the more important question is whether the underlying business can justify a higher price still. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

If the past week is anything to go by, investor sentiment for Chegg isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Chegg

While Chegg made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last three years, Chegg saw its revenue grow by 5.0% per year, compound. That's not a very high growth rate considering it doesn't make profits. But the share price crash at 24% per year does seem a bit harsh! We generally don't try to 'catch the falling knife'. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

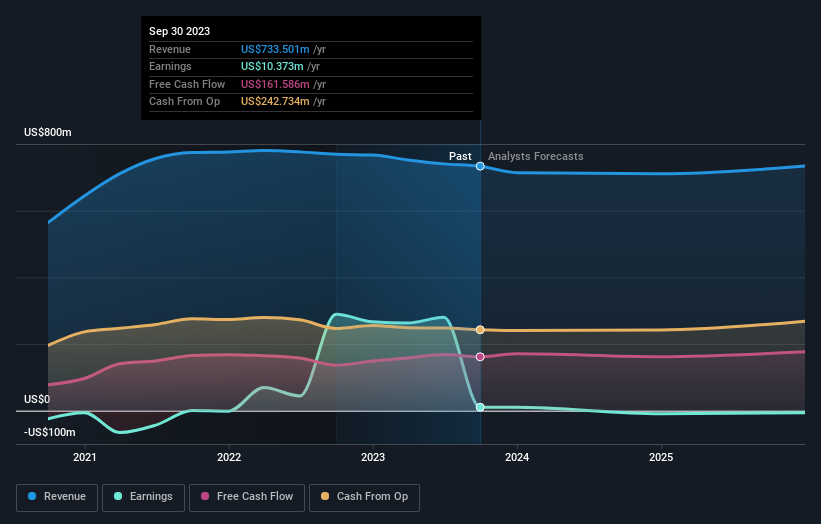

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Chegg is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Chegg will earn in the future (free analyst consensus estimates)

A Different Perspective

While the broader market gained around 22% in the last year, Chegg shareholders lost 58%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with Chegg (including 1 which shouldn't be ignored) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.